The Impact of Spot Ethereum ETFs on the Market: Insights from Crypto VC Andrew Kang

In a recent article on the social media platform X (formerly Twitter), crypto VC Andrew Kang shares his insights on the potential impact of spot Ethereum (ETH) ETFs, which are expected to launch in the U.S. soon.

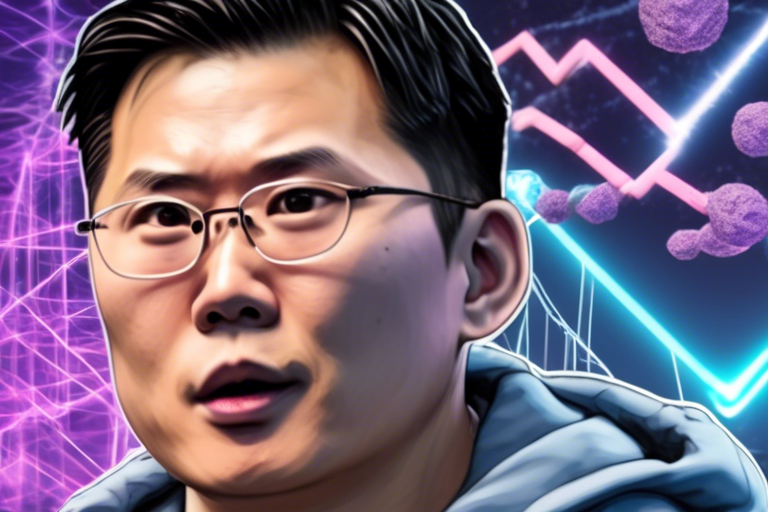

Andrew Kang: A Prominent Figure in the Crypto Industry

Andrew Kang is a well-known figure in the cryptocurrency industry, recognized for his role as the co-founder and partner of Mechanism Capital, a firm that focuses on cryptocurrency investments, particularly in decentralized finance (DeFi). With a background in portfolio management and venture capital at Digital Capital Management, Kang has a strong understanding of financial and investment strategies within the crypto space.

- Mechanism Capital was founded in September 2020 and invests in various aspects of the crypto market including prop trading, mining, ventures, and secondary markets.

- Kang actively participates in analyzing and commenting on DeFi projects, often sharing his insights on platforms like Twitter. He has made angel investments in several crypto projects and led Mechanism Capital’s investments in notable projects.

The Comparison Between Spot Bitcoin ETFs and Spot ETH ETFs

In his article, Kang compares the impact of the upcoming spot ETH ETFs to the previously launched spot Bitcoin (BTC) ETFs. He notes that spot Bitcoin ETFs opened the door for many new buyers, significantly impacting BTC’s market dynamics and outperforming ETH in recent returns.

- Spot Bitcoin ETFs accumulated $50 billion in assets under management (AUM), with net inflows closer to $5 billion after accounting for pre-existing assets and market rotations.

- Kang estimates that spot ETH ETFs might see lower inflows, ranging from $0.5 billion to $1.5 billion within six months after launch.

The Challenges Faced by Ethereum in Attracting Traditional Finance Investors

Ethereum, often referred to as a “tech asset” due to its applications in decentralized finance (DeFi) and NFTs, faces challenges in convincing traditional finance (TradFi) investors. Kang mentions that Ethereum’s economic indicators currently do not make a compelling case for significant investment from institutional players.

- Kang predicts that ETH’s price might experience a modest increase before the launch of spot ETH ETFs, ranging from $2,400 to $3,800 post-launch.

- Despite challenges, Kang remains cautiously optimistic about ETH’s long-term prospects, especially if blockchain technology becomes integrated into traditional financial systems.

Andrew Kang’s Thesis on the Impact of Spot ETH ETFs

Andrew Kang believes that while the launch of spot ETH ETFs will bring new capital into Ethereum, the scale and impact will be less than spot Bitcoin ETFs. He anticipates a continued downtrend for the ETH/BTC ratio over the next year.

Hot Take: Conclusion and Insights

Kang’s analysis sheds light on the potential impact of spot Ethereum ETFs on the market, highlighting the challenges Ethereum faces in attracting traditional finance investors and predicting a modest price increase for ETH post-launch. As investors navigate the evolving landscape of cryptocurrency investments, Kang’s insights offer valuable perspectives on the future of Ethereum in the market.

By

By

By

By

By

By

By

By

By

By