Warren Buffett’s Indirect Bitcoin Venture Pays Off

Warren Buffett, known as the Oracle of Omaha, has always been skeptical about Bitcoin and other cryptocurrencies, considering them to be “gambling tokens” with no real value. However, his recent investment in Nubank, a digital bank based in Brazil, has inadvertently propelled him into the crypto industry.

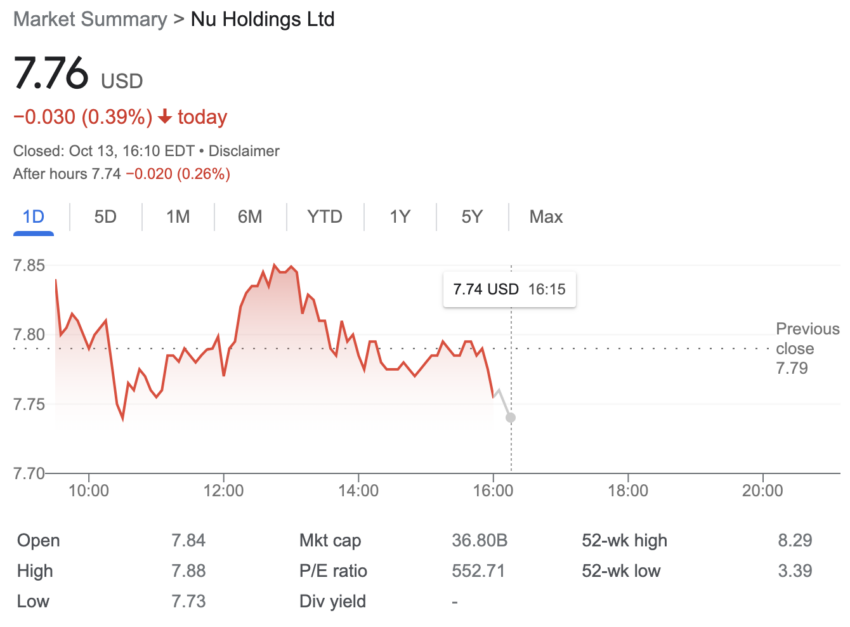

In 2021, ahead of Nubank’s IPO, Buffett’s Berkshire Hathaway invested $500 million in the fintech company. Nubank offers traditional banking services and allows customers to trade Bitcoin and other cryptocurrencies. Following the IPO, Berkshire Hathaway invested an additional $250 million in Nubank, bringing the total investment to $750 million. The value of this position is now around $840 million.

Nubank has further expanded its presence in the crypto industry by launching its own altcoin, Nucoin. This move has resulted in a significant increase in Nubank’s stock price, outperforming other major holdings in Buffett’s portfolio such as Amazon, Apple, Coca-Cola, Bank of America, and Kraft Heinz.

Traditional Finance Meets Crypto

Buffett’s indirect involvement with crypto through Nubank reflects a broader trend of traditional finance and crypto finding common ground. Despite his criticism of Bitcoin, the success of Nubank highlights the financial potential inherent in the crypto industry that even staunch critics cannot ignore.

Other traditional investors are also recognizing the value of cryptocurrencies. Hedge fund manager Paul Tudor Jones, for example, believes that given the challenging political and geopolitical environment, Bitcoin and gold should have a larger presence in investment portfolios.

“I would love gold and Bitcoin together. I think they probably take on a larger percentage of your portfolio than historically they would because we’re going to go through both a challenging political time here in the United States, and we’re going to go through – we’ve obviously got a geopolitical situation,” Jones said.

Buffett’s Evolving Investment Approach

Despite Buffett’s continued skepticism towards Bitcoin, his indirect involvement in Nubank’s thriving venture sparks a discussion about the changing dynamics of investment in the modern financial era.

While he may still consider Bitcoin as “rat poison,” Buffett’s foray into the crypto industry through Nubank indicates a shift in how traditional investors perceive and interact with cryptocurrencies.

Hot Take: Warren Buffett’s Indirect Crypto Venture Highlights Changing Investment Landscape

Warren Buffett’s investment in Nubank, a digital bank facilitating cryptocurrency trading, showcases a changing investment landscape where traditional finance and crypto converge. Despite his previous skepticism towards Bitcoin, Buffett’s involvement with Nubank reflects an increasing recognition of the financial potential within the crypto industry. This highlights a broader trend among traditional investors who are reevaluating their approach to cryptocurrencies amidst uncertain global markets. As established figures like Buffett indirectly engage with crypto ventures, it signals an evolving acceptance of cryptocurrencies as a legitimate asset class. The success of Nubank’s venture further challenges the notion that cryptocurrencies are mere “gambling tokens” and underscores the growing influence of crypto in the modern financial epoch.

By

By

By

By

By

By

By

By