HSBC to Launch Digital Asset Custody Service by 2024

HSBC Holdings has announced plans to launch a digital asset custody service for institutional clients by 2024. The bank will partner with European firm Metaco, owned by Ripple Labs in the US, to safeguard client assets. This new system will be added to the HSBC Orion service, which began issuing tokenized gold last week. Orion uses Distributed Ledger Technology to ascribe ownership of physical gold represented with digital tokens.

HSBC Says Need for Custody is Growing

Zhu Kuang Lee, the chief digital, data, and innovation officer of securities services at HSBC, noted an increasing demand for digital asset services. According to Lee, there is growing demand for custody and fund administration of digital assets from asset managers and owners as the market continues to evolve.

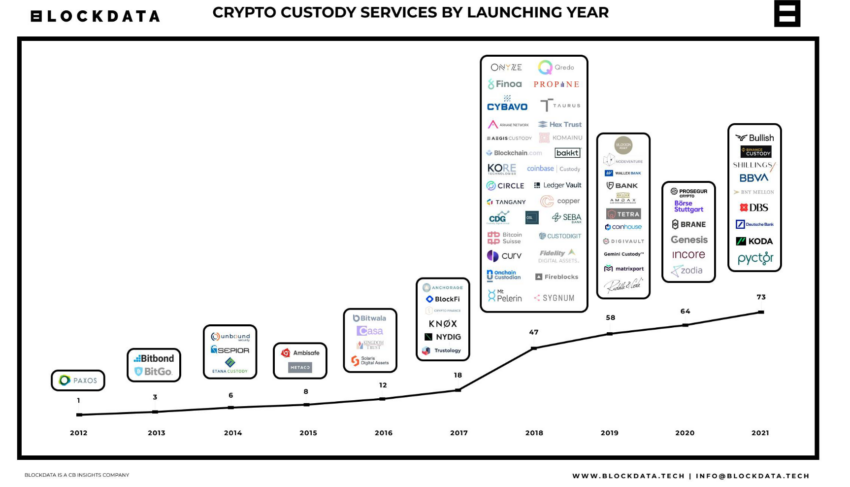

Asia is slowly onboarding the real-world asset tokenization trend that could further increase demand for digital asset custody beyond what HSBC is seeing. The Singapore branch of Switzerland’s Sygnum Bank recently received a license to operate a digital asset trading and custody platform. UK-headquartered firm Zodia launched its crypto custody services in Hong Kong in October.

Asia Lags European and US Banks

Despite its recent crypto push, Asia’s tokenization efforts trail those of European and US banks. German giant Deutsche Bank started holding crypto assets for its institutional clients in September. JPMorgan recently launched a blockchain service to transfer tokenized securities for use as collateral for other trades.

In February, Goldman Sachs helped German engineering firm Siemens with a $63 million bond on a public blockchain. US Mercantile Bank announced plans to tokenize commercial paper in partnership with crypto startup Prontoblock in August.

Hot Take: Asia’s Role in the Digital Asset Custody Race

HSBC’s move into digital asset custody services highlights the growing demand in this sector, especially in Asia where tokenization efforts are still catching up with those in Europe and the US. With banks like HSBC making significant strides towards offering these services, it’s clear that the need for secure and reliable custody solutions will continue to grow as more institutions seek exposure to digital assets.

By

By

By

By

By

By

By

By

By

By

By

By