The Most Bullish Bitcoin Chart Of All

If you look at the BTCUSD chart, you’ll see that Bitcoin’s price has risen to around $37,000, increasing by over $10,000 in the last month. This change is making the BTCUSD chart appear quite bullish. However, an even more bullish chart to consider is the BTCUSD versus the M1 money supply. In fact, this comparison could indicate that Bitcoin is on the verge of experiencing its most significant bull run since 2017.

Some believe that Bitcoin will return to $10,000 due to negative macroeconomic conditions. Others are waiting for the next “halving” before they expect further appreciation in BTC value. But it’s possible that a bull market is forming, and these market participants may be in disbelief and affected by recency bias.

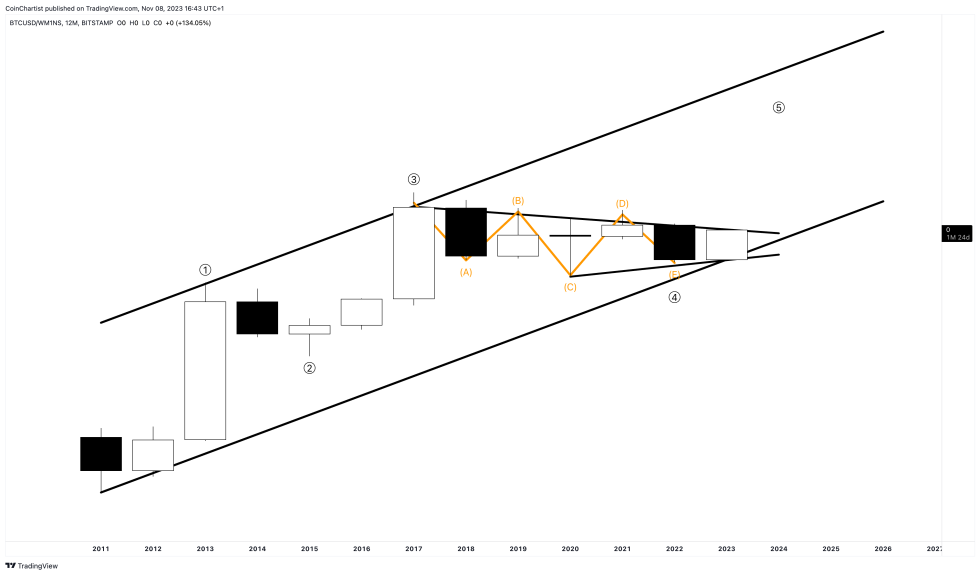

The long-term primary uptrend channel depicted in the chart above began in 2011. Unlike Bitcoin’s regular chart against the US dollar, this ratio hasn’t reached a new high since 2017. It’s been in a bear market for six years when compared against the entire supply of money. The price action is contained within a contracting triangle from a technical perspective.

According to Elliott Wave Principle, primary trends move in five waves up, with triangles typically appearing in wave 4 or wave B during a corrective phase. The chart above shows the same back and forth trading sequence that could lead to a thrust above the upper trend line of the pattern.

