The Crypto Market Celebrates as Bitcoin Surpasses $31,000

Bitcoin has broken past the $31,000 mark, reaching its highest point since July. This milestone is not just a number but also reflects growing confidence in the potential approval of a spot Bitcoin ETF (Exchange Traded Fund).

Bitcoin Breaks $31,000 on ETF Speculation

Bitcoin’s rally continued into its second week, with a surge of over 4% in the last 24 hours pushing its price above $31,000. This level hasn’t been seen since July. The current trading price of Bitcoin is $31,300, demonstrating its strength and contributing to a 3.7% increase in the global cryptocurrency market capitalization to $1.22 trillion.

This surge in Bitcoin’s price is driven by several bullish signals, including the narrowing GBTC discount of -11%. BlackRock CEO Larry Fink believes this indicates a growing consensus for the approval of a spot Bitcoin ETF in Q1 2024, which could lead to significant capital inflows. Bitnomial Exchange’s Michael Dunn also highlights the decoupling of Bitcoin from altcoins as investors anticipate an ETF approval.

“We’re seeing Bitcoin decoupling from altcoins due to bitcoin’s status as a digital gold, coupled with the market’s anticipation of a spot ETF approval. The Bitcoin dominance metric, which has been increasing since the end of 2022, highlights its outperformance compared to other cryptocurrencies,” Dunn said.

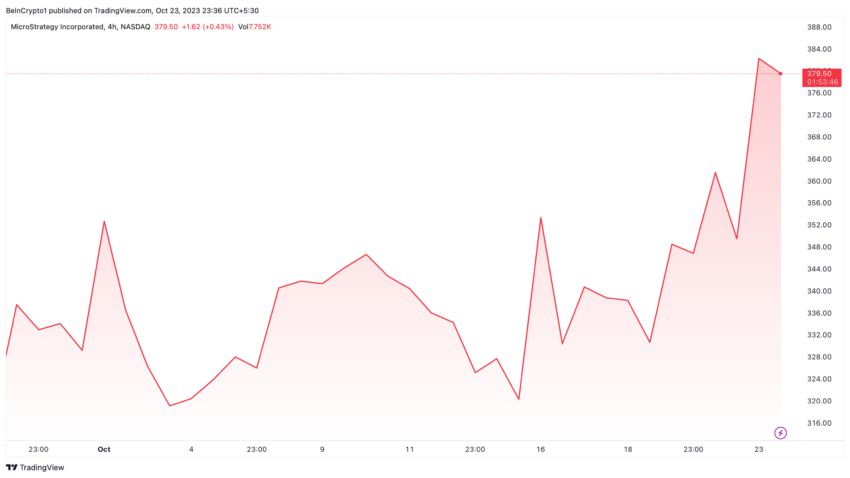

MicroStrategy Is Back In Profits

The rally in Bitcoin has not only impacted market dynamics but also propelled MicroStrategy into profitability once again. With Bitcoin surpassing $31,000, MicroStrategy’s average purchase price of $29,582 has become profitable. This success is a result of the company’s strategic and aggressive approach to purchasing Bitcoin since 2020, led by its co-founder Michael Saylor.

MicroStrategy’s shares have also seen significant growth, rising by about 160% this year after a 74% decline in 2022. This turnaround is directly influenced by Bitcoin’s 85% surge in value this year. Analysts predict that MicroStrategy’s treasury will reflect this positive trend in its upcoming quarter report.

“Given the degree to which MicroStrategy’s treasury is dominated by Bitcoin, their stock should ostensibly trade well or at least they’ll report a stronger quarter on the back of the gains. To the extent that they’ve tried to build around the services of the space, they could outright see increased demand for their services,” said Stephane Ouellette, FRNT Financial’s CEO.

Hot Take: Bitcoin’s Surge Brings Hope and Excitement

As Bitcoin continues its upward climb, it brings renewed optimism to stakeholders like MicroStrategy. The market is eagerly watching to see how high Bitcoin will soar and what opportunities lie ahead.

By

By

By

By

By

By

By

By

By

By