The Hong Kong Securities and Futures Commission (SFC) Open to Approving Crypto ETFs

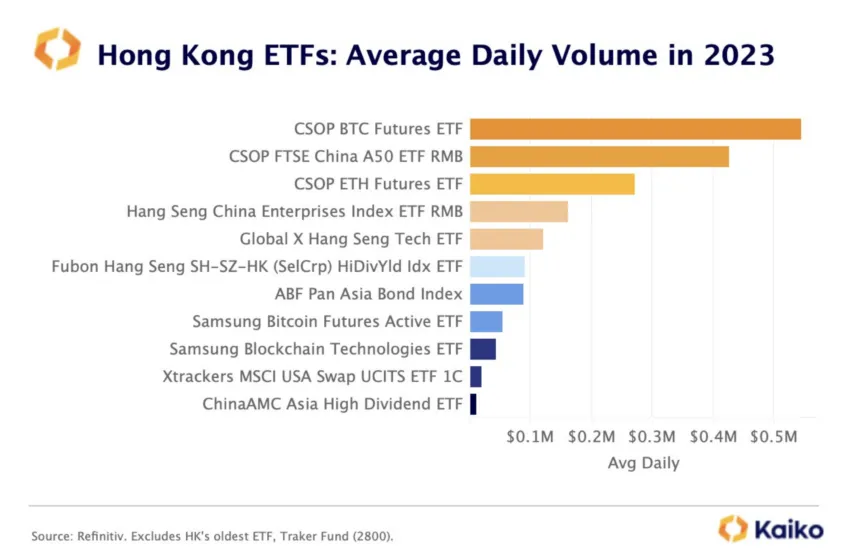

The Hong Kong Securities and Futures Commission (SFC) is willing to approve exchange-traded funds (ETFs) that directly invest in cryptocurrency, as long as regulations address the associated risks. The SFC has already approved two Bitcoin futures ETFs and one Ethereum futures fund. The chief executive of the SFC, Julia Leung, stated that the regulator is open to proposals that enhance efficiency and improve the customer experience. However, Leung emphasized the need for a comprehensive regulatory framework to mitigate risks, especially in light of the alleged fraud at the Hong Kong Exchange JPEX.

Hong Kong ETF Requires Risk Review

Julia Leung stressed the importance of conducting a risk review for a crypto ETF in Hong Kong. She mentioned that while they are open to considering such ETFs, new risks must be adequately addressed. This cautious approach applies regardless of the asset being considered. The SFC is currently refining its crypto regulations and working on guidelines for stablecoins and tokenized real-world assets.

The Hong Kong Monetary Authority (HKMA) is also working on guidelines to assist banks in holding tokenized assets. These efforts may contribute to the SFC’s development of rules for securing crypto assets in ETFs.

US Needs Clear Rules on Customer Assets

The US Securities and Exchange Commission (SEC) has delayed the approval of Bitcoin ETFs due to concerns about market manipulation and asset losses for customers. Several companies, including BlackRock and Fidelity Investments, have applied to launch Bitcoin ETFs, but the SEC is cautious about potential risks. To mitigate these risks, investment managers have amended their applications to include market surveillance agreements with exchanges.

The approval of a crypto ETF in the US may also require clearer laws regarding the safekeeping of customer assets. The SEC’s current proposal includes the requirement for a qualified third-party custodian to hold assets on behalf of customers, but there is no clear qualification path or list of qualified companies provided. Coinbase Custody, for example, safeguards digital assets for BlackRock using multiparty computation, but this arrangement lacks explicit legal standardization.

Hot Take: Hong Kong’s Openness to Crypto ETFs Signals Growing Market Potential

The Hong Kong Securities and Futures Commission’s openness to approving crypto ETFs reflects the growing potential and interest in the cryptocurrency market. While regulatory frameworks need to address risks and ensure investor protection, the willingness to consider such investment vehicles indicates a maturing industry. As more countries explore the possibility of crypto ETFs, it signals a broader acceptance and recognition of cryptocurrencies as legitimate investment assets. This development could pave the way for increased institutional participation and further mainstream adoption of cryptocurrencies.

By

By

By

By

By

By

By

By

By

By

By

By