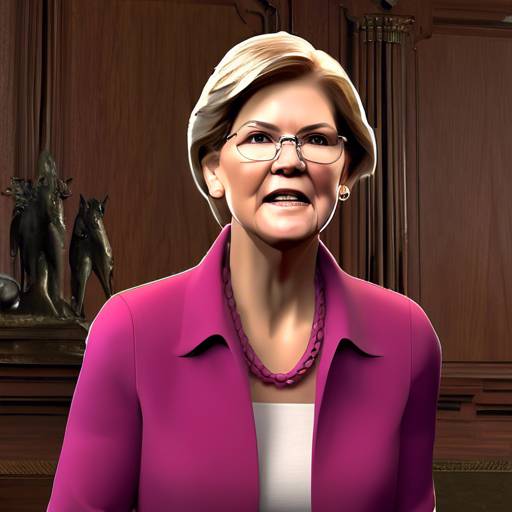

Elizabeth Warren’s Influence on Financial Regulators

Massachusetts Senator Elizabeth Warren is facing criticism from the crypto community due to her strong anti-crypto stance and her close association with SEC Chair Gary Gensler. This scrutiny has intensified as Warren prepares for upcoming elections and as the regulatory battles surrounding cryptocurrencies continue.

A Closer Look at the Controversy

Ryan Selkis, the founder of Messari, has publicly criticized Senator Warren and SEC Chair Gensler, accusing Gensler of corruption and suggesting that Warren has significant influence over financial regulators.

Kraken CEO Dave Ripley has also added fuel to the fire by revealing details about their ongoing legal battle with the SEC. Ripley has highlighted Kraken’s testimony before Congress, which emphasizes the need for clear crypto regulations while limiting the SEC’s jurisdiction.

In addition, Ripley argues that the SEC’s lawsuit against Kraken is an attempt to stifle political speech and intimidate crypto innovators. He believes that the lawsuit lacks substance and was timed to hinder advocacy efforts for better regulatory frameworks.

Anthony Scaramucci, founder of SkyBridge Capital, has joined in on the criticism, calling for a change in President Biden’s approach to cryptocurrency. He specifically singles out Senator Warren and Gary Gensler, attributing potential election losses to their stance on crypto.

The Battle between Regulatory Authorities and Industry Stakeholders

The clash between regulatory authorities and industry stakeholders in the crypto landscape continues to intensify. The outcome of this battle will not only shape the future of cryptocurrencies but also influence broader perceptions of regulatory oversight in the digital age.

Hot Take: The Impact of Elizabeth Warren’s Anti-Crypto Stance

Massachusetts Senator Elizabeth Warren’s strong anti-crypto stance and her association with SEC Chair Gary Gensler have drawn significant criticism from the crypto community. Here’s why it matters:

1. Stifling Innovation

Warren’s anti-crypto stance could hinder innovation in the cryptocurrency industry. By advocating for strict regulations, she may discourage entrepreneurs and investors from participating in the space, limiting its growth potential.

2. Regulatory Overreach

Warren’s influence over financial regulators raises concerns about regulatory overreach. If she wields significant power over the SEC and other regulatory bodies, it could lead to excessive regulations that stifle the industry and limit its ability to thrive.

3. Lack of Understanding

Warren’s strong opposition to cryptocurrencies suggests a lack of understanding about their potential benefits. By dismissing this emerging technology, she may overlook opportunities for financial inclusion, economic growth, and technological advancement.

4. Potential Electoral Impact

The crypto community’s criticism of Warren’s anti-crypto stance could have electoral consequences. As more individuals become interested in cryptocurrencies, they may prioritize candidates who support innovation and embrace new technologies.

5. Influence on SEC Policies

Given her association with SEC Chair Gary Gensler, Warren’s anti-crypto stance may influence the agency’s policies towards cryptocurrencies. This could result in stricter regulations and enforcement actions that impact the industry as a whole.

In Conclusion

The controversy surrounding Senator Elizabeth Warren’s anti-crypto stance and her association with SEC Chair Gary Gensler highlights the tensions between regulators and the crypto community. The outcome of this battle will shape the future of cryptocurrencies and impact broader discussions about regulatory oversight in the digital age.

By

By

By

By

By

By

By

By