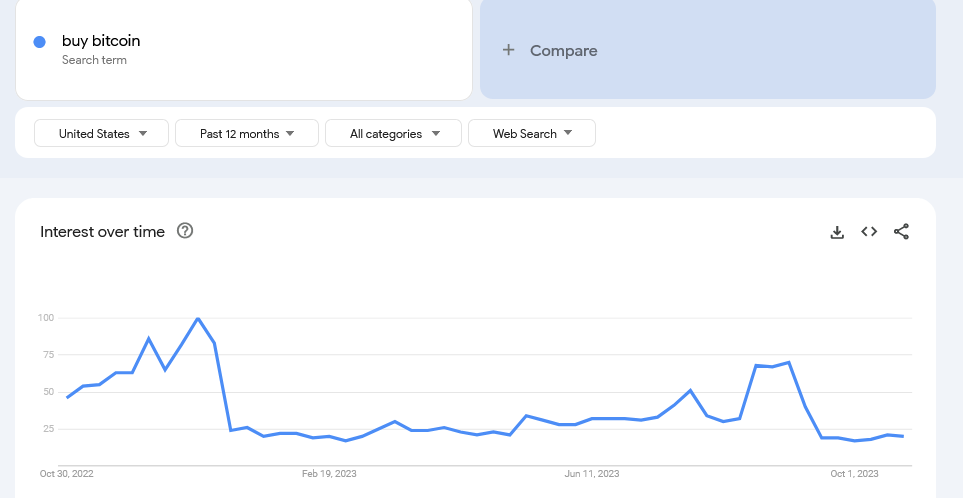

Americans’ Lack of Interest in Bitcoin Revealed by Google Trends

According to data from Google Trends, it appears that Americans may not be interested in Bitcoin (BTC) or that their interest is extremely low and declining, despite recent bullish events. A quick look at Google Trends shows that searches related to “buy Bitcoin” have been consistently decreasing and are currently at their lowest point since 2023, with an average daily search volume of less than 20. The only significant spike in searches occurred in early September, indicating a temporary surge in curiosity and potential buyers.

The Impact of Sentiment on Crypto Markets

Sentiment plays a crucial role in the cryptocurrency market as it can influence prices. When sentiment improves, investors are more likely to buy and hold their cryptocurrencies, hoping to profit from the emerging trend. Conversely, during periods of falling prices, holders often seek safety by selling their coins for stablecoins or cash. However, when there are limited options, investors may choose to exit into well-established coins like Bitcoin or Ethereum, causing those assets to surge.

Factors such as news events, regulatory developments, and influencer comments can significantly impact sentiment. For example, Elon Musk’s alleged involvement in manipulating Dogecoin prices through a pump-and-dump scheme has affected investor sentiment towards cryptocurrencies.

SEC Expected to Approve First Spot Bitcoin ETF in the US

Despite the anticipation surrounding the Securities and Exchange Commission (SEC) potentially approving the first spot Bitcoin Exchange-Traded Fund (ETF), interest in BTC remains at a yearly low in the United States. Analysts have been gradually increasing the likelihood of the SEC approving a Bitcoin ETF in Q4 2023 or early 2023, although it is uncertain whether the agency will authorize one or multiple products simultaneously. JPMorgan analysts have warned that a disapproval could lead to legal issues for the SEC.

Despite recent price stability, Bitcoin recently surpassed its previous highs from July 2023 and reached a new high above $35,000. Traders expect the upward trend to continue, especially with the upcoming Bitcoin halving event in 2024.

Hot Take: Americans’ Disinterest in Bitcoin May Be Temporary

The lack of interest in Bitcoin among Americans, as shown by Google Trends data, could be temporary and influenced by various factors such as market conditions and news events. While current search volumes for “buy Bitcoin” are low, it is essential to consider that sentiment can change rapidly in the cryptocurrency market. The potential approval of a spot Bitcoin ETF by the SEC and upcoming events like the Bitcoin halving could attract renewed interest and drive up demand for Bitcoin. Therefore, it is crucial to monitor future developments and market trends before drawing definitive conclusions about Americans’ overall interest in Bitcoin.

By

By

By

By

By

By

By

By