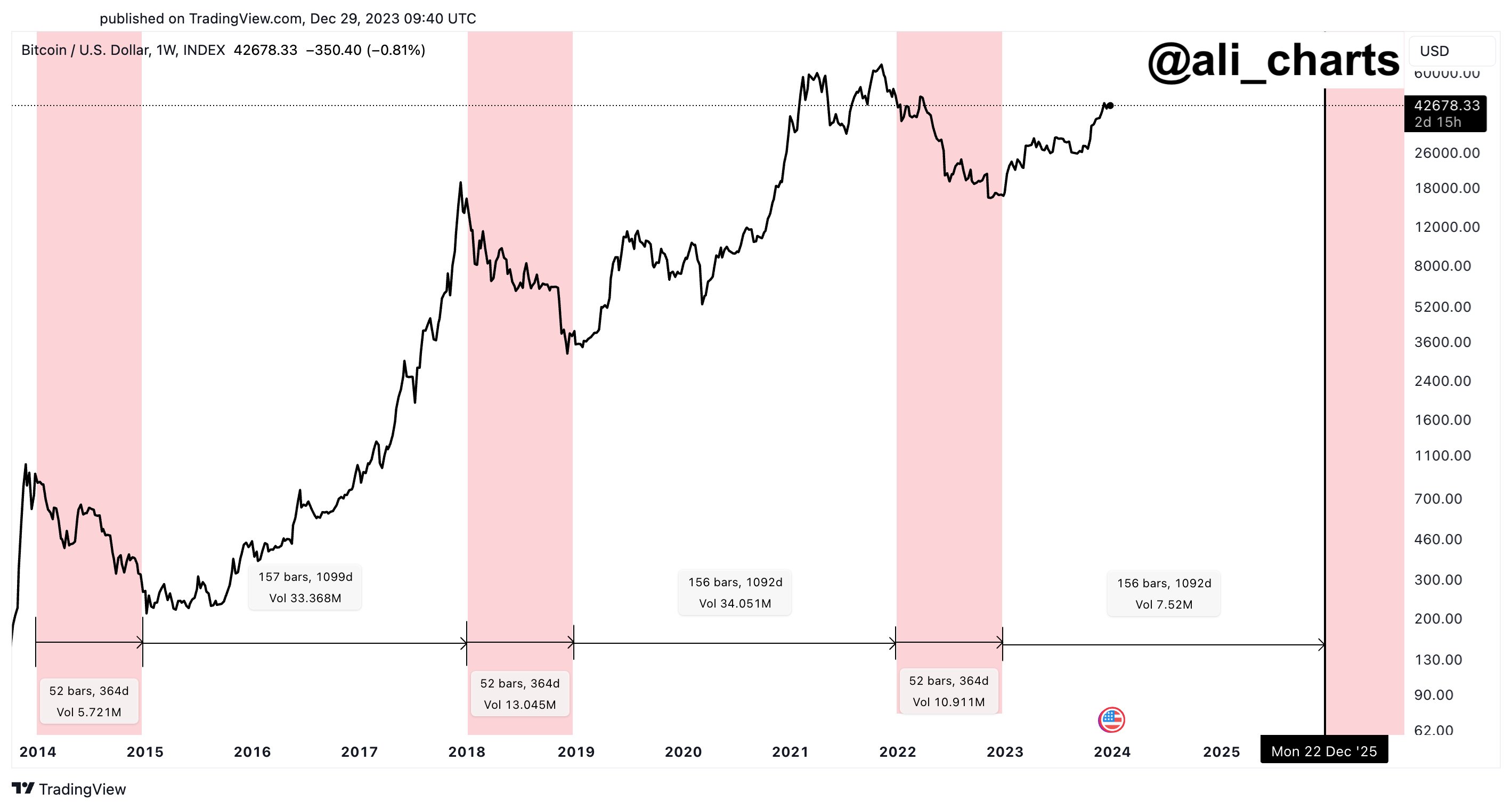

Bitcoin’s Four-Year Cycle

Bitcoin has a history of following a four-year cycle, consisting of three years of bullish trends and one year of bearish correction. During the last bear market, BTC price dropped significantly from November 2021 to December 2022.

Analyst Predicts Two More Years of Bull Run

Analyst Ali Martinez suggests that Bitcoin operates in four-year cycles, driven by halving events that occur every four years. These events have historically caused a surge in Bitcoin’s price. Martinez believes that the current bullish phase started in January 2023 and will likely continue until December 2025, despite regulatory challenges and lawsuits.

Upcoming Bitcoin Halving Event

The next Bitcoin halving is projected to take place on April 20, 2024. This event will reduce the block reward from 6.25 BTC to 3.125 BTC. The anticipation of this halving event has already contributed to the recent rally in Bitcoin’s price.

Current Trading Status

In the past 24 hours, BTC price has been trading sideways around $42,916. The trading volume has also decreased by 7%, indicating a decline in trader interest.

Factors Influencing Bitcoin Price Rally

The approval of a spot Bitcoin ETF by the US SEC and positive sentiment resulting from rate cuts by the US Federal Reserve have played a role in driving Bitcoin’s price rally.

Hot Take: Bitcoin’s Bullish Future

Bitcoin’s historical patterns and the upcoming halving event suggest that the bull run will likely continue for the next two years. Despite challenges and setbacks, Bitcoin has shown resilience and the potential for significant growth in the coming years.

By

By

By

By

By

By

By

By

By

By

By

By