Bitcoin Price Analysis: Key Levels to Watch

If Bitcoin manages to break above the $26,750 level, it could face strong resistance from the descending trend line. A failure to surpass this point could lead to a dip towards $26,600 or even a retest of the $26,000 support. In the worst-case scenario, increased selling pressure might push BTC’s value down to approximately $25,250.

However, several technical indicators, such as the 50-day exponential moving average, relative strength index (RSI), and moving average convergence and divergence (MACD), all suggest a buying trend and highlight a sustained bullish momentum.

Traders should closely monitor the $26,500 mark as it holds pivotal importance. Prices above this level may indicate buying potential, while prices below it might signal selling opportunities.

Top 15 Cryptocurrencies to Watch in 2023

Stay ahead in the world of digital assets by exploring our carefully selected list of the top 15 alternative cryptocurrencies and ICO projects that are worth watching for in 2023. Stay informed and uncover the potential of these digital assets.

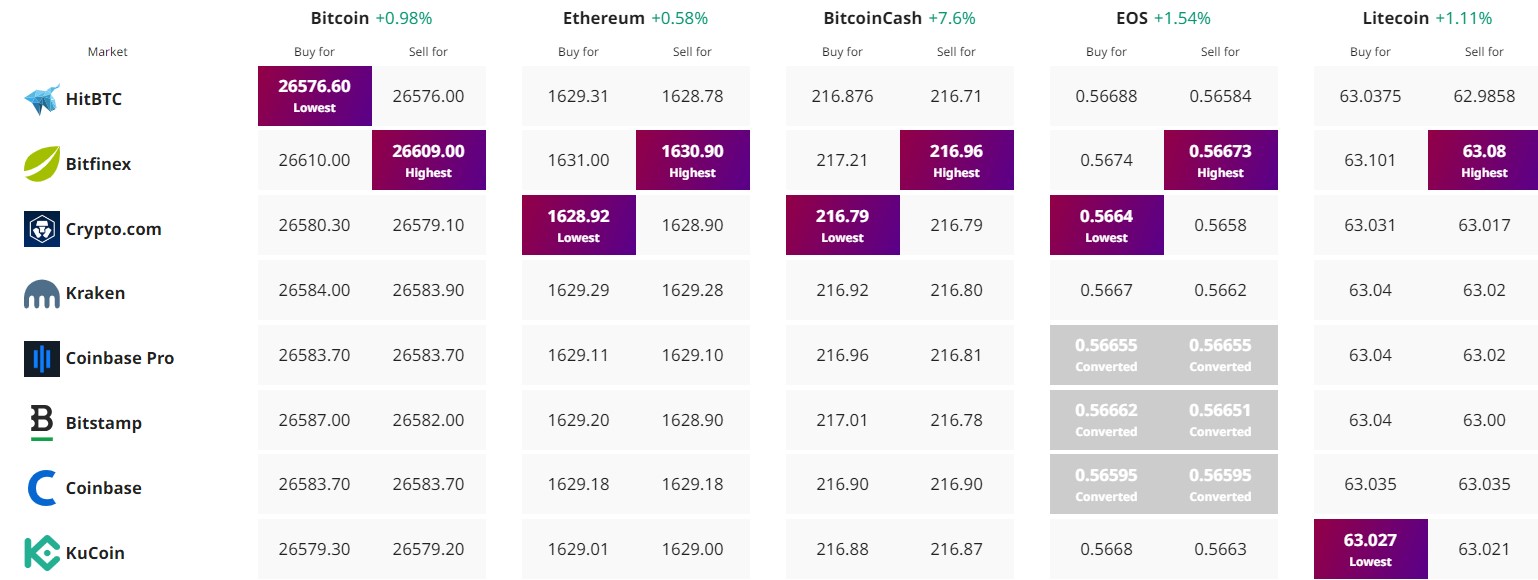

Find The Best Price to Buy/Sell Cryptocurrency

Hot Take: Bitcoin Price Analysis

Based on the technical indicators and key levels to watch, Bitcoin appears to be in a buying trend with sustained bullish momentum. However, breaking above the $26,750 level might be challenging due to a strong descending trend line. Traders should closely monitor the $26,500 mark as it holds significant importance for determining buying potential or selling opportunities. Stay informed about the cryptocurrency market and explore our list of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

By

By

By

By

By

By