PwC Champions Blockchain for Wider Financial Access

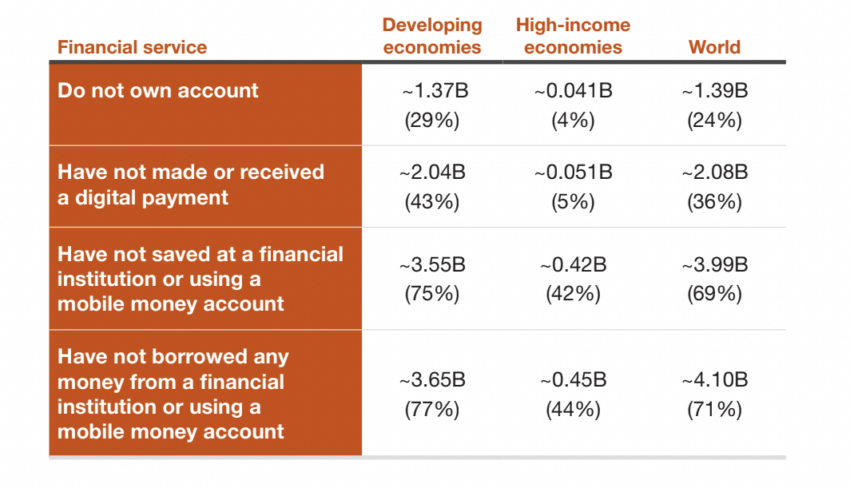

A recent report from PricewaterhouseCoopers (PwC) highlights the importance of blockchain technology in addressing the global financial inclusion issue. According to the report, over 1.4 billion people lack access to bank accounts or essential financial services.

PwC emphasizes the significant growth of innovative services within blockchain networks, which has played a crucial role in fostering financial inclusion. One notable development is the rise of stablecoins, with nearly 200 different stablecoins available today. These stablecoins offer users the stability of traditional fiat currencies while retaining the benefits of digital assets, with the largest stablecoins pegged to the U.S. dollar.

The report underscores the importance of providing alternatives, as many individuals in developing nations have limited access to traditional financial institutions.

PwC also highlights that approximately 3.55 billion people in emerging economies have never saved money. To address this, crypto platforms are now enabling digital wallets on blockchain networks for storing stablecoins and generating yields.

CBDC’s Preferred In Developing Countries

In addition, the report reveals that 43% of individuals in developing countries have never made online payments.

Furthermore, a recent survey by the CFA Institute shows that central bank digital currencies (CBDCs) are gaining traction in developing nations. While only 37% of respondents in developed countries prefer CBDCs, the figure rises to 61% in emerging markets.

On a global scale, 130 countries, representing 98% of the global economy, are actively exploring the implementation of CBDCs. Most G20 nations are aggressively pushing forward with their plans to introduce CBDCs in the near future.

India is among the countries embracing CBDCs, with thousands of customers and merchants participating in the CBDC pilot for the e-rupee initiative. This initiative aims to explore the feasibility of a digital cash alternative.

Hot Take: The Role of Blockchain in Financial Inclusion

The report from PwC sheds light on the crucial role that blockchain technology can play in addressing the global financial inclusion challenge. With over 1.4 billion people lacking access to essential financial services, innovative solutions like stablecoins and digital wallets on blockchain networks offer alternatives for individuals in developing nations. Additionally, the growing interest in central bank digital currencies (CBDCs) in emerging markets highlights their potential for promoting financial inclusion. As more countries explore and implement CBDCs, it is evident that blockchain technology has the power to revolutionize financial access and empower individuals worldwide.

By

By

By

By

By

By

By

By

By

By

By

By