The Chicago Mercantile Exchange Takes the Throne in Bitcoin Futures

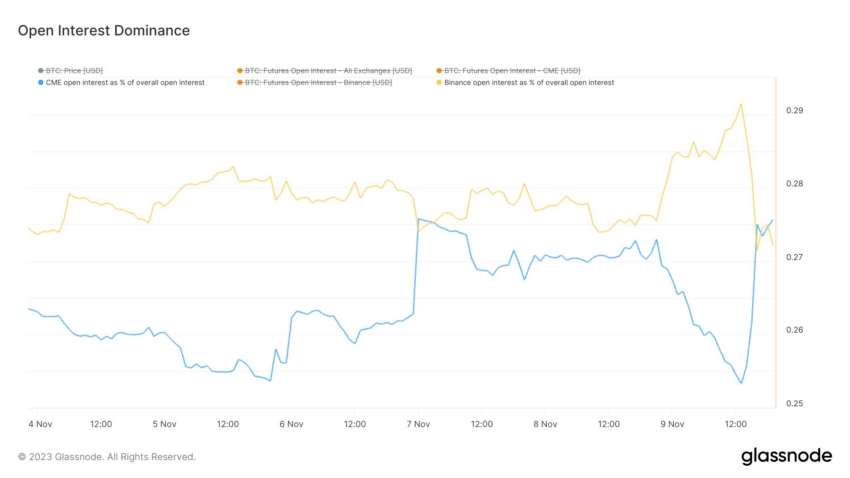

Recently, the Chicago Mercantile Exchange (CME) surpassed Binance as the largest Bitcoin futures exchange based on open interest. This development suggests a potential shift towards institutional interest in the cryptocurrency sector.

The New Bitcoin Futures King

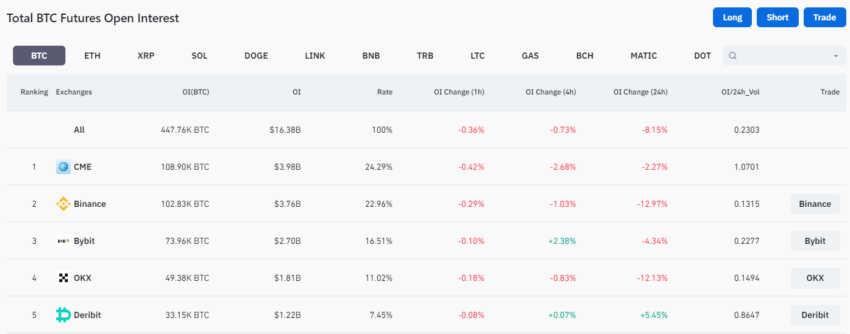

CME, known for its traditional futures contracts with predetermined expiry dates, now boasts an open interest of approximately $4 billion, giving it a market share of over 24%. In contrast, Binance saw its open interest drop to $3.76 billion, representing a nearly 13% decline in the last 24 hours.

Last week, Gabor Gurbac, a strategy advisor at VanEck, pointed out the increasing open interest in Bitcoin futures on CME and predicted that CME would soon overtake Binance as the largest exchange based on Bitcoin futures open interest.

Gurbac sees this as a sign of the crypto market’s early stage and believes that physical markets will catch up soon. Crypto analyst Will Clemente also weighed in on this perceived shift from retail to institutional dominance.

Forces at Play

While CME’s rise underscores institutional attraction to Bitcoin futures, it is essential to consider the overall health of secondary markets and their potential impact on price discovery mechanisms.

The scenario unfolded as Bitcoin surged to an 18-month high of nearly $38,000 before retracing to $36,000. At the same time, Ethereum surpassed $2,100 for the first time in seven months following news that BlackRock had registered an Ethereum trust in Delaware.

This trend reflects a broader pattern of institutional interest in Bitcoin futures. As the crypto market continues to mature, futures exchanges’ dynamics may further evolve, potentially signaling a new era of institutional investment in cryptocurrency.

Hot Take: The Rise of Institutional Interest in Bitcoin Futures

The shift from Binance to CME as the largest Bitcoin futures exchange signals a significant pivot towards institutional involvement in the cryptocurrency sector. As more institutions enter the crypto space through established platforms like CME, it is likely to reshape the landscape and lead to a new era of institutional investment in digital assets.

By

By

By

By

By

By

By

By

By

By