In the current bull market frenzy focusing on Bitcoin and Ethereum, a quieter yet significant surge is happening with SOL, the primary token of the Solana blockchain.

Despite previous connections to disgraced crypto tycoon Sam Bankman-Fried, Solana has managed to thrive, reaching unprecedented levels and attracting a growing number of users to its network.

VanEck Highlights Thriving Ecosystem

The Solana blockchain positions itself as a quicker and more cost-effective option to Ethereum. However, Ethereum remains the leading choice for NFT marketplaces and decentralized financial applications.

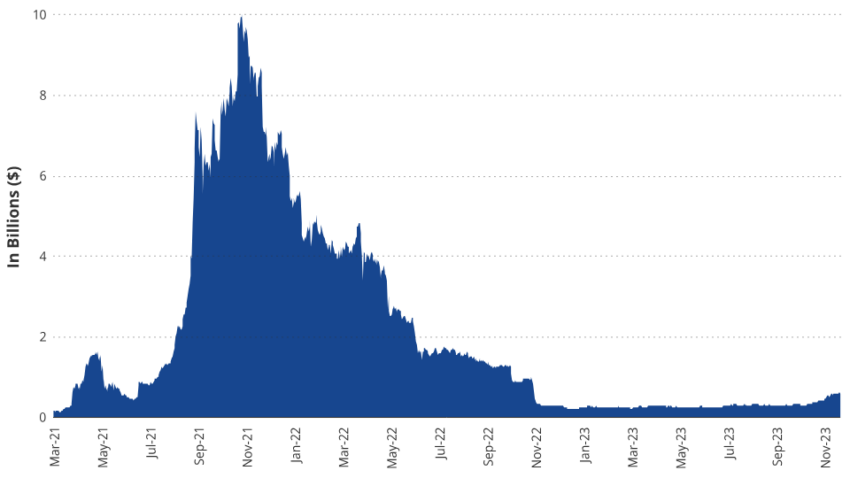

But that could substantially change next year as asset management firm VanEck predicted that Solana would become a top three blockchain network by market capitalization, total value locked (TVL), and active users. The firm envisaged several asset managers applying for a spot Solana ETF (exchange-traded fund) by next year.

Read more: How To Prepare for a Bitcoin ETF: A Step-by-Step Approach

Solana’s current ecosystem lends credence to this prediction. During the past year, Solana has forged key collaborations with traditional global financial institutions. The platform has secured partnerships with industry giants like Visa and Shopify, who are using its technology to fasten their payment processes.

Furthermore, VanEck highlighted the potential for Solana-based protocols, such as Pyth Network, to surpass those operating on Ethereum. Pyth Network functions as an oracle provider akin to Chainlink. Currently, Chainlink secures approximately $15 billion of assets, whereas Pyth Network manages less than $2 billion.

Read more: Top 10 Cryptocurrencies to Invest in December 2023

However, VanEck said that could change if Solana gains more market share and sees more DeFi activity.

“As Chainlink struggles to find institutional adoption of its LINK token, we expect Pyth to gain meaningful market share on the back of several genuine innovations, including its “push” architecture and confidence interval system,” analysts at VanEck said.

Solana Draws Apple Comparison

Moreover, CEO of Real Vision Raoul Pal pointed out that Solana’s user experience makes it easier for its applications. In his view, the comparison between Solana and Ethereum is like Apple versus Android.

While Solana is more like Apple with its sleek design and closed system, Ethereum is broader and more open.

“The comparison is like Android versus Apple. It’s like Solana feels like Apple; its a closed system, but it is very slick, very good, will create great loyalty. [But] Ethereum is much broader, much more open in terms of other things that can be built on top of it,” Pal said.

Still, Pal believes Ethereum will remain dominant because developers constantly innovate. Even then, he expects Solana to grow to become a multibillion-dollar ecosystem in terms of valuation.

Hot Take: Solana’s Rise as a Top Blockchain Competitor

In the midst of the Bitcoin and Ethereum bull market frenzy, Solana has emerged as a significant contender. Despite past connections to Sam Bankman-Fried, the token has thrived and attracted a growing user base. Asset management firm VanEck predicts that Solana will become a top three blockchain network by market capitalization, total value locked (TVL), and active users. The platform’s collaborations with global financial institutions, such as Visa and Shopify, lend credibility to this prediction. Additionally, VanEck highlights the potential for Solana-based protocols like Pyth Network to surpass those on Ethereum. While Solana’s user experience draws comparisons to Apple’s closed system, Ethereum’s openness and constant innovation are expected to maintain its dominance.

By

By

By

By

By

By

By

By