The Truth About FTX’s Insurance Fund Revealed

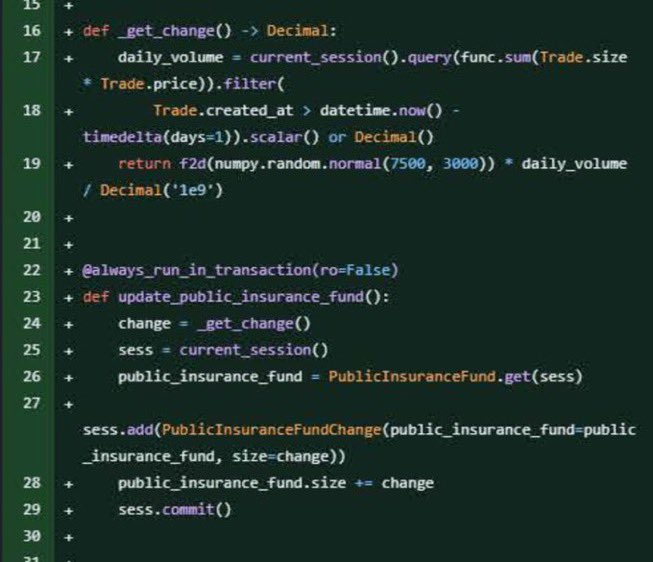

According to FTX co-founder Gary Wang, the amount of money reported to be held in the bankrupt crypto exchange’s insurance fund was not accurate. During the trial of his former business partner Sam Bankman-Fried, Wang testified that FTX used a random number multiplied by the platform’s daily volume and divided by one billion to determine the cash added to the fund. However, this displayed number did not match the actual balance in the database. In reality, the insurance fund balance was lower than what was publicly showcased.

The Discrepancy and its Implications

When asked if the displayed number had any connection to the actual insurance fund balance, Wang responded with a clear “No.” Insurance funds serve as a safety net to cover losses and distribute profits, preventing forced closures of profitable positions due to widespread counterparty liquidations. The revelation about FTX’s insurance fund raises concerns about transparency and accountability within the exchange.

Implications for Investors

For investors using FTX, this discrepancy in the reported and actual insurance fund balance is troubling. It calls into question whether their investments are adequately protected in case of unforeseen circumstances or market volatility. The lack of accurate information about the insurance fund undermines investor confidence in FTX’s risk management practices.

The Need for Greater Transparency

FTX and other crypto exchanges must prioritize transparency and provide accurate information regarding their insurance funds. Investors should have access to real-time data about fund balances to make informed decisions about their investments. Increased transparency will promote trust and confidence in the crypto market, attracting more participants and contributing to its long-term growth.

Hot Take: FTX’s Lack of Transparency Raises Concerns

The revelation that FTX’s reported insurance fund balance did not match reality highlights the importance of transparency in the cryptocurrency industry. Investors rely on accurate information to assess risks and make informed decisions. FTX must address this discrepancy, provide clarity about their risk management practices, and restore investor trust. The incident serves as a reminder for all crypto exchanges to prioritize transparency and accountability, ensuring that investors’ funds are adequately protected.

By

By

By

By

By

By

By

By