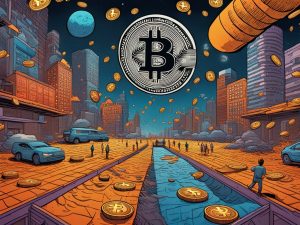

Peter Schiff Raises Concerns Over Bitcoin ETF Trading

Renowned gold investor and economic commentator, Peter Schiff, has expressed his concerns about the accessibility and resilience of Bitcoin trading through Exchange-Traded Funds (ETFs). Schiff believes that the restricted liquidity in ETF trading, especially during non-U.S. market hours, poses a significant risk for investors.

According to Schiff, the limited liquidity in ETF trading can leave investors unable to execute trades during overnight market downturns. This frustration of being stranded without the ability to exit positions until U.S. trading hours resume highlights the challenges faced by investors navigating the volatile crypto landscape through traditional investment vehicles like ETFs.

The Impact of Recent Market Events

The cryptocurrency market recently experienced turmoil when Bitcoin’s price dropped below the $63,000 threshold. This sudden descent sent shockwaves across the global financial landscape, resulting in an 8% contraction in the total market capitalization of cryptocurrencies, which fell to $2.4 trillion within 24 hours.

This significant decline in Bitcoin’s valuation has reignited discussions about its resilience during market downturns. There are also concerns about the role played by institutional investors, including ETFs, and their impact on market stability and price discovery mechanisms.

Critique of MicroStrategy’s Actions

Peter Schiff has turned his critical lens towards business intelligence firm MicroStrategy and its CEO, Michael Saylor, regarding their strategic approach to Bitcoin acquisitions. Schiff questions Saylor’s use of borrowed funds to fuel MicroStrategy’s aggressive buying spree of Bitcoin, especially after significant price surges in the cryptocurrency.

Schiff implies that such actions may artificially inflate Bitcoin’s value, potentially at the expense of unsuspecting investors. As the debate on corporate involvement in Bitcoin intensifies, Schiff’s scrutiny of MicroStrategy’s investment strategy adds complexity to the ongoing discourse.

The Concerns with Bitcoin ETF Trading

Schiff’s concerns about Bitcoin trading through ETFs revolve around the restricted liquidity during non-U.S. market hours. He believes that this limitation poses risks for investors, such as being unable to execute trades during overnight market downturns and being stranded without the ability to exit positions until U.S. trading hours resume.

This highlights the challenges faced by investors who rely on traditional investment vehicles like ETFs to navigate the volatile crypto landscape. The limited liquidity in ETF trading can leave investors vulnerable and hinder their ability to react swiftly to market changes.

The Impact of Recent Market Turmoil

The recent turmoil in the cryptocurrency market, triggered by Bitcoin’s sudden drop below $63,000, has had far-reaching consequences across the global financial landscape. Within just 24 hours, the total market capitalization of cryptocurrencies experienced an 8% contraction, falling to $2.4 trillion.

This decline in Bitcoin’s valuation has sparked discussions about its resilience during market downturns. It has also raised concerns about the role of institutional investors, including ETFs, and their potential impact on market stability and price discovery mechanisms.

MicroStrategy’s Controversial Bitcoin Strategy

Peter Schiff has turned his attention to MicroStrategy and its CEO, Michael Saylor, criticizing their approach to Bitcoin acquisitions. Schiff questions Saylor’s use of borrowed funds to fuel MicroStrategy’s aggressive buying spree of Bitcoin, especially after significant price surges in the cryptocurrency.

According to Schiff, such actions may artificially inflate Bitcoin’s value, potentially at the expense of unsuspecting investors. This criticism adds another layer of complexity to the ongoing debate surrounding corporate involvement in Bitcoin.

Conclusion: Navigating the Challenges of Bitcoin Trading

The concerns raised by Peter Schiff highlight the challenges faced by investors when trading Bitcoin through ETFs. The limited liquidity during non-U.S. market hours can leave investors vulnerable to overnight market downturns and hinder their ability to exit positions until U.S. trading hours resume.

Furthermore, recent market turmoil has brought attention to the resilience of Bitcoin and the role played by institutional investors, including ETFs. The ethical implications and broader market ramifications of corporate involvement in Bitcoin are also subjects of intense debate.

Hot Take: Considering the Risks and Opportunities

As a crypto investor, it is crucial to consider the risks and opportunities associated with Bitcoin trading through ETFs. While ETFs offer convenience and accessibility, the limited liquidity during non-U.S. market hours can pose challenges.

It is essential to stay informed about market developments, especially during times of volatility, and be prepared to react swiftly when necessary. Understanding the impact of institutional investors, like MicroStrategy, on market stability is also vital for making informed investment decisions.

By staying vigilant and adopting a cautious approach, you can navigate the challenges of Bitcoin trading effectively and seize opportunities in this dynamic and evolving market.

By

By

By

By

By

By