The Bitcoin Price Pumps Above $43,000

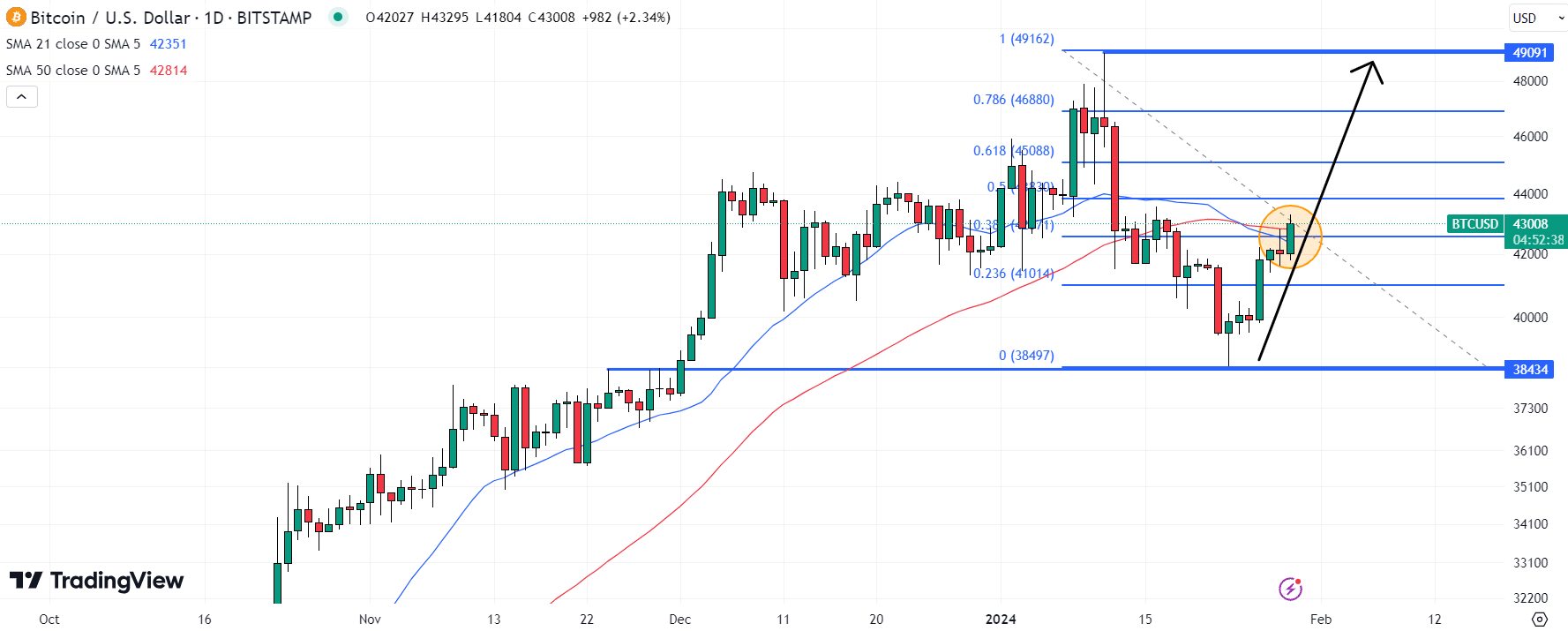

The Bitcoin price surged back above the $43,000 level on Monday, signaling a comeback for BTC bulls. This comes as concerns about Grayscale’s sell pressure ease and new bullish bets enter the market.

Grayscale’s GBTC has been facing heavy sell pressure since becoming an ETF earlier this month. This caused the Bitcoin price to drop to the $38,000s from its previous highs above $49,000.

However, Grayscale only transferred 6,500 BTC tokens to exchanges for selling on Monday, a significant decrease from the nearly 20K BTC tokens per day they were dumping previously.

JP Morgan believes that post-ETF approval profit-taking from GBTC is nearing its end. Additionally, analyst Marcus Thielen suggests that new long positions could enter the market above $43,000 as the Bitcoin price begins wave 5 towards new yearly highs.

Bitcoin Price Catalysts to Watch This Week

The Bitcoin price is currently at a critical point as it tests its 21 and 50-day moving averages (DMAs). A sustained break above these levels and the 50% Fibonacci retracement of the recent pullback could confirm bullish momentum.

However, the upcoming Fed meeting on Wednesday could impact the Bitcoin price. If the Fed pushes back against market expectations of imminent interest rate cuts, it could lead to a stronger US dollar and higher yields, negatively affecting crypto.

While Fed rate cuts may not happen in March, they are still anticipated at some point this year, especially if US regional banks face difficulties when a key liquidity program expires in March.

Traders will also be monitoring spot Bitcoin ETF flows, particularly the slowdown in GBTC outflows and the inflows into other ETFs.

Hot Take: Bitcoin Bulls Regain Control

The Bitcoin price has made a comeback, surpassing $43,000 as BTC bulls regain control. This surge is attributed to easing concerns about Grayscale’s sell pressure and new bullish bets entering the market. Analysts believe that post-ETF profit-taking from GBTC is coming to an end and that new long positions could enter above $43,000. However, the upcoming Fed meeting and potential unwinding of rate-cut bets could impact the Bitcoin price. Additionally, traders will be closely watching spot Bitcoin ETF flows to gauge market sentiment. Overall, there are positive indicators for Bitcoin’s future performance but potential risks remain.

By

By

By

By

By

By

By

By

By

By