Executive Summary 📊

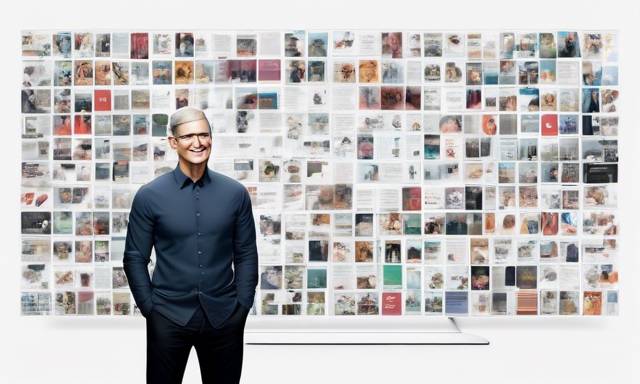

The recent share sale by Apple CEO Tim Cook has sparked discussions among crypto readers about the implications for the company’s stock. Selling over $50 million worth of shares, and doing so when prices have been rising since earlier in the year, raises questions about potential insider insights. Despite these concerns, several analysts believe that the long-term outlook for Apple remains positive, even as challenges like regulatory issues loom on the horizon. Understanding these dynamics could provide valuable insights into Apple’s market positioning.

CEO Tim Cook’s Recent Stock Sale 💼

Tim Cook, the Chief Executive Officer of Apple, made headlines by selling more than $50 million in the company’s shares, despite the price showing positive movement since early May this year. Specifically, he sold 223,986 shares on October 2, gathering a total of $50,276,076 at a price of $224.46 per share.

At the time of the report, Apple’s stock was trading at $225.54, reflecting a daily increase of 0.98% and a year-to-date rise of 21.50%. This indicates a robust upward trend for the stock.

Analyzing the Implications of Cook’s Sale 📈

The timing of Cook’s sale naturally leads to speculation, particularly since it occurred near AAPL’s peak price of $243.82 from July 16, a mere 8.6% away. This situation raises questions about whether Cook has access to confidential information that could suggest a drop in stock performance, which would be seen as a bearish indicator.

It’s important to note, however, that regulations designed to prevent insider trading usually provide a more reliable safeguard against company insiders acting inappropriately than they do for political figures. Sales like this are often planned well in advance, and Cook’s SEC filing indicates that the sale was made under a pre-established 10b5-1 plan initiated on May 21.

At that time, AAPL shares were trading at a much lower price of $192.35, suggesting that this transaction was part of a long-term strategy rather than a knee-jerk reaction to recent price movements.

Future Prospects for AAPL Stock 🔮

While there is a generally positive outlook from both retail and institutional investors about Apple, there are dissenting opinions too. The expectation is that the company could reach a $4 trillion valuation by 2025, but some analysts argue that competitors like Amazon, Microsoft, and Nvidia may provide more attractive opportunities.

Additionally, there have been concerns regarding disappointing preorder figures and initial sales for the new iPhone 16. Nevertheless, industry experts, including Atif Malik from Citi, still believe in the potential for demand to rise as lead times stabilize in the coming months.

This sentiment was echoed by market commentator Jim Cramer, who recalled past instances where initial sales figures were unimpressive, only for subsequent periods to show significant growth.

Challenges on the Horizon ⚠️

Despite the predominantly optimistic outlook for Apple, traders should remain aware of various challenges. Regulatory hurdles could pose a significant risk, such as the need for the company to pay approximately $14 billion to the Irish government due to back taxes. Additionally, the introduction of third-party app stores has opened up Apple’s previously closed ecosystem, which might affect profit margins and stock performance.

As you navigate through the complexities of Apple’s market environment, keeping a watchful eye on these developments can enhance your understanding of how both external and internal factors could influence AAPL’s trajectory.

Hot Take 🔥

For crypto readers, the recent sales activities of Apple’s CEO, combined with the company’s future growth prospects and inherent challenges, present a multifaceted picture. While issues such as regulatory scrutiny and competition exist, the potential for growth in the tech sector and Apple’s strong brand reputation could lead to exciting developments ahead. Stay informed on these dynamics, as they may significantly influence your perspective on the market and Apple’s position within it.

By

By

By

By

By

By

By

By