Bitcoin ETF Applicants Face SEC Critiques

Recently, issuers of spot Bitcoin exchange-traded funds (ETFs) submitted revised applications disclosing previously undisclosed fee structures. However, the U.S. Securities and Exchange Commission (SEC) quickly responded with comments on the revisions, causing speculation about potential delays in the approval of the Bitcoin ETFs.

SPOT BITCOIN ETF UPDATE: The SEC just issued additional comments on pending applicant’s S-1s. This is a delay signal.

#BitcoinETF #bitcoin

— Perianne (@PerianneDC) January 9, 2024

According to Chamber of Digital Commerce CEO Perianne Boring, the SEC’s comments on the S-1s suggest a delay in the process.

Analysts Disagree on Bitcoin ETF Delays

Bloomberg Intelligence ETF analyst James Seyffart disagreed with the speculation, stating that the SEC’s quick response does not necessarily indicate a delay. Seyffart highlighted the speed at which the SEC is reviewing these applications, suggesting that if they wanted to delay, the issuers would not have received comments back so quickly.

Really this just shows how quickly the SEC is turning these things around. Borderline unheard of to send over a document to the SEC in the morning and get comments back the same day (I think)

If they wanted to delay — the issuers wouldn’t have gotten comments back tonight

— James Seyffart (@JSeyff) January 9, 2024

Finance lawyer Scott Johnsson explained that the SEC can approve 19b-4 forms for spot Bitcoin ETFs without requiring complete S-1 forms. This suggests that the comments on the S-1s are part of an expedited process for approval and launch.

Fox Business journalist Eleanor Terrett also confirmed that sources indicated no change in plans from the SEC, further easing concerns about delays.

Just spoke with a couple of people who received additional comments. They say they’re not worried and the @SECGov hasn’t conveyed a change of plans.

My sense is that they’re fairly confident this is just part of the process to get everything in before January 10th.

— Eleanor Terrett (@EleanorTerrett) January 9, 2024

Terrett’s sources expressed confidence that the comments were part of the regular process to meet the January 10 deadline.

Issuers Disclose Fees in S-1 Forms

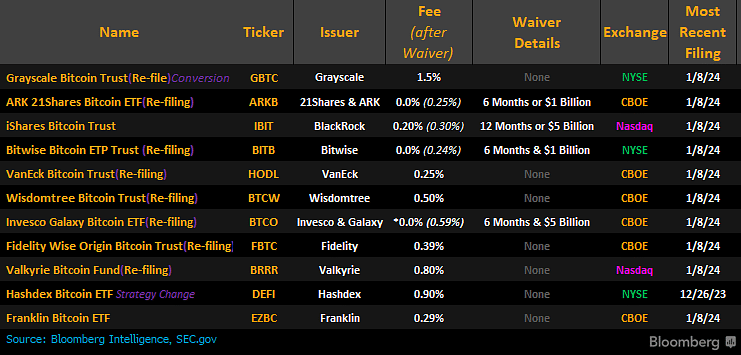

In the revised S-1 forms, different issuers of Bitcoin ETFs revealed varying fee structures. Bitwise set a competitive tone with a fee of 0.24%, while VanEck and ARK Invest had slightly higher fees at 0.25%. Invesco stood out by offering a fee waiver, reducing its fee from 0.59% to zero for the first six months.

Although Grayscale has the highest fee at 1.5%, its Bitcoin Trust (GBTC) demonstrated strong trading volume, surpassing many ETFs on January 8.

Hot Take: SEC Comments Spark Speculation, But Analysts Remain Optimistic

The recent comments from the SEC on the revised S-1 forms of Bitcoin ETF applicants have caused some speculation about potential delays. However, analysts and industry insiders remain optimistic about the approval process. While concerns were raised, experts like James Seyffart and Scott Johnsson point out that the quick response from the SEC actually demonstrates their efficiency and commitment to moving forward with the approval and launch of Bitcoin ETFs. Additionally, sources close to the SEC have indicated that there are no plans to change the schedule, alleviating worries further. Overall, although there may be some uncertainty, there is still confidence in the timely approval of Bitcoin ETFs.

By

By

By

By

By

By

By

By

By

By

By

By