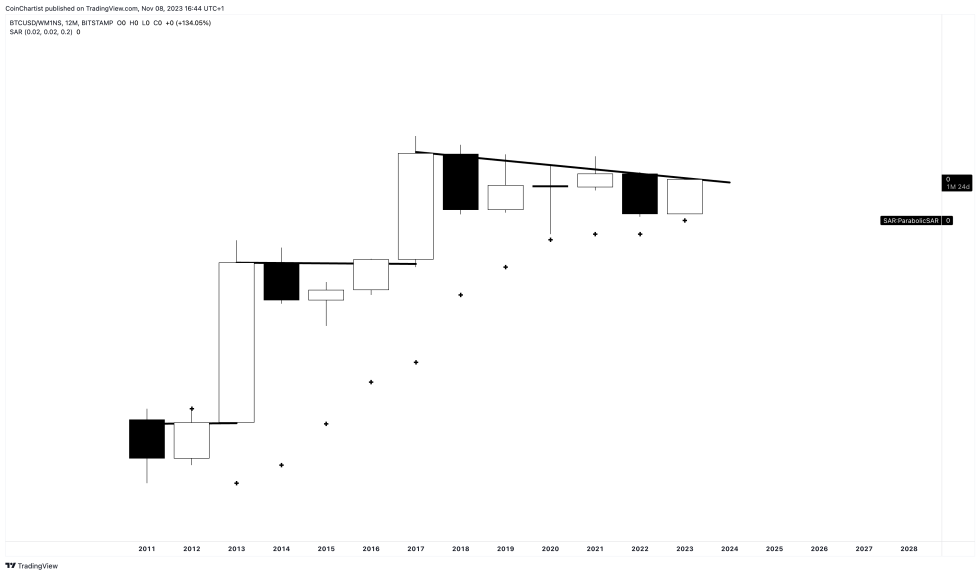

A breakout from a downtrend line appears imminent on the 12M Bitcoin versus M1 money supply chart. Higher timeframes always have the most significance in technical analysis, so if Bitcoin can make a higher high above 2017, its value compared to the supply of money could skyrocket.

The Parabolic SAR also indicates that the ratio is still in a long-term uptrend. If Bitcoin makes two all-time highs without a true breakout against the money supply, what happens once this ratio breaks out?

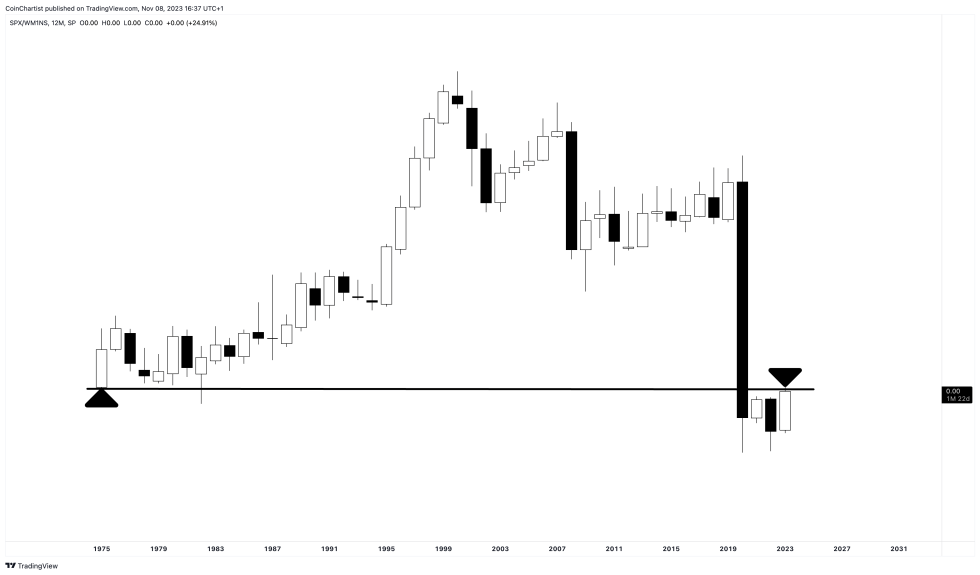

Comparing this chart to S&P 500 against M1 money supply shows that while BTC made a higher high since COVID-related money supply increases, the stock market has sunk to all-time lows against M1. This could be where Bitcoin’s restricted 21 million BTC supply comes into play as it tends to reduce or at least stay constant while money supply increases.

Hot Take: Is This The Start Of A Major Bull Run?

This comparison of Bitcoin’s performance relative to M1 money supply versus traditional USD charts suggests potential for significant growth and could be indicative of an upcoming major bull run for Bitcoin.

By

By

By

By

By

By

By

By

By

By