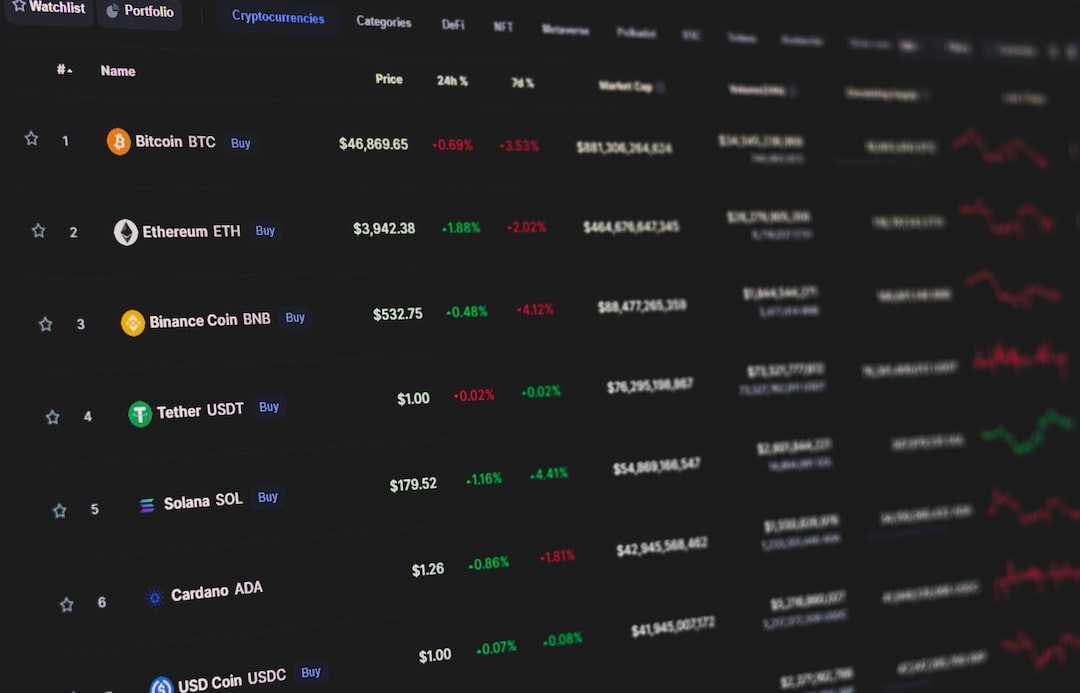

Bitcoin’s price experienced a significant surge in the past 24 hours, primarily due to news about ETFs. This development seems to have triggered the price pump, although there are other factors at play as well.

Yesterday, two important pieces of news emerged regarding ETFs, particularly BlackRock’s application with the SEC. BlackRock is the world’s largest asset manager and has a high ETF approval rate. When it filed its application in July for a spot Bitcoin ETF, BTC’s price reached new highs of around $31,800.

Furthermore, Grayscale’s successful lawsuit against the SEC indicated that the agency no longer had an excuse to reject this type of ETF. As a result, crypto markets reacted positively. Yesterday, BlackRock made headlines again when it started the preliminary fundraising for its ETF and listed iShares Bitcoin Trust on the DTCC.

Chinese markets also played a role in Bitcoin’s price increase. The surge occurred when traditional US and European financial markets were closed, and Asian markets were open. Although Chinese markets initially opened down, they rebounded shortly after, leading to a spike in Bitcoin’s price above $35,000.

The role of the dollar cannot be ignored either. As the Dollar Index declined below 106 points while US stock markets opened, Bitcoin’s price rose from $30,400 to $31,400. Another spike occurred when the Dollar Index fell from 105.5 to 105.4 points simultaneously with a spike on Chinese exchanges.

In summary, multiple factors have contributed to Bitcoin’s recent price boom. The news about ETFs has had the most significant impact on the increase. However, the influence of Chinese markets should not be underestimated as it has been ongoing for several days. Additionally, the slight decline in the dollar suggests renewed interest in risk-on assets.

Over the past ten days alone, Bitcoin’s price has risen by 27%, reaching its highest levels in 2023 so far. This increase occurred in three phases, with each phase marking a return to higher price levels.

By

By

By

By

By

By

By

By