Shiba Inu Whales Withdraw from Exchanges: What It Means for SHIB’s Price

An analyst has pointed out that there has been a significant decrease in the supply of Shiba Inu on exchanges recently. This refers to the percentage of the total circulating supply of Shiba Inu that is held in centralized exchange wallets. When this metric decreases, it indicates that investors are transferring coins from exchanges to their self-custodial wallets, which suggests long-term holding.

Conversely, if the value of this indicator increases, it could be a bearish signal as holders may be depositing their coins on exchanges for selling purposes.

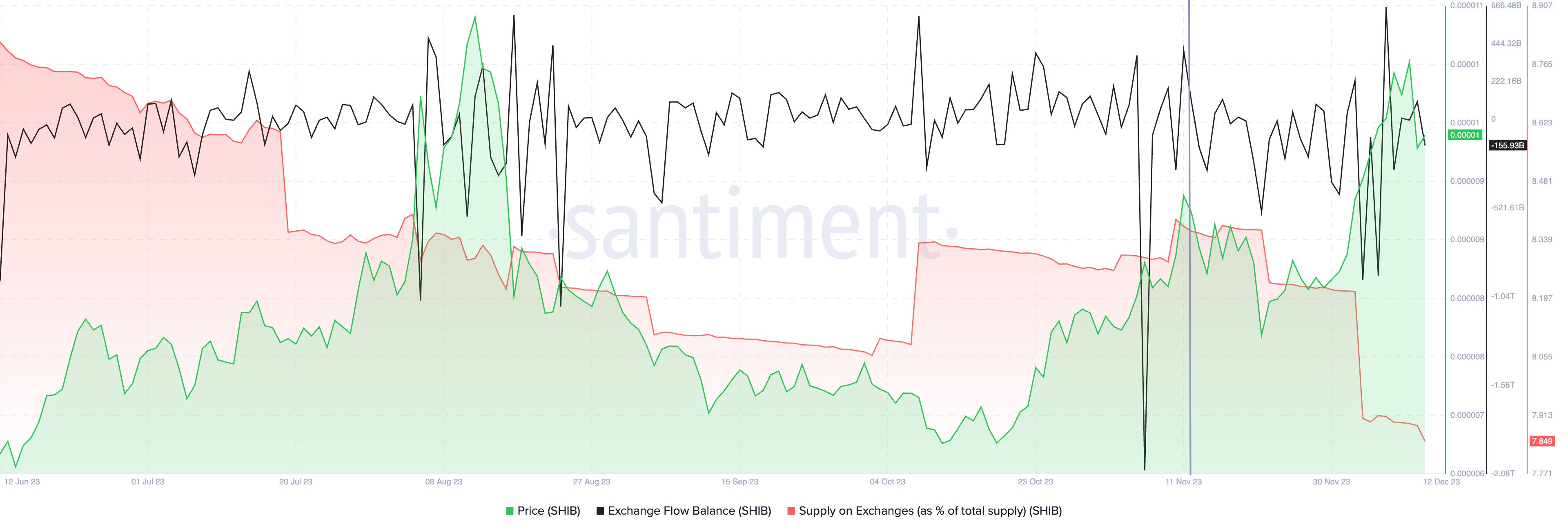

The chart below shows the trend in Shiba Inu supply on exchanges over the past month:

The graph reveals a significant decrease in Shiba Inu supply on exchanges over the past month, with approximately 0.51% of the total circulating supply leaving these platforms. Interestingly, these withdrawals coincided with a rally in SHIB’s price, suggesting buying activity from whales.

Despite the recent decline in SHIB’s price, more withdrawals have continued to occur, indicating that investors have not reacted negatively to the plunge yet.

While exchange outflows can have short-term effects on price, they also indicate a healthier distribution of supply and reduce the control of large entities over a cryptocurrency. This trend towards decentralization can lead to a more independent market in the future.

SHIB Price

Shiba Inu briefly surpassed the $0.00001000 level but has since dropped to $0.00000942.

Hot Take: Shiba Inu Whales’ Withdrawals Signal Positive Developments for SHIB

The recent decrease in Shiba Inu supply on exchanges due to whale withdrawals is a positive development for the cryptocurrency. It indicates that investors are opting for self-custodial wallets and holding their coins for the long term. This trend towards decentralization and reduced control by large entities bodes well for SHIB’s stability and market independence. Despite a decline in price, investors have continued to withdraw from exchanges, suggesting confidence in the asset. Moving forward, it will be interesting to see how this trend affects SHIB’s price and market dynamics.

By

By

By

By

By

By

By

By

By

By