A Bullish Signal for Bitcoin, According to Crypto Analyst

A well-known crypto analyst suggests that Bitcoin has shown a bullish signal after its recent decline. According to trader Ali Martinez, Bitcoin could see an 8% bounce if it remains above a crucial price level. Martinez shared on social media that the TD Sequential indicator presented a buy signal on the three-day chart. If Bitcoin can sustain a close above $26,800, it may surge to $28,000. However, if BTC dips below $25,300, this bullish scenario would be invalidated.

The Tom DeMark Sequential indicator tracks price points to indicate potential trend reversals. It identifies a pause, pullback, or reversal in the current trend. A reversal is signaled when nine consecutive candles close lower than the candles four periods earlier.

At the time of writing, Bitcoin is trading at $25,862, experiencing a 0.3% increase in the past 24 hours. Martinez also noted that a significant amount of BTC has been sent to crypto exchanges, suggesting a potential increase in Bitcoin selling.

Ethereum Faces a Market Correction Risk

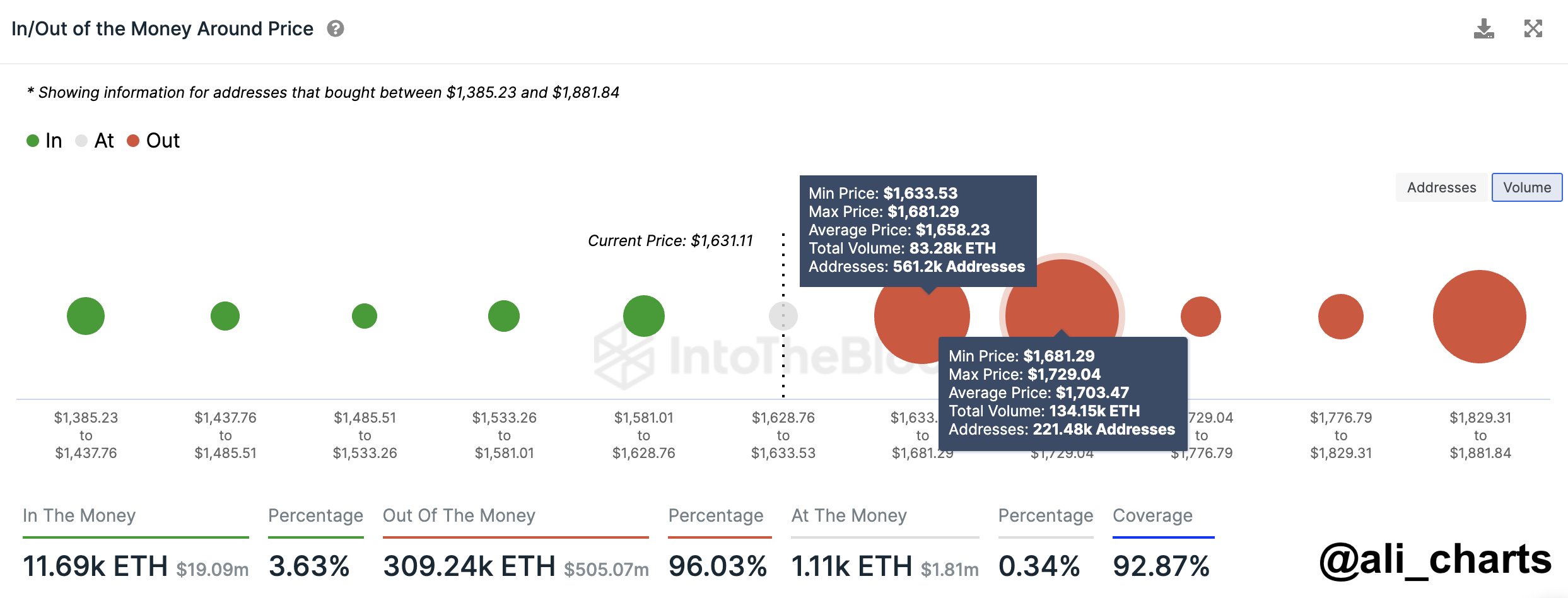

Martinez warns that Ethereum may experience a severe market correction if it fails to maintain a key price level. He bases his assessment on the profit or loss of ETH holders at specific price levels. If Ethereum falls below $1,680, it could pave the way for a substantial correction down to $1,200.

Currently, Ethereum is trading at $1,628, showing a 0.1% decrease in the last 24 hours. Additionally, Martinez observed that large amounts of Cardano (ADA) are being sold off by crypto whales.

Cardano Whales Sell Off ADA

According to Martinez, Cardano whales have sold or redistributed approximately 1.02 billion ADA in the past week, amounting to around $265 million. Cardano is trading at $0.25, down 0.1% in the last 24 hours.

Hot Take: Bitcoin and Ethereum Face Crucial Levels

The recent analysis by Ali Martinez highlights the importance of key price levels for Bitcoin and Ethereum. Bitcoin’s potential bullish scenario depends on staying above $26,800, while Ethereum faces a market correction risk if it falls below $1,680. It is crucial for crypto traders to monitor these levels closely to make informed investment decisions.

By

By

By

By

By

By

By

By

By

By