Bitcoin Breaks September Slumber with Positive Performance

In a surprising turn of events, Bitcoin has managed to break free from its historical September slump and is experiencing its first positive performance for the month since 2016. This achievement is noteworthy considering the resistance it has faced from the U.S. Securities and Exchange Commission (SEC) regarding Bitcoin spot exchange-traded fund (ETF) applications. Starting the month at around $25,800, Bitcoin has surged by almost 4%, reaching nearly $27,000 at the time of writing.

Bitcoin’s Rally Despite SEC Scrutiny

Despite the SEC repeatedly postponing decisions on multiple BTC spot ETF applications, Bitcoin continues to rise. The regulatory body has delayed decisions on over seven applications in the past month, even with recent efforts to speed up the approval process.

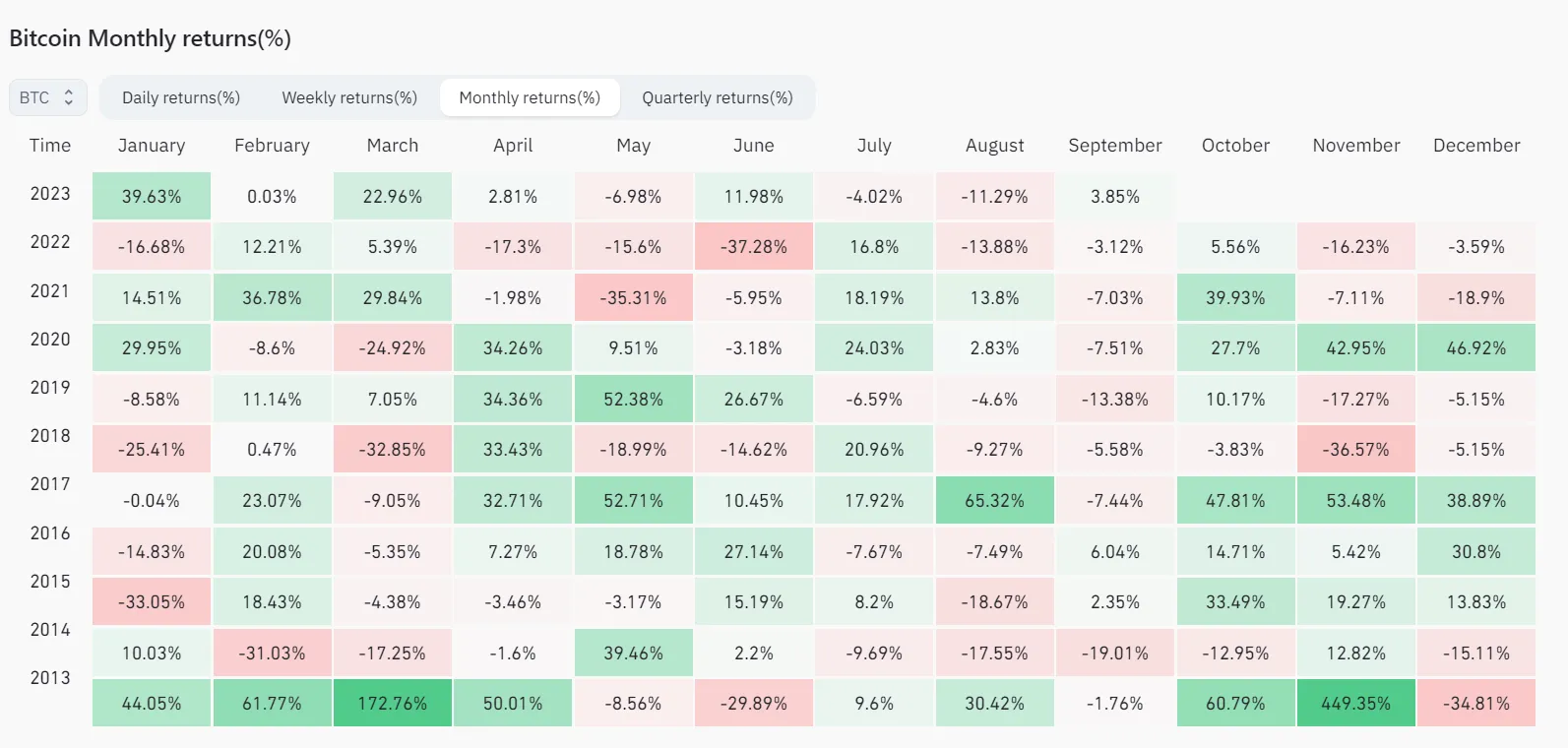

According to Coinglass data, this price surge marks Bitcoin’s fourth positive September since 2013 and its first since 2016. Interestingly, two crypto analysts failed to predict this price movement accurately.

However, it’s important to note that despite a strong September, Bitcoin experienced its first quarterly loss of the year, losing approximately 12% of its value over the past three months.

Anticipating a Bullish October

Looking ahead, investors are cautiously optimistic about Bitcoin’s performance in October. Historically, the cryptocurrency has performed well during this month. Even with a significant market downturn last October that led to the collapse of several crypto-related firms, Bitcoin still recorded a 5.56% gain.

Crypto analyst Tedtalksmacro explains this strong October performance as “a period of positive seasonality.” He stated that October has been Bitcoin’s best-performing month on average over the past three years, and this positive trend usually extends into Q1 of the following year.

