The US Consumer Price Index (CPI) and its Impact on Crypto Prices

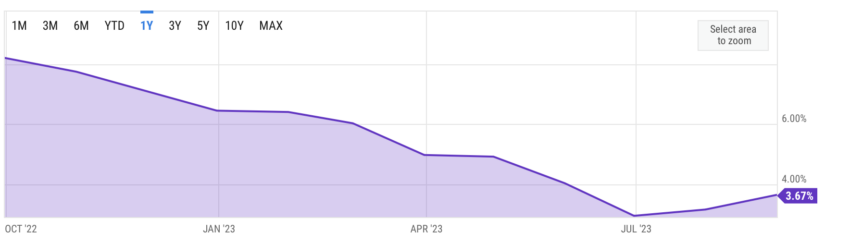

The US Consumer Price Index (CPI) experienced a 0.6% month-on-month increase in August and a 3.7% year-on-year rise. This caused a brief decline in equities, with the S&P 500 dropping slightly. Bitcoin (BTC) also saw a minor decrease from $26,178 to $26,125, while Ethereum (ETH) fell slightly from $1,601 to $1,596.

Inflation Figures and Market Reactions

Core inflation, excluding food and energy prices, rose by three-tenths of a percent in the last month and 3.7% year-on-year. The cost of shelter increased by 0.3%, but there was a slight decrease of 0.1% in the prices of used cars and trucks.

The Role of CPI for Investors

The US Federal Reserve relies on various factors such as CPI, the Personal Consumption Expenditure Index, and labor data to make informed decisions regarding interest rates. The central bank will convene next week to determine whether an increase in rates is necessary to bring annual headline inflation back to the target rate of 2%.

Using Cryptocurrency as an Inflation Hedge

If you’re concerned about inflation, cryptocurrency can be a potential shield against its effects. To learn more about how you can use cryptocurrency as a hedge, click here.

Following the release of the CPI data, markets quickly returned to pre-trading levels as investors eagerly await the upcoming retail sales numbers scheduled for Thursday.

Hot Take: Crypto as a Hedge Against Inflation

In times of rising inflation, cryptocurrencies like Bitcoin and Ethereum can provide an alternative investment option that may act as a hedge against traditional currency devaluation. By utilizing decentralized networks and limited supply, cryptocurrencies have the potential to retain value and even appreciate during periods of economic uncertainty. As demonstrated by the recent market reaction to the CPI data, investors are increasingly turning to cryptocurrency as a means of protecting their wealth from the effects of inflation.

By

By

By

By

By

By

By

By

By

By