The Relationship Between Bitcoin and Stablecoins Supply

The trend in the total supply of stablecoins may have indicated in advance that the recent Bitcoin rally wouldn’t last long. Stablecoins supply refers to the circulating supply of all stablecoins in the cryptocurrency sector.

- Investors use stablecoins to escape the volatility of other cryptocurrencies.

- When the stablecoins supply increases, it indicates new tokens are being minted due to demand or fresh capital coming into the market.

- These investors seek safety in stablecoins as a temporary place to store their capital before jumping back into volatile coins like Bitcoin.

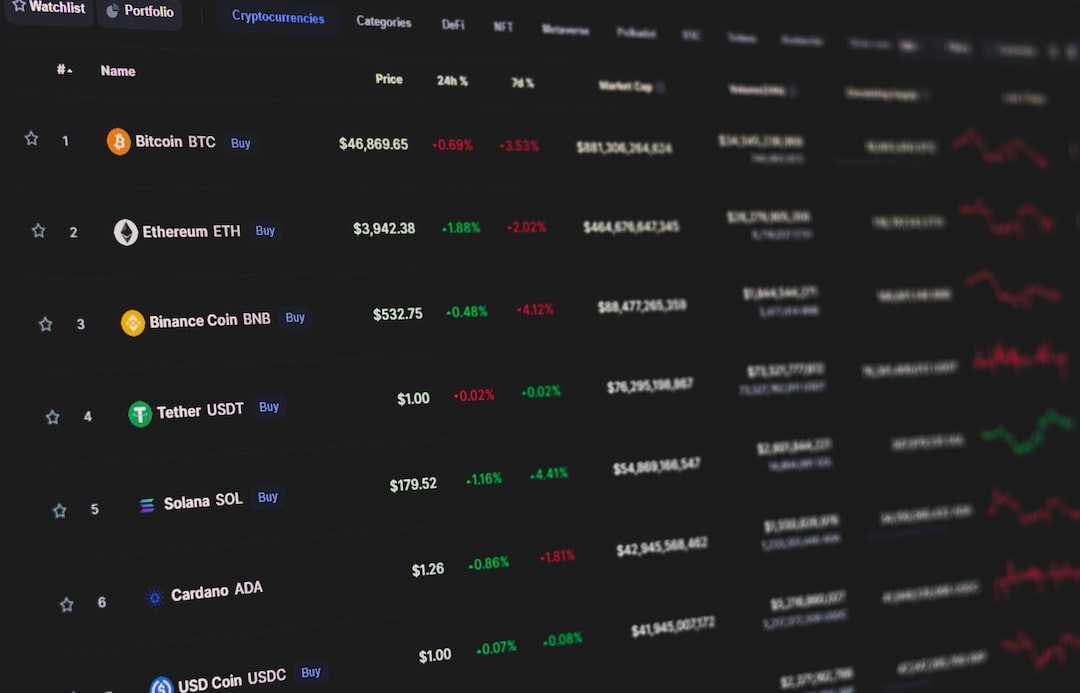

- The chart shows a correlation between the Bitcoin spot price and stablecoin supply, with major increases in Bitcoin following rises in stablecoin supply.

- However, the recent rally in Bitcoin wasn’t supported by an increase in stablecoin supply, suggesting weak market growth.

Therefore, the decline in Bitcoin’s price below $26,000 may be a consequence of this weak market structure.

Hot Take: Weak Market Structure Leads to Bitcoin Decline

The lack of movement in stablecoins supply suggests that the recent Bitcoin rally was not supported by constructive market growth. This may have been an early sign that the rally wouldn’t last long. As Bitcoin’s price declines below $26,000, it indicates that the weak market structure is taking its toll. Investors should be cautious and assess the market carefully before making any decisions.

By

By

By

By

By

By

By

By

By

By