Bitcoin Miners Prepare for Halving to Maximize Profits

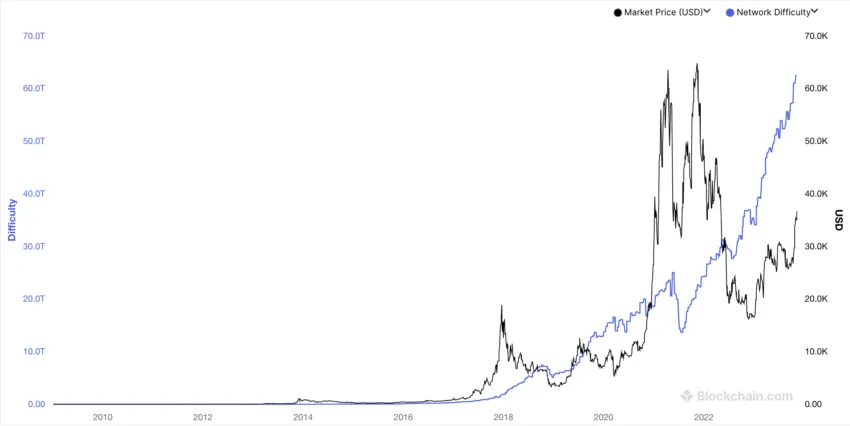

Mining rigs are being set up by miners who want to capitalize on the Bitcoin (BTC) surge before next year’s halving. JPMorgan analysts note that the hashrate, which measures online mining power on the Bitcoin network, has reached all-time highs in recent months.

Bitcoin (BTC) Miners Try to Beat Rising Difficulty

The increased mining power is being noticed by the Bitcoin algorithm, which adjusts the difficulty of solving blocks every two weeks based on how long it took to solve the previous 2,016 blocks. Miners are buying machines that consume less power per hash and relocating to areas with cheaper electricity to improve their margins.

Halving Will Wash Out Smaller Miners

The upcoming halving will reduce miner revenue per block from 6.25 Bitcoin to 3.125 Bitcoin, leading some miners without optimized power-purchasing agreements to fold when revenues drop. Larger miners like Marathon Digital and Riot plan to acquire smaller ones who fail after the halving, potentially leading to mergers, acquisitions, and bankruptcies.

“We might see some mergers and acquisitions. We might see some bankruptcies. We might see some liquidations in terms of loans. There will be a very unstable market where the bigger players can get bigger, and they can improve their market positions, and weak players can die or be acquired by some of these companies.”

Smaller operations may not survive the halving, as stated by William Szamosszegi, CEO of Sazmining.

Hot Take

As Bitcoin’s price continues to rise ahead of the halving, miners are scrambling to maximize profits through increased mining power and strategic business decisions. The upcoming halving is expected to shake up the mining industry, potentially leading to mergers, acquisitions, and bankruptcies as larger players seek to strengthen their positions while weaker ones face potential extinction.

By

By

By

By

By

By

By

By

By

By

By

By