Coinbase Receives Regulatory Approval for Perpetual Futures Trading Services

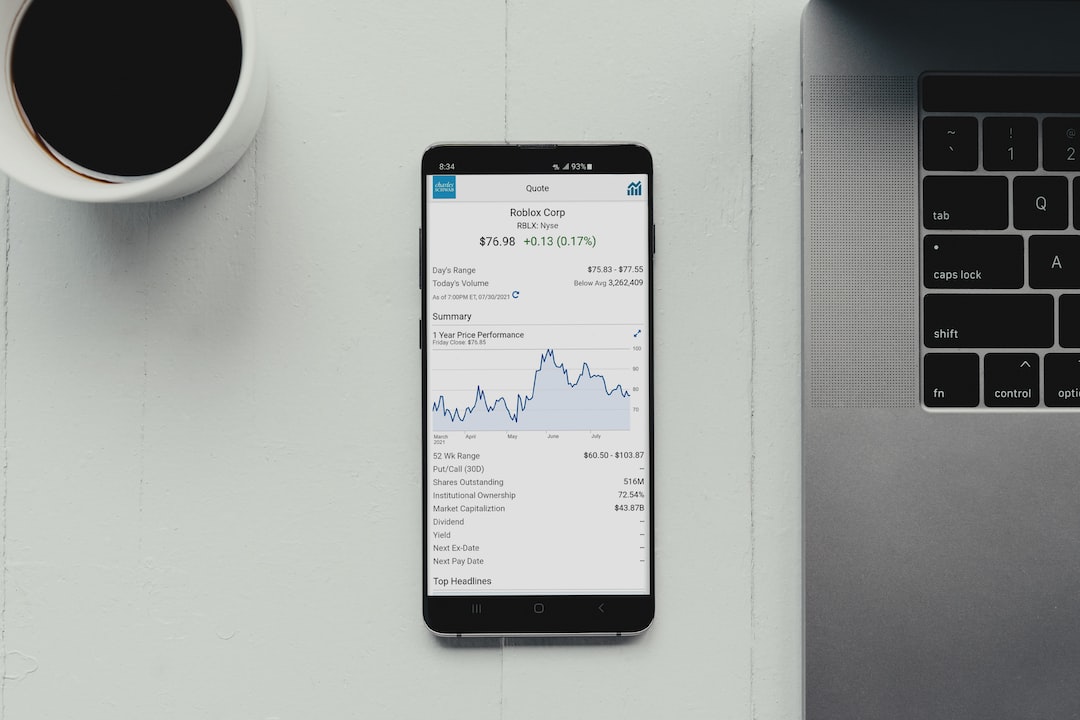

Coinbase, the largest US-based crypto exchange, has received regulatory approval from the Bermuda Monetary Authority (BMA) to offer perpetual futures trading services to non-US retail users. This new approval allows Coinbase to expand its offering to retail customers outside of the United States. The exchange’s international division, Coinbase International Exchange, has already facilitated over $5.5 billion in notional futures trading volume from institutional clients in Q2 of this year.

Derivatives Trading and Retail Demand

Derivatives trading plays a significant role in the global crypto market, accounting for approximately 75% of the total trading volume. Recognizing this trend, Coinbase aims to tap into the growing demand for perpetual futures trading among retail investors.

Working with Regulators and Building a Regulatory Framework

Coinbase expressed its commitment to working with forward-looking regulators to establish a comprehensive regulatory framework that supports crypto innovation while ensuring consumer protection. The exchange believes that a well-defined regulatory framework is crucial for the long-term growth and adoption of cryptocurrencies.

Coinbase’s Global Expansion Strategy

Coinbase’s international strategy focuses on 24 countries, including G20 members, as well as Hong Kong, Switzerland, the United Arab Emirates, and Singapore. The exchange has obtained Anti-Money Laundering (AML) compliance registration from the Bank of Spain, allowing it to offer its products and services in Spain while complying with local regulations. Coinbase has also received Virtual Asset Service Provider (VASP) registrations in several European countries and launched services in Singapore, Brazil, and Canada.

The Push for Global Expansion Amid US Regulatory Challenges

Coinbase’s global expansion efforts come at a time of growing regulatory hostility in the US. The exchange faced a lawsuit from the SEC for alleged securities violations and was also issued Show Cause orders by 11 US states. Despite these challenges, Coinbase continues to pursue its international growth plans.

Hot Take: Coinbase Expands Perpetual Futures Trading Services to Retail Customers

Coinbase’s regulatory approval from the Bermuda Monetary Authority allows the exchange to offer perpetual futures trading services to non-US retail users. With derivatives trading playing a significant role in the crypto market, Coinbase aims to meet the growing demand among retail investors. The company’s commitment to working with regulators and establishing a comprehensive regulatory framework showcases its dedication to long-term growth and adoption of cryptocurrencies. As Coinbase pushes for global expansion, it faces regulatory challenges in the US but remains focused on its international strategy.

By

By

By

By

By

By

By

By

By

By