Bitcoin Exchange Reserve Indicates More Drawdown for Price

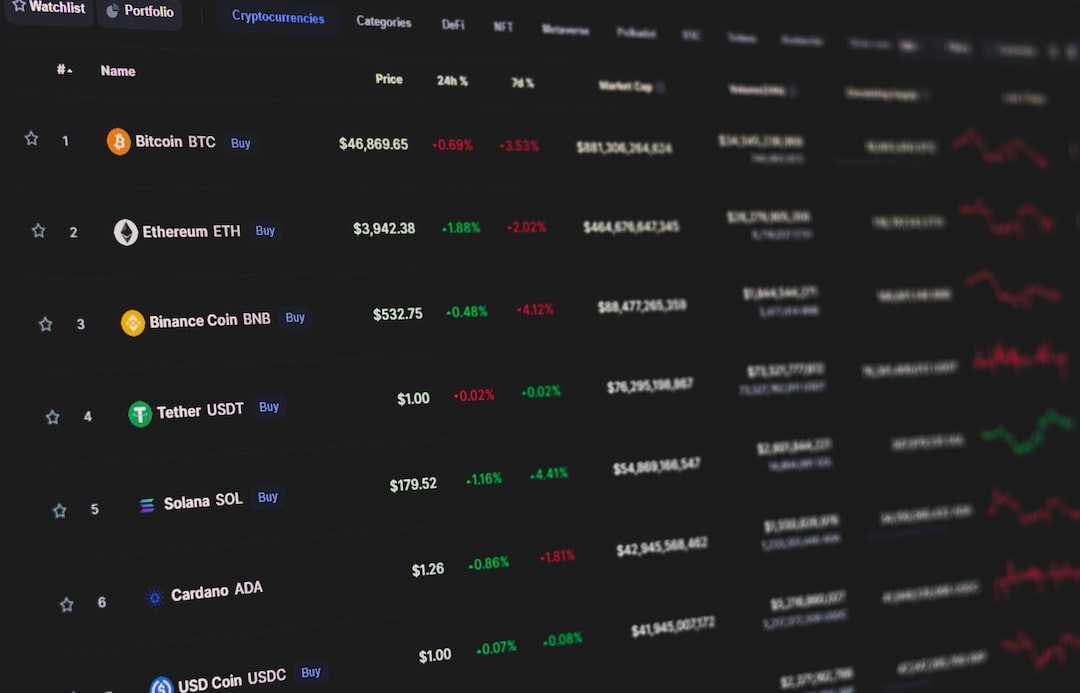

Bitcoin’s exchange reserve has experienced a significant increase, suggesting that further decline in price may be on the horizon. The recent crash in the cryptocurrency market saw Bitcoin’s price drop from above $29,000 to below $26,000 in an instant. Since then, Bitcoin has failed to show signs of recovery and is currently trading around $25,800, marking an 11% decline in the past week. This performance is worse than other top coins like Ethereum and Cardano.

On-chain data reveals that the exchange reserve has risen in the past few hours. The exchange reserve measures the total amount of Bitcoin stored in centralized exchange wallets. An increase in this metric signifies that investors are depositing more Bitcoin to these platforms, potentially for selling purposes. This trend can have bearish implications for the cryptocurrency’s price.

Conversely, a decrease in the exchange reserve indicates that holders are withdrawing their BTC from these centralized entities, implying accumulation by investors. This can be bullish for the cryptocurrency in the long term.

The chart displaying the trend in Bitcoin exchange reserve shows a sharp uptick in the past few hours, with the majority of the rise coming from derivative platforms, particularly Binance. While spot exchanges are usually used for selling, the deposits towards derivative platforms may indicate investors opening new positions in the futures market, leading to increased volatility.

Despite the rise in spot exchange reserve, albeit smaller in scale, a potential selloff is still possible. The overall increase in exchange reserve suggests that more drawdown may be expected for Bitcoin’s price.

Hot Take:

The recent increase in Bitcoin’s exchange reserve indicates that more selling pressure may be looming for the cryptocurrency. As investors deposit more Bitcoin to centralized exchange platforms, the potential for a selloff increases. However, the rise in derivative platforms suggests that investors may also be looking to open new positions in the futures market, leading to increased volatility. The direction of Bitcoin’s price remains uncertain, but the data suggests that caution should be exercised in the current market conditions.

By

By

By

By

By

By

By

By