Ethereum Futures ETFs Expected to Receive Approval from SEC in Early October

According to industry experts and analysts, the US Securities and Exchange Commission (SEC) is likely to approve an Ethereum futures product in early October, making it the first ETH futures ETF in the United States. Bloomberg intelligence analyst James Seyffart has been monitoring the situation and believes that filings indicate the acceleration of Ethereum futures ETFs for launch. However, the potential approval of these ETFs is contingent upon Congress reaching a deal to pass a spending bill by the end of this month.

Implications for Bitcoin Futures ETFs

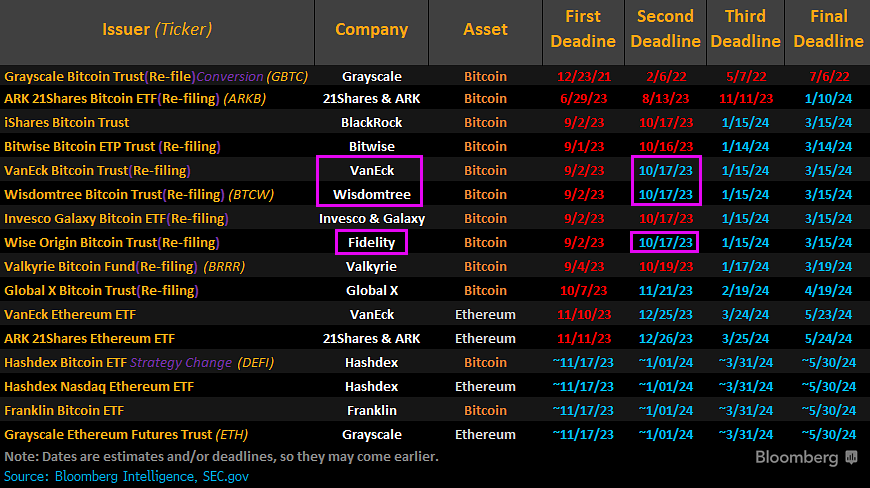

If the SEC approves Ethereum futures ETFs, it would suggest that they are not planning to force closure or delisting of Bitcoin (BTC) futures ETFs. The response from the SEC to a recent Grayscale court ruling will also be closely observed, as it may influence their decisions regarding BTC spot ETFs. Currently, there are 15 Ethereum futures ETFs from nine issuers awaiting approval, including Valkyrie, VanEck, ProShares, Grayscale, Volatility Shares, Bitwise, Direxion, and Roundhill.

SEC’s Delaying Tactics

The SEC has been postponing decisions on various crypto ETFs this week. On September 28, they extended the review period for BlackRock, Valkyrie, and Bitwise’s spot Bitcoin ETF applications. It is anticipated that delay orders for the remaining issuers (WisdomTree, VanEck, and Fidelity) will be issued soon before a potential government shutdown. In addition to these delays, the SEC recently pushed back its decision on ARK 21Shares Ethereum ETF and VanEck Ethereum ETF until late 2023. Analyst James Seyffart believes that all these actions by the SEC are influenced by the looming shutdown.

Hot Take: The Potential Approval of Ethereum Futures ETFs Signals Positive Developments for the Crypto Market

If the US SEC approves the launch of an Ethereum futures product, it will be a significant milestone for the crypto market. This move not only opens up new investment opportunities for individuals and institutions but also indicates a growing acceptance and recognition of Ethereum as a legitimate asset class. Furthermore, the potential approval suggests that the SEC may take a more favorable stance towards other cryptocurrency-based ETFs in the future, including Bitcoin spot ETFs. Overall, this development is likely to boost investor confidence and contribute to the mainstream adoption of cryptocurrencies.

By

By

By

By

By

By

By

By