Bloomberg Strategist: Bitcoin’s Price Indicates Economic Turbulence Ahead

Bloomberg Intelligence senior macro strategist Mike McGlone suggests that recent price movements in Bitcoin (BTC) may be a sign of impending economic turbulence.

In a tweet to his 60,000 followers on the social media platform X, McGlone points out that Bitcoin is showing bearish divergence against the Nasdaq 100 Stock Index, which could indicate a coming recession.

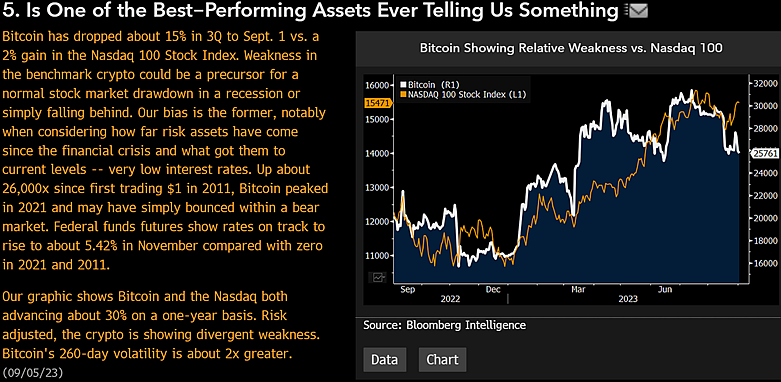

The Performance Gap: Bitcoin vs. Nasdaq 100 Stock Index

Bitcoin has seen a 15% drop in the third quarter compared to a 2% gain in the Nasdaq 100 Stock Index. This weakness in the benchmark cryptocurrency could be a precursor to a stock market drawdown in a recession or simply a lagging performance. McGlone’s bias leans towards the former, especially considering the low-interest rates that have boosted risk assets since the financial crisis.

Fed Rate Hikes and Bitcoin’s Performance

McGlone also highlights the federal funds futures rate, which suggests that further interest rate hikes from the Federal Reserve are on the horizon. This, combined with Bitcoin’s performance relative to Japan’s Nikkei 225 index, contributes to his bearish outlook on the cryptocurrency.

Bitcoin’s close directional relationship with the Nikkei 225 and recent weakness in the crypto market could indicate a potential contagion. Alternatively, Bitcoin could recover and follow the path of the Nikkei, which reached a 33-year high in June. McGlone advises paying attention to the leading-indicator signals from Bitcoin and respecting the downward-sloping 100-week moving average.

The Bearish Outlook: Bitcoin’s Decline and Tightening Central Banks

McGlone believes that if Bitcoin can reclaim the $31,000 price level, it could indicate a bullish reversal. However, he predicts that BTC will continue to decline due to the tightening monetary policies of central banks, including the Federal Reserve. At the time of writing, Bitcoin is trading at $25,746, down 0.1% in the last 24 hours.

Hot Take: Prepare for Market Turbulence

Based on the analysis by Bloomberg strategist Mike McGlone, the stagnant price of Bitcoin suggests that economic turbulence may lie ahead. The performance gap between Bitcoin and the Nasdaq 100 Stock Index, as well as Bitcoin’s relationship with the Nikkei 225, indicate potential market downturns or contagion. As central banks tighten their policies, Bitcoin’s decline may continue. It remains to be seen whether Bitcoin can overcome these challenges and experience a bullish reversal. However, it’s important for crypto investors to be prepared for potential market turbulence in the near future.

By

By

By

By

By

By

By

By

By

By

By

By