Germany’s Finance Sector Considers Bitcoin Legal Tender

Bundestag member Joana Cotar has expressed her support for recognizing Bitcoin as legal tender in Germany, signaling a potential shift in the country’s approach to digital currencies. This stands in contrast to the European Central Bank’s current efforts to develop a digital euro central bank digital currency (CBDC).

Advocacy for Bitcoin in German Finance

Cotar aims to bring Bitcoin into the mainstream of German finance by establishing a legal framework that formally recognizes Bitcoin as legal tender. Her goal is to create a balanced regulatory environment that ensures legal security for companies and citizens while addressing challenges such as money laundering and tax evasion associated with Bitcoin usage.

Bitcoin in the Bundestag Program

Cotar has launched the “Bitcoin in the Bundestag” program to educate her parliamentary colleagues about the benefits of Bitcoin, emphasizing privacy protection, robust security standards, and a regulatory approach that avoids excessive restrictions. Her efforts are exclusively focused on Bitcoin, highlighting its unique technological attributes and societal significance.

Digital Euro Pushback

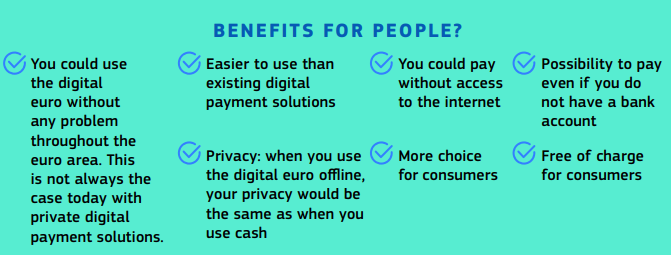

Cotar opposes the digital euro CBDC, arguing that Bitcoin’s decentralized nature makes it a more suitable digital asset for Germany, promoting financial freedom and privacy. This contrasts with the ECB’s project to create a digital euro, which aims to offer high levels of privacy and instant payment settlements.

Hot Take: Implications of Germany Recognizing Bitcoin as Legal Tender

Cotar’s push for Bitcoin as legal tender in Germany could position it as a pioneer in adopting Bitcoin at a governmental level, potentially influencing other nations to reconsider their stance on Bitcoin. Given Germany’s economic influence in Europe and globally, this move has significant implications for the future of cryptocurrency adoption worldwide.

By

By

By

By

By

By

By

By