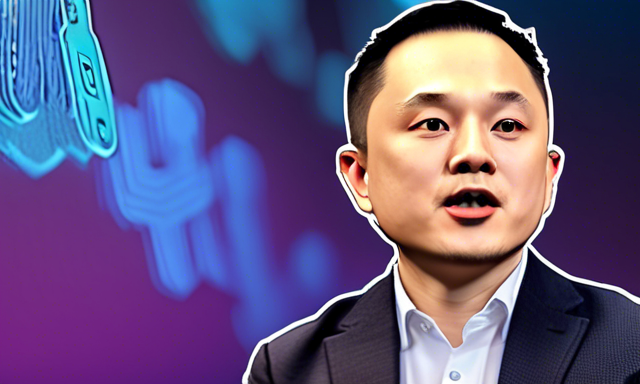

Tron Founder Defends USDD Collateral Removal

Justin Sun, the founder of Tron, has addressed concerns surrounding the recent removal of 12,000 Bitcoin from the collateral backing the USDD stablecoin. This move, which amounted to around $732 million, was executed without a vote from the Tron DAO Reserve, sparking questions about the decentralization and governance of the stablecoin.

USDD was introduced in 2022 as a competitor to TerraUSD (UST) and operates as an algorithmic stablecoin that is designed to maintain a peg to the US dollar. Following the removal of Bitcoin from its reserves, USDD is now predominantly supported by Tron’s native token TRX and Tether (USDT).

Justin Sun’s Defense

- Justin Sun defended the decision, drawing parallels to MakerDAO’s DAI stablecoin and explaining that when collateral surpasses a specified threshold (typically between 120% and 150%), holders can withdraw without needing approval.

- He emphasized that this principle is fundamental to DeFi and pointed out USDD’s long-term collateralization rate of over 300% as justification for the adjustment, suggesting that there was inefficient capital utilization.

Despite these reassurances, concerns persist about the transparency and governance of USDD, especially given the lack of a DAO vote on the recent collateral removal. Critics argue that while USDD is promoted as being governed by a DAO, there has been minimal community involvement in decision-making processes.

USDD has faced previous scrutiny, with stablecoin rating agency Bluechip assigning it the lowest rating and advising against its usage. The assessment focused on USDD’s stability mechanisms and raised doubts about the ownership of wallets containing its collateral.

Transparency and Reserve Details

- USDD currently has over 744 million tokens in circulation.

- The stablecoin’s reserves are comprised of $1.7 billion worth of TRX and USDT, leading to a collateralization ratio of over 230%.

- This ratio indicates that USDD has more assets in reserve compared to the stablecoins in circulation, positioning it favorably against competitors like DAI, USDT, and USDC.

Despite experiencing price fluctuations since its inception, including an all-time low of $0.92 in March 2023, Sun maintains that USDD’s current collateralization ratio provides sufficient backing for the stablecoin.

In response to the concerns raised, Sun hinted at potential upgrades to enhance USDD’s competitiveness in the market. However, he did not provide specific details regarding these planned improvements.

Hot Take: Sun’s Response and Future Plans

As the debate around USDD’s governance and collateralization continues, Justin Sun’s defense of the recent collateral removal highlights conflicting views within the crypto community. While he maintains that the stablecoin’s long-term stability is reinforced by a strong collateralization ratio, critics question the lack of transparency and community involvement in decision-making processes. Moving forward, Sun’s commitment to enhancing USDD’s functionality and competitiveness suggests that further developments may be on the horizon.

By

By

By

By

By

By