Bitcoin Miner Reserve Has Been On The Decline Recently

According to analyst James V. Straten, Bitcoin miners have shifted from accumulating to selling recently. This shift is reflected in the declining miner balance, which tracks the total amount of Bitcoin miners hold in their wallets.

When the miner balance increases, it indicates that miners are accumulating coins, which is generally bullish for Bitcoin’s price. Conversely, a declining miner balance suggests that miners are selling their coins, putting selling pressure on the market.

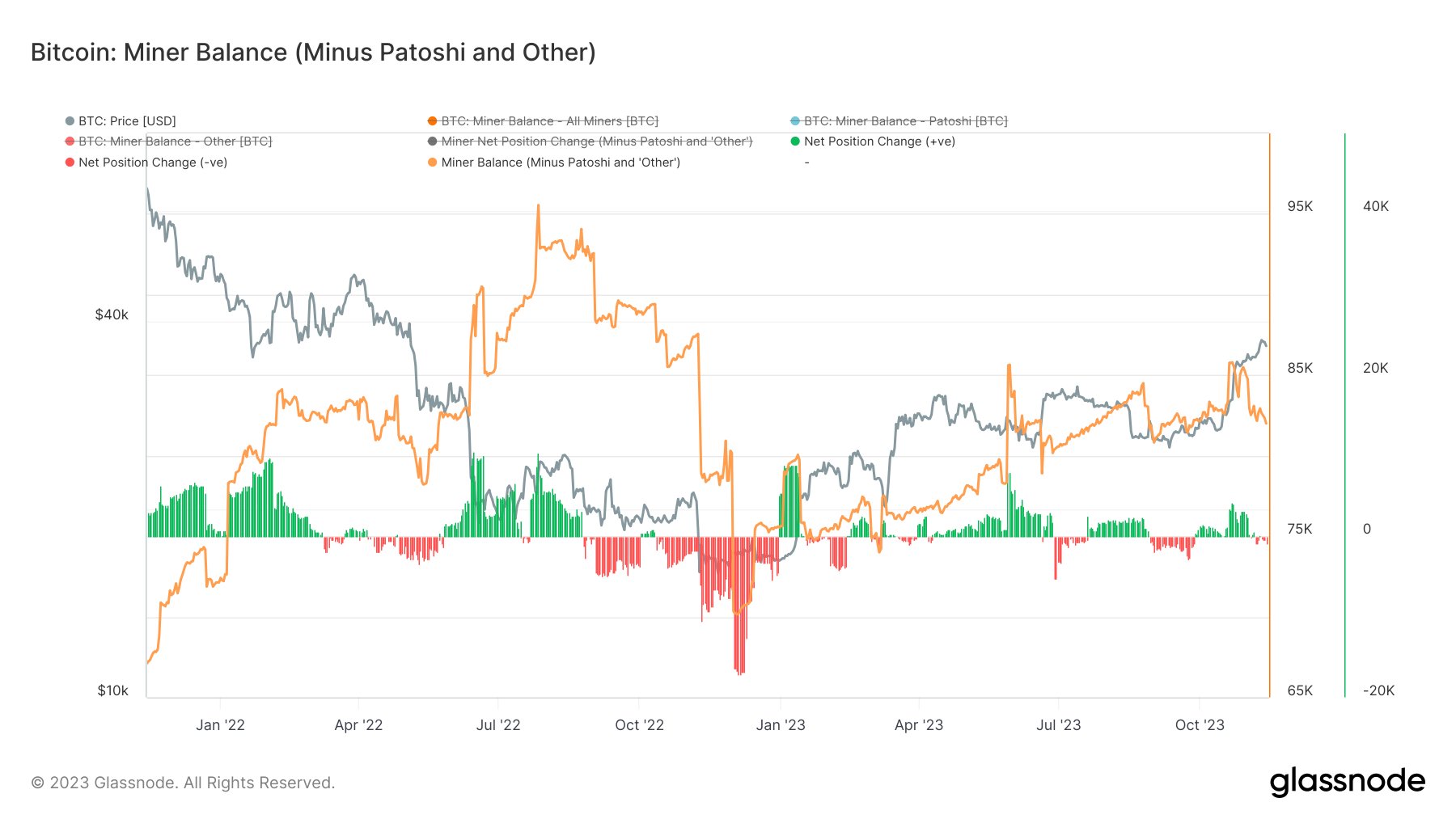

The chart below illustrates the trend in Bitcoin miner balance over the past few years:

Note that the miner balance excludes data for Patoshi and other entities unlabelled by Glassnode. The graph shows a recent downtrend in Bitcoin miner balance, indicating that some miners have been selling their coins.

Furthermore, the net position change metric has turned negative recently, suggesting a shift from accumulation to selling among miners.

This selling trend is interesting given that miners’ revenues have been strong due to a price rally and increased transaction fees. Despite this prosperity, some miners have chosen to sell their BTC profits during this latest rally.

BTC Price

As of writing, Bitcoin is trading at around $36,400, up 3% in the past week.

Hot Take: Miner Selling May Impact BTC Price

Bitcoin’s price could be affected by the recent shift from accumulation to selling among miners. The decline in miner reserve and negative net position change indicate potential selling pressure on the market despite strong revenues. Keep an eye on how this trend evolves as it may influence BTC’s price movements in the near future.

By

By

By

By

By

By