Big Fine For Binance

Imagine being fined more than $4 billion. That would be disastrous for most companies, but for Binance, it’s unlikely to be the case. Even though the news has caused some market turbulence, the bigger picture might not be so bleak. Recently, there was news that Binance’s CEO, Changpeng “CZ” Zhao, would step down from his role as head of the world’s largest crypto exchange. Binance and CZ have agreed to settle with the US Department of Justice for a $4.3 billion penalty, including a $3.4 billion penalty from the US Treasury’s Financial Crimes Enforcement Network and another $968 million from the Office of Foreign Assets Control.

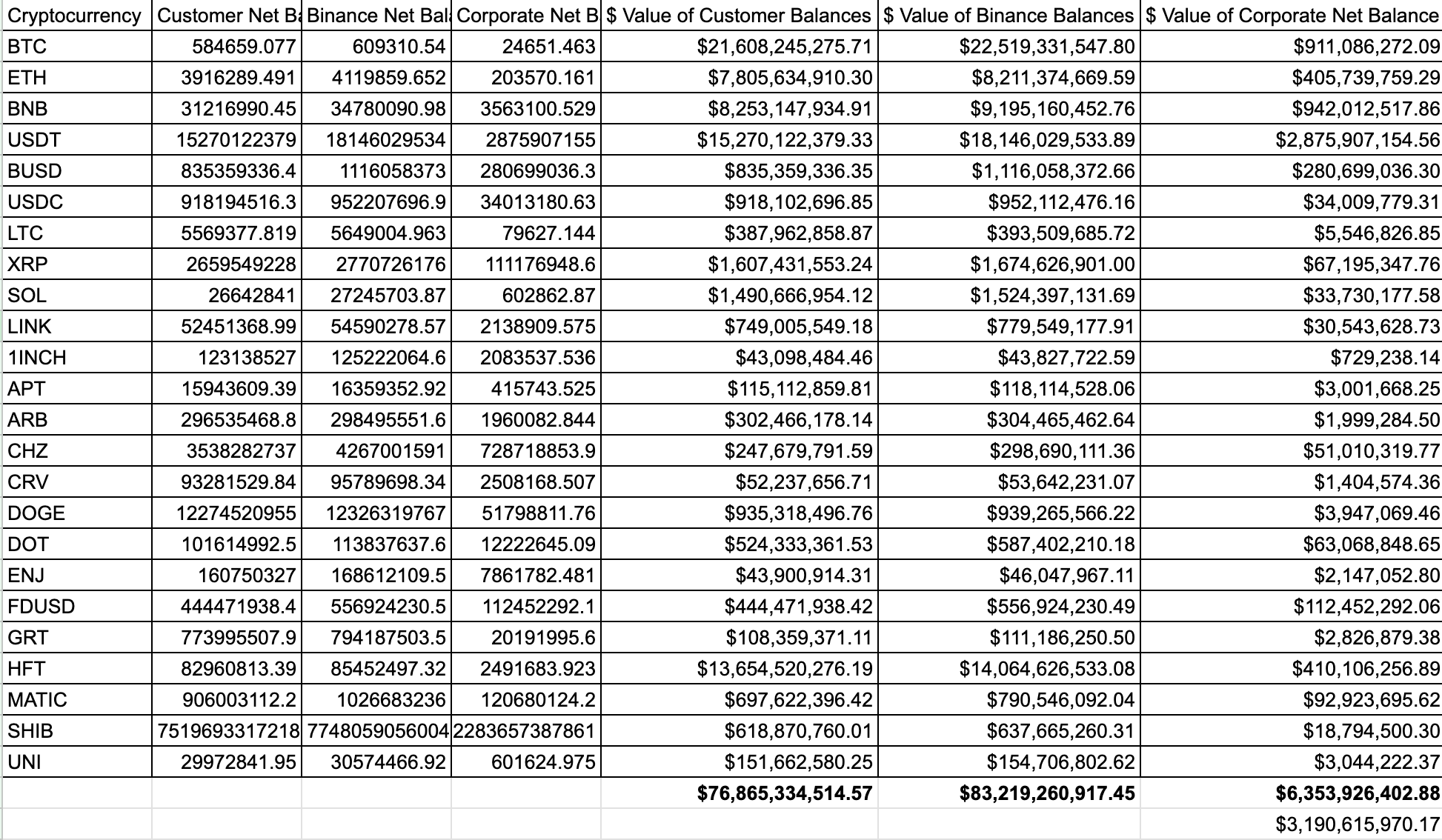

Binance’s Reserves

However, the fine is just a small fraction of what Binance has in its reserves. According to a recent report from Coinbase, Binance holds approximately $6.35 billion in total corporate crypto assets, including $3.19 billion in stablecoins. This figure does not even consider off-chain cash balances or funds held in wallets not reported in the proof of reserves. In addition, Binance has $76.8 billion in total customer asset balances.

This should alleviate any worries about Binance selling customer’s crypto to pay its fines.

Minor Market Reaction

Following the news, crypto markets experienced a slight decline. Total market capitalization fell by about 3%, with approximately $50 billion leaving the market. Subsequently, though, markets began to recover during the Wednesday morning Asian trading session. The total cap increased to $1.43 trillion and remained within November’s range-bound channel. Bitcoin and Ethereum both experienced some losses, and BNB was the biggest loser, dropping 9% to $235.

Hot Take

Despite the $4.3 billion fine, Binance is unlikely to face financial ruin due to its substantial reserves and customer asset balances. The market reacted with a minor dip before quickly recovering, reflecting the resilience of the crypto industry in the face of significant news. The company’s ability to pay the fine without resorting to customer asset sales is reassuring and instills confidence in the firm’s stability.

By

By

By

By

By

By

By

By

By

By