The S&P 500 (SPX) Falls, How Will Bitcoin React?

The S&P 500 (SPX) has experienced a nearly 1% decrease since the market closed yesterday. Some stocks have fallen by almost 20%, including Coinbase Global, Inc. (COIN), which has dropped more than 5%. Now the question is, how will this decrease impact the price of Bitcoin (BTC)? Let’s explore the correlations between stocks and Bitcoin to find out.

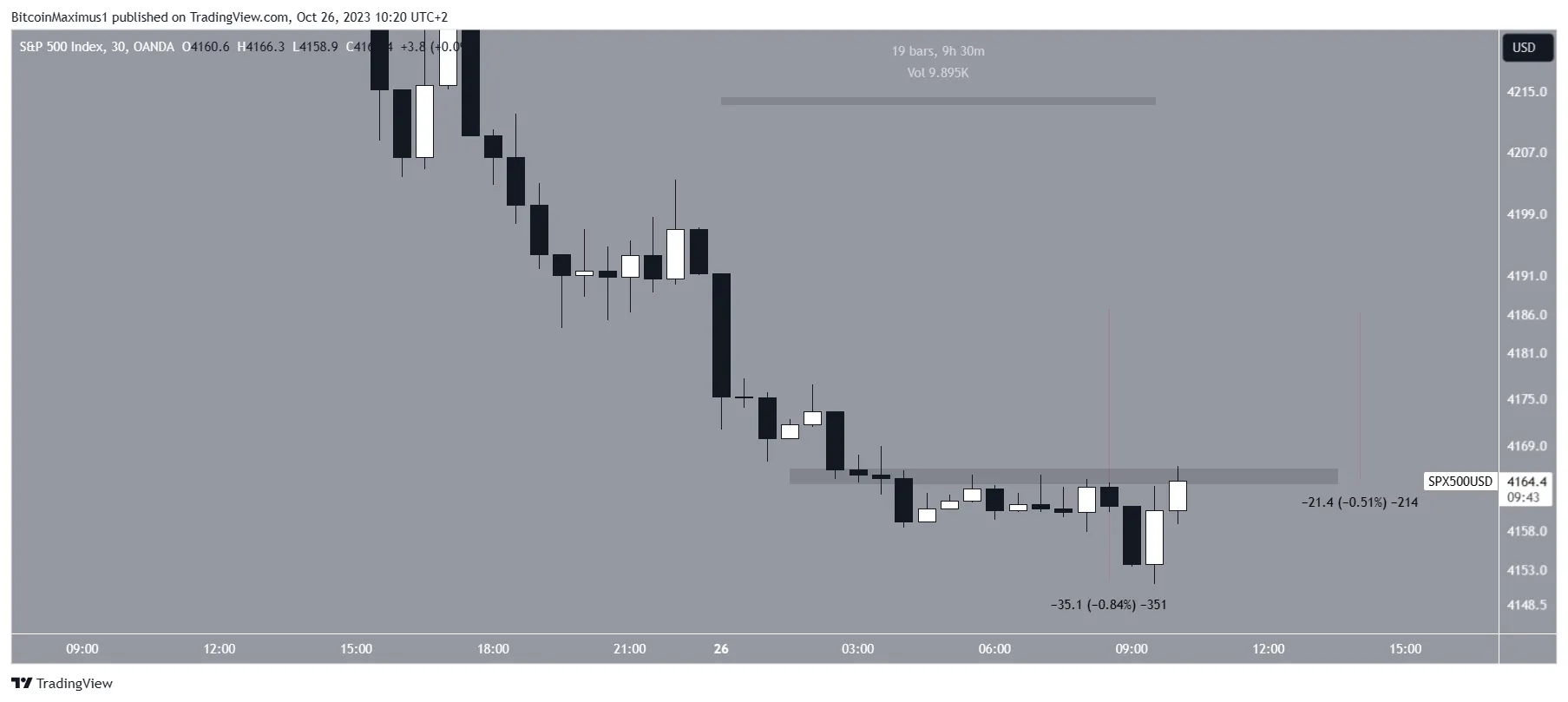

SPX Falls During After-Hours

Immediately after the market closed last night, the SPX price began to decline. It has fallen by nearly 1%, reaching $4,151 early this morning. Although there has been a slight bounce, the price is still 0.8% below yesterday’s close. The SPX drop has created a resistance area at $4,165, which the price is currently attempting to break out of.

When an asset’s price significantly drops during after-hours, it creates a gap because the next day’s opening is lower than the previous day’s close. In this case, yesterday’s close was $4,186 and the current price is $4,167, indicating a potential gap when the market opens today. Similar gaps occurred on June 20, August 2, and September 21.

Examining the position of the gap, it could be classified as an exhaustion gap. This type of gap occurs at the end of a price pattern and represents a final attempt to reach new lows.

In the two most recent gaps (on September 21 and August 2), the Bitcoin price fell significantly. However, in the June 20 gap, BTC experienced a considerable increase. Currently, the correlation between SPX and Bitcoin is -0.65, indicating that an upward movement in SPX is expected to cause a downward movement in BTC.

Although this may suggest that BTC is expected to increase due to the downward gap, it’s important to note that the correlation was -0.60 during the August 2 gap when BTC’s price sharply fell.

Biggest Stock Losers

The top five pre-market losers are:

- Align Technology, Inc. (ALGN): 25.10% decrease.

- MaxLinear, Inc (MXL): 19.84% decrease.

- Blue Hat Interactive Entertainment (BHAT): 18.97% decrease.

- Akili, Inc (AKLI): 18.50% decrease.

- FaZe Holding Inc. (FAZE): 15.68% decrease.

Cryptocurrency-related stocks are also experiencing losses, as seen in the COIN price which is more than 5% below yesterday’s close at $73.41. COIN has been trading between $66 and $80 since August and is currently in the middle of this range.

Hot Take: Investors Keep an Eye on Stocks vs Bitcoin Correlation

This week, while Bitcoin remains relatively strong, investors will be closely monitoring the correlation between stocks and Bitcoin. The recent stock market decline may have implications for the cryptocurrency market, and understanding the relationship between these two assets can provide valuable insights for traders and investors.

By

By

By

By

By

By

By

By