Tron’s Revenue from Stablecoin Transactions

In the last 30 days, Tron, a smart contract platform, has generated $96.74 million in revenue from on-chain transactions, mainly from USDT. According to data shared on November 8 by @MorenoDV_ on X, there were 59 million transactions posted in the last 30 days on Tron, with the average gas fee at around $1.52. Out of these figures, Tron generated $96.74 million, cementing the platform’s role in enabling stablecoin transactions.

Tron as a Stablecoin Chain: Data

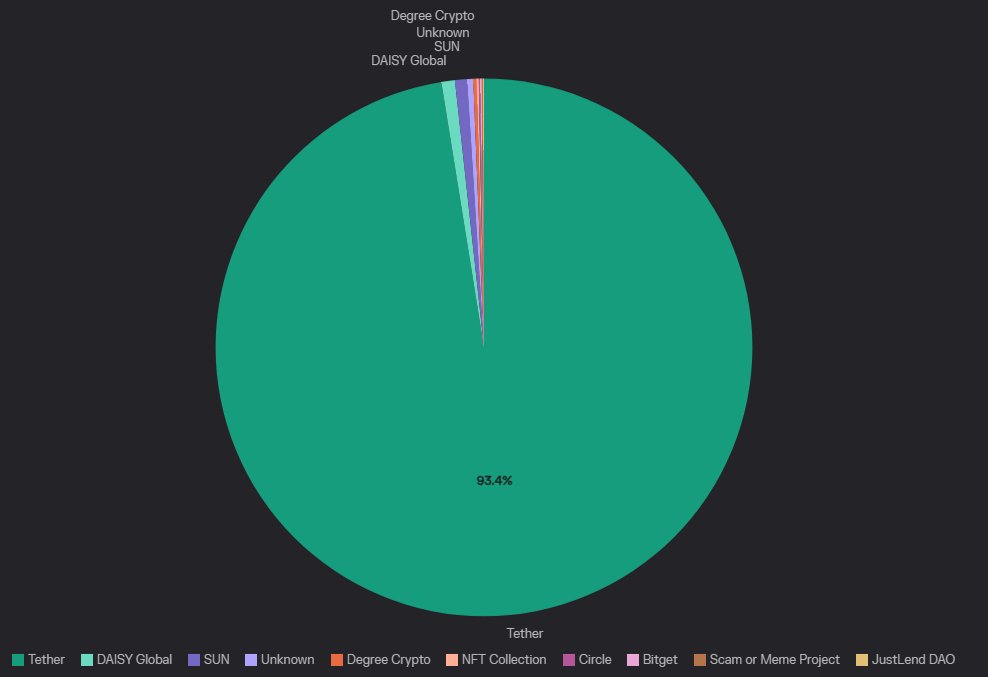

Tron, a public ledger co-founded by Justin Sun, is one of the most active platforms for protocols opting for a scalable layer-1 with relatively low trading fees. Over the years, Tron has become the lead portal for stablecoin transfers. At least 93% of the over 59 million transactions posted on the network were USDT. In Tron, USDT complies with the TRC-20 token standard.

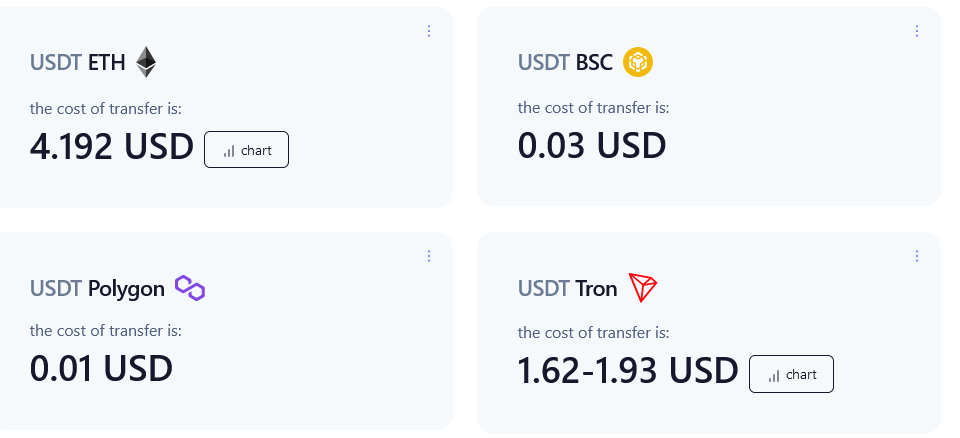

There are multiple reasons why Tron is popular for stablecoin transfers, especially enabling USDT TRC-20 token transfers. Tron is more scalable than Ethereum and has lower on-chain fees. The gas fee on Ethereum stands at around $4.19, while the same transaction on Tron costs between $1.62 and $1.93.

Tron’s USDD And Tether’s Investment

In 2022, Tron launched USDD, an over-collateralized decentralized stablecoin backed by the Tron DAO reserve. The Tron DAO reserve is a decentralized vault governed by TRX holders whose goal is to safeguard the overall blockchain industry and crypto market. USDD provides an alternative to DAI, an algorithmic stablecoin issued by Maker.

In early November, Tether invested $610 million in Northern Data AG, a Bitcoin miner in Germany. Part of the funds received will be used to purchase more mining gear, increasing the firm’s capacity.

Hot Take

The rise of Tron as a leading platform for stablecoin transfers and its strategic investments indicate its growing influence and potential to shape the future of decentralized finance and blockchain technology.

By

By

By

By

By

By

By

By

By

By