MicroStrategy’s Premium Will Decrease, MSTR Prices to Drop

A value investor, Mike Alfred, predicts that once a spot in the Bitcoin ETF is approved in the United States, MicroStrategy, the public business intelligence company, will suffer. According to Alfred, MicroStrategy’s stock price, currently at around $600, may recover steadily in the next bull run despite the expected reduction in its premium.

In the daily chart of MSTR stock, prices seem to be peaking. They reached as high as $717 in early January before dropping 16% to current rates. The sell-off is ongoing with primary support at the $475 and $500 zone.

Regulated Spot Bitcoin ETF May Impact MSTR Demand

Analysts suggest that if a regulated spot Bitcoin ETF is approved, more institutions will choose this product instead of investing in Bitcoin through MSTR stock. This would likely lead to a decrease in demand for MSTR shares.

Therefore, the short-term sell-off of MSTR may continue. However, as predicted by Alfred, share prices are expected to recover and rally up to $1,500 later on.

Will a Spot Bitcoin ETF Push BTC to $100,000?

Alfred further stated that as Bitcoin reaches record highs above $100,000, the recovery of MSTR will follow suit. As of now, BTC prices remain firm, reaching $47,200 on January 8, while awaiting the decision of the United States Securities and Exchange Commission (SEC) on the spot Bitcoin ETF.

If the coveted derivative product is approved, Bitcoin bulls believe prices could rally to as high as $69,000, last seen in November 2021.

Despite the fall in MSTR price, some believe that buying the stock is a better alternative to a spot Bitcoin ETF. MicroStrategy has indirectly and actively increased shareholders’ exposure to Bitcoin through its accumulation strategy, without charging a management fee. This has benefited clients, including institutions who saw MSTR stock as a “shadow spot Bitcoin ETF.”

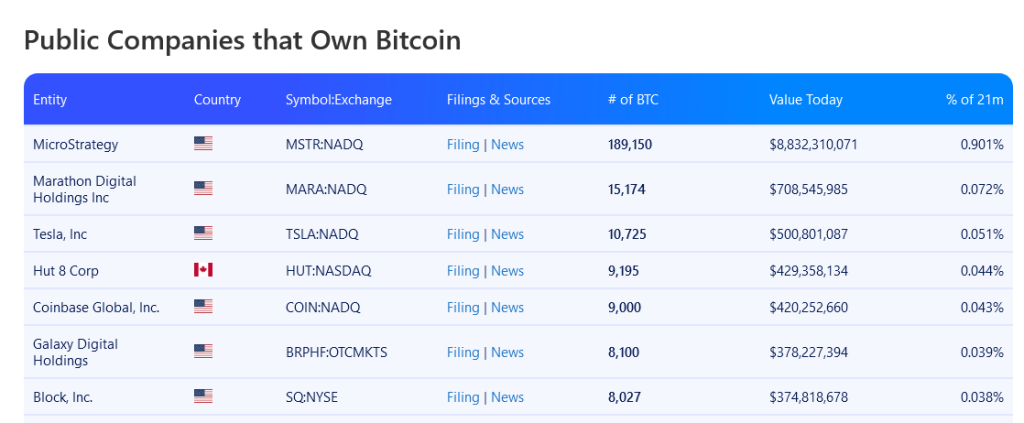

To demonstrate, data from Bitcoin Treasuries on January 9 shows that MicroStrategy holds 189,150 BTC worth over $8.8 billion at current rates on its balance sheet. This makes it the leading public company in terms of Bitcoin ownership.

Hot Take: The Impact of a Spot Bitcoin ETF on MicroStrategy

According to value investor Mike Alfred, MicroStrategy’s stock price may suffer once a spot in the Bitcoin ETF is approved in the United States. While the stock’s premium is expected to decrease, Alfred predicts that it will recover steadily in the next bull run. However, analysts suggest that if a regulated spot Bitcoin ETF is approved, more institutions may opt for this product instead of investing in MicroStrategy shares. This could result in a contraction of demand for MSTR shares. Despite this, some believe that buying the stock is a better alternative to a spot Bitcoin ETF because of MicroStrategy’s accumulation strategy and its leading position in terms of Bitcoin ownership among public companies.

By

By

By

By

By

By

By

By

By

By