Bitcoin Continues to Surge as Institutional Traders Drive Buying Pressure

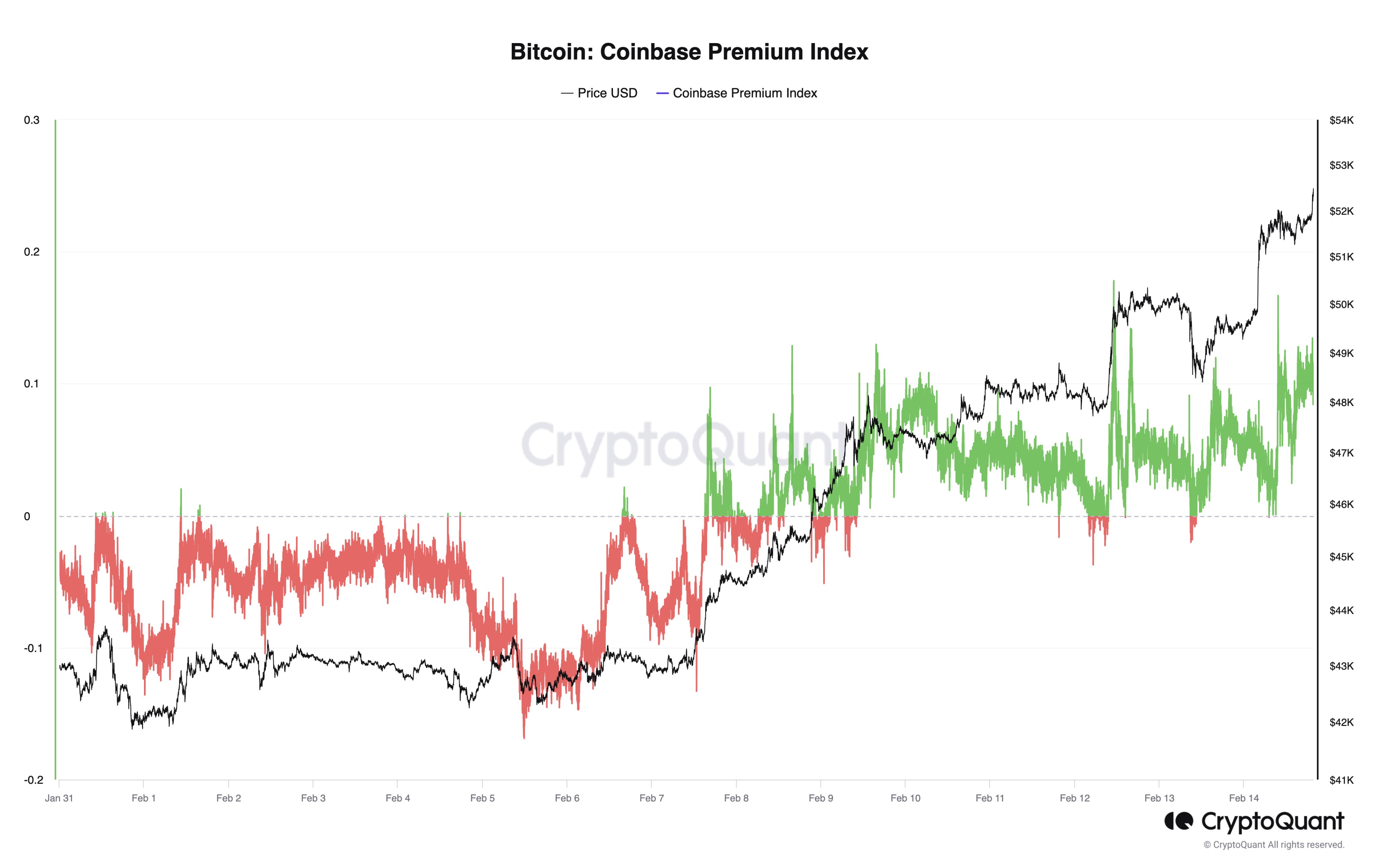

Bitcoin has surpassed the $52,000 mark, thanks to institutional traders who have been actively buying the asset on Coinbase to fulfill their clients’ Bitcoin orders. The Coinbase Premium Index, which measures the percentage difference between BTC prices on Coinbase and Binance, indicates that American institutional entities are exerting buying pressure on the market.

Understanding the Coinbase Premium Index

The Coinbase Premium Index provides insights into the buying and selling behaviors of different demographics. With a mostly positive trend in recent weeks, the index suggests that the price on Coinbase has remained higher than on Binance. This condition occurs when there is greater buying pressure from Coinbase users or lower selling pressure on Coinbase.

Institutional Traders Driving Bitcoin’s Rise

The recent surge in Bitcoin’s price coincides with positive values in the Coinbase Premium Index, indicating high buying pressure from US-based institutional traders. During the first week of the month, when the indicator was negative, Bitcoin’s price consolidated sideways. However, as the index rose towards positive levels, the current rally began, highlighting the influence of these large entities in the market.

American Investors Driving Bitcoin’s Returns

