The Bitcoin Price Declines After Reaching a High

The price of Bitcoin (BTC) has dropped since reaching a peak of $28,592 on October 2. This decrease confirms that the $28,000 horizontal area is now acting as resistance.

Bitcoin Falls After Range High Rejection

According to technical analysis on the daily timeframe, the Bitcoin price has fallen after reaching a high of $28,580 on October 2. It initially appeared that BTC had broken out from the $28,000 resistance level. However, the price quickly fell below this area, confirming it as resistance on October 6. Since then, Bitcoin has experienced a rapid decline, reaching a low of $26,538 on October 11.

The daily Relative Strength Index (RSI) indicates a bearish trend. The RSI is used by traders to identify overbought or oversold conditions and make decisions about buying or selling assets. A reading above 50 and an upward trend suggests an advantage for bulls, while a reading below 50 indicates the opposite. Currently, the RSI is below 50 and falling, signaling a bearish trend. It has also broken down from its previous bullish divergence trendline.

Interesting Bitcoin News Today

Today is the final deadline for the Securities and Exchange Commission (SEC) to challenge a court’s decision regarding a Spot Bitcoin Exchange-Traded Fund (ETF). If the SEC does not contest this ruling by the end of the day, they will no longer have the option to reject any other Spot Bitcoin ETFs. This could potentially lead to the approval of all spot ETFs, not just Bitcoin.

In addition, 24,000 Bitcoin options contracts worth $640 million are set to expire today, which is 50% more than last week’s amount. Furthermore, the US Consumer Price Index (CPI) for September came in at 3.7%, slightly higher than expected. This could result in a slight interest rate hike at the next meeting. While the US dollar index responded positively to the CPI, Bitcoin experienced a slight decrease.

BTC Price Prediction: When Will Price Bottom?

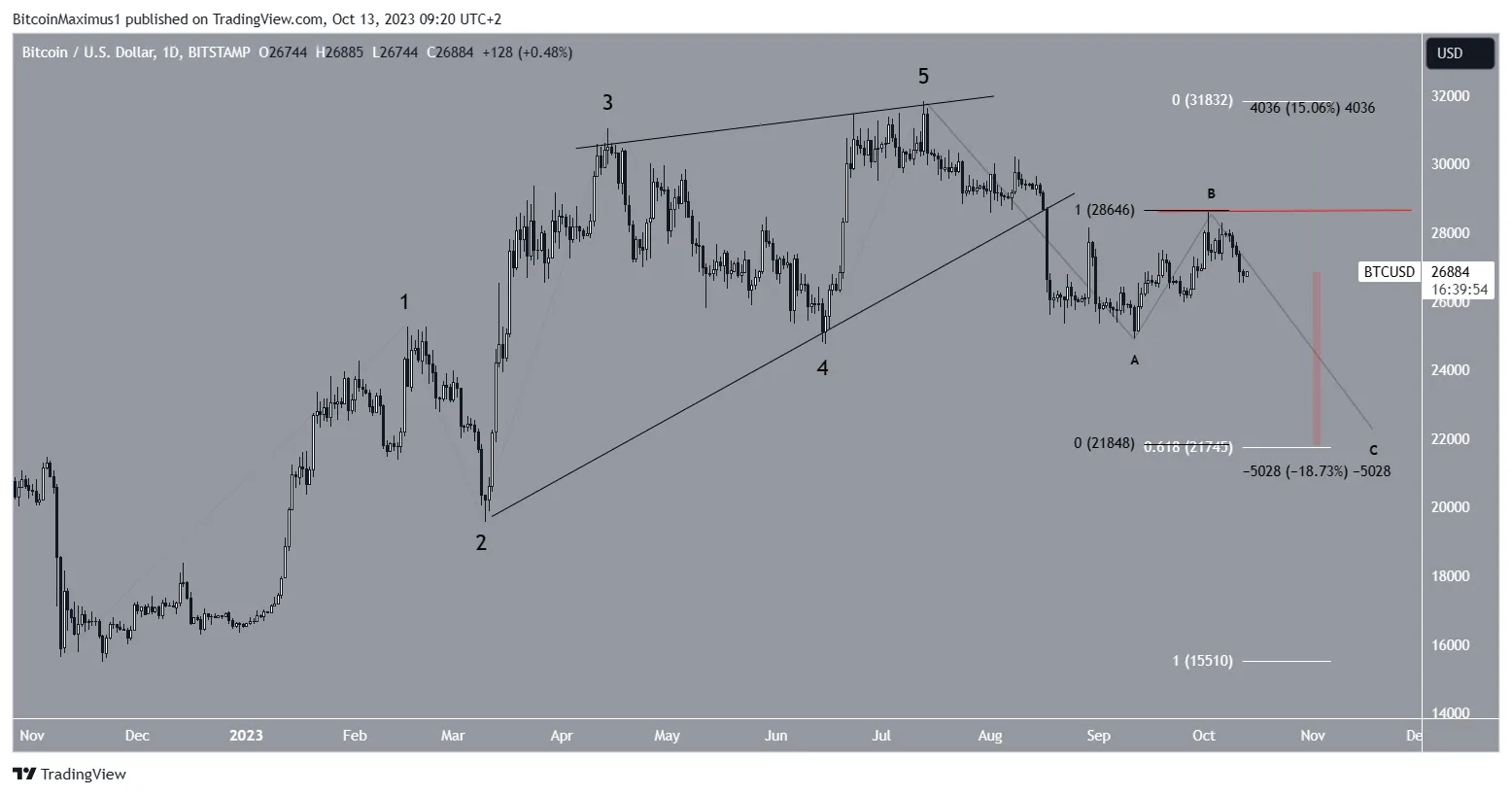

Technical analysts are using the Elliott Wave theory to predict the direction of the Bitcoin price. The most likely scenario is a bearish wave count. Since reaching a bottom of $15,479 in November 2022, BTC has completed a five-wave upward movement and is now correcting that increase. If the decline continues, the bottom of wave C is expected to be around $21,800, which aligns with the 0.618 Fib retracement support level and would create a 1:1 ratio between waves A and C. This would represent a nearly 20% decrease from the current price.

Despite this bearish prediction, if Bitcoin surpasses the high of wave B at $28,592, it could lead to a 15% upward movement towards the $30,500 resistance area.

Hot Take: Bitcoin Price Declines as Resistance Holds Strong

The price of Bitcoin has experienced a decline after failing to break through the $28,000 resistance level. Technical indicators suggest a bearish trend, with the Relative Strength Index (RSI) falling below 50. Additionally, interesting developments in the cryptocurrency market include the SEC’s final deadline for challenging a court’s decision on a Spot Bitcoin ETF and the expiration of $640 million worth of Bitcoin options contracts. Furthermore, the US CPI for September came in slightly higher than expected, potentially leading to an interest rate hike. Looking ahead, technical analysis and Elliott Wave theory predict a potential bottom for Bitcoin at around $21,800. However, if Bitcoin surpasses the previous high, it could see an upward movement towards the $30,500 resistance area.

By

By

By

By

By

By

By

By

By

By

By

By