Hong Kong’s Immigration Investment Scheme and the Potential for Bitcoin

The Hong Kong government introduced an Immigration Investment scheme in March, aiming to attract overseas investments from 200 family offices by 2025. The scheme also has the potential to pave the way for Bitcoin (BTC) as a financial product, according to a member of the Innovation, Technology and Industry Bureau. The regulatory authority is considering spot exchange-traded funds (ETFs).

Crypto Assets as Viable Investments

Legislator Qiu Dagan stated that it’s “theoretically possible” for Bitcoin to qualify as a foreign investment product under the immigration investment scheme. Foreign investors need clarity on whether Bitcoin can be considered an eligible financial product since it is traded on exchanges. The government hopes to compete with Dubai and Singapore, aiming to attract 250 family offices by 2025.

Hong Kong’s Existing ETFs and Regulations

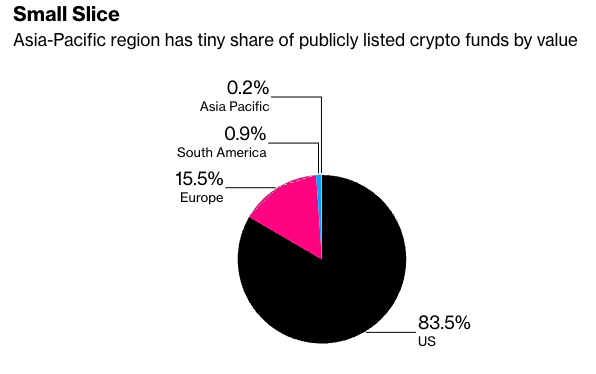

Hong Kong established new rules for crypto assets and exchanges in June. UBS Group AG has integrated two exchange-traded funds tracking Bitcoin futures and one ETF tracking Ethereum futures. However, Asia needs new regulations to address crypto risks for it to become significant in the crypto ETF space.

Hot Take: The Future of Crypto in Hong Kong’s Investment Scheme

The Hong Kong Securities and Futures Commission has promised to consider ETFs tracking the prices of crypto assets directly if policies address new risks. As discussions continue, it remains to be seen whether Hong Kong will allow Bitcoin in its Immigration Investment scheme.

By

By

By

By

By

By

By

By