“Prior to 2022, BTC had never existed in a world with rates much higher than 2%… whereas now in late-2023, the Federal Funds rate is above 5% and will likely remain there for much longer while central banks of the world try to keep the lid on inflation.”

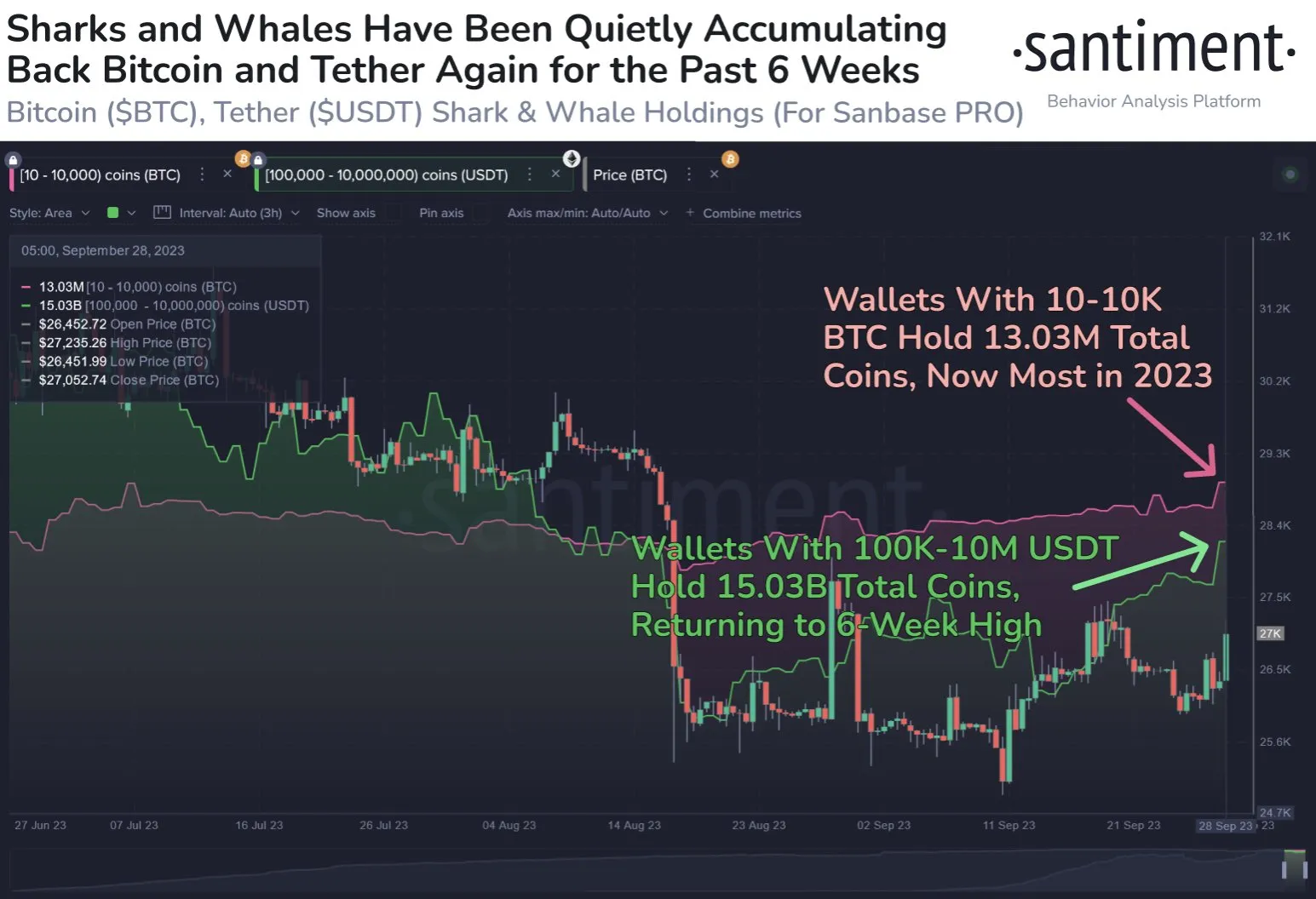

Meanwhile, blockchain analytics firm Santiment highlights Bitcoin’s promising long-term prospects. Whales have been accumulating Bitcoin alongside Tether’s USDT for the past six weeks, indicating buying power and suggesting that the rally could continue into October.

While expectations for October are high, it’s essential to remember that the SEC’s decision on any of the spot-ETF applications could potentially impact Bitcoin’s price behavior.

Hot Take: Bitcoin Defies Expectations with Positive September Performance

Bitcoin has defied historical trends by delivering its first positive September performance since 2016. Despite facing resistance from the SEC regarding ETF applications, Bitcoin has surged by almost 4% this month. This marks its fourth positive September since 2013 and showcases the cryptocurrency’s resilience in the face of regulatory challenges. While a bullish October is anticipated based on historical performance, factors such as the SEC’s decisions and global interest rates may influence Bitcoin’s future trajectory. Nevertheless, Bitcoin’s ability to break free from its September slumber demonstrates its potential for growth and highlights its significance in the crypto market.

By

By

By

By

By

By

By

By

By

By