The Likelihood of a Bitcoin ETF Approval is Increasing

Industry experts are increasingly confident that the Securities and Exchange Commission (SEC) will approve a spot-based Bitcoin exchange-traded fund (ETF). The recent approval of America’s first Ethereum futures ETFs has boosted their confidence in this regard.

Bitcoin ETF Odds Increasing

Crypto trader and analyst Alex Krüger predicts that the odds of a spot Bitcoin ETF approval are 70%, likely to occur in January. He notes that selling the news requires front-running, as crypto traders are professionals in this regard.

The SEC has been opposed to spot-based crypto derivatives that require holding the underlying asset, instead favoring those based on futures contracts due to concerns about volatility and market manipulation.

Nate Geraci, President of ETF store, believes that the recent launch of Ether futures ETFs is an indication that spot ETFs will likely be approved soon. Ripple’s partial victory against the SEC further strengthens the argument for a spot Bitcoin ETF approval.

“Crypto Rover” states that the SEC now has no valid arguments to deny a spot Bitcoin ETF and will be forced to accept it. The “Bitcoin Therapist” agrees, adding that although they may use the crypto fraud narrative for some time, ultimately a spot Bitcoin ETF will be approved with trillions of dollars flowing through it.

“Mister Crypto” shares that according to the former director of BlackRock, the SEC will approve spot Bitcoin ETFs within three to six months, potentially leading to capital inflows of up to $200 billion.

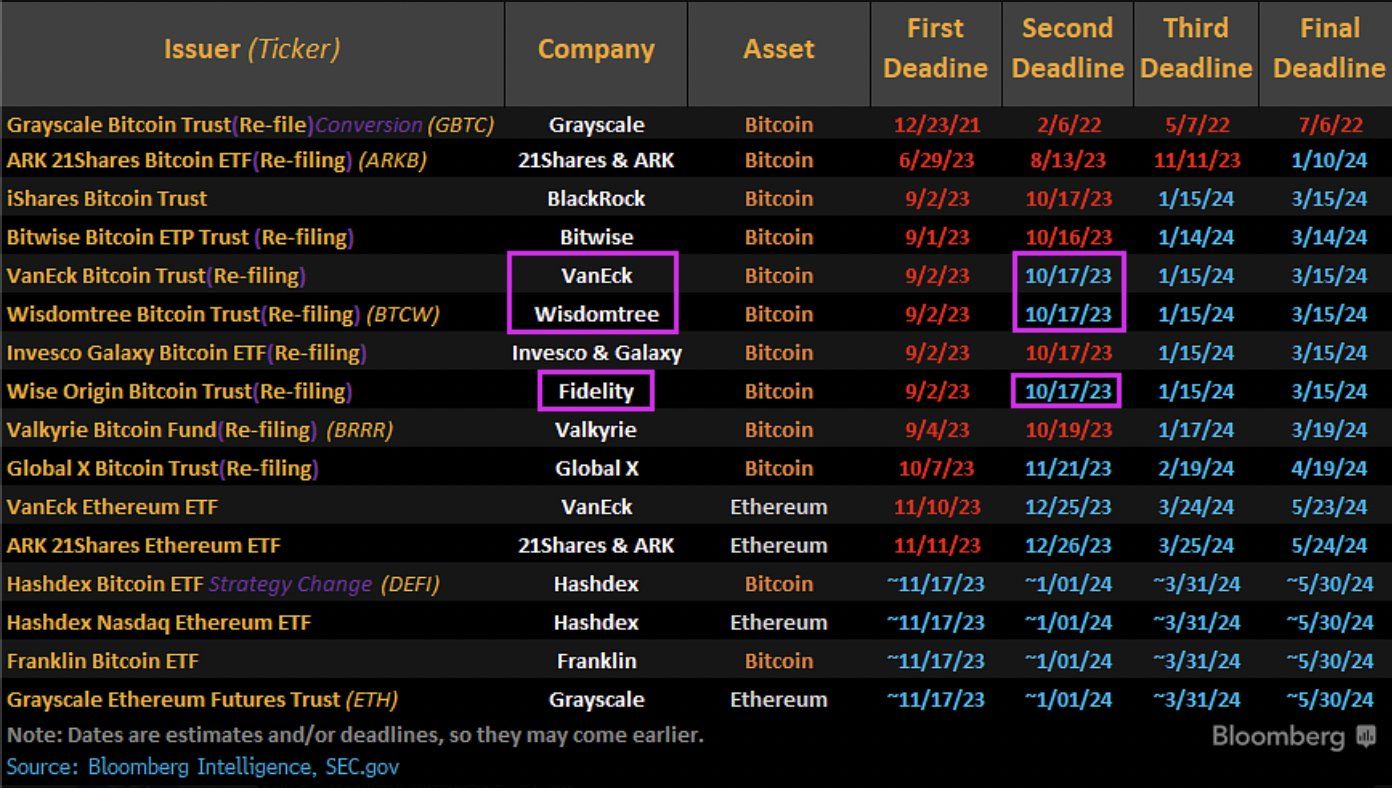

A Large ETF Queue

There is a long list of pending applications for ETF approvals. The SEC has until October 13 to appeal the Grayscale ruling, and all spot filings are expected to be delayed until January 3. The SEC is actively working with ETF issuers to refine their filings.

The second deadline for VanEck, WisdomTree, and Fidelity is on October 17, and it is highly likely that their applications will be postponed until January.

Hot Take: Bitcoin ETF Approval on the Horizon

With the recent approval of Ethereum futures ETFs and the growing confidence among industry experts, it seems increasingly likely that the SEC will approve a spot-based Bitcoin ETF in the near future. Despite previous resistance to such products, the changing landscape and Ripple’s legal victory suggest that the SEC’s arguments against a spot Bitcoin ETF are weakening. This anticipated approval could lead to significant capital inflows and further mainstream adoption of cryptocurrencies. The crypto community eagerly awaits this development, which could have far-reaching implications for the market.

By

By

By

By

By

By

By

By

By

By

By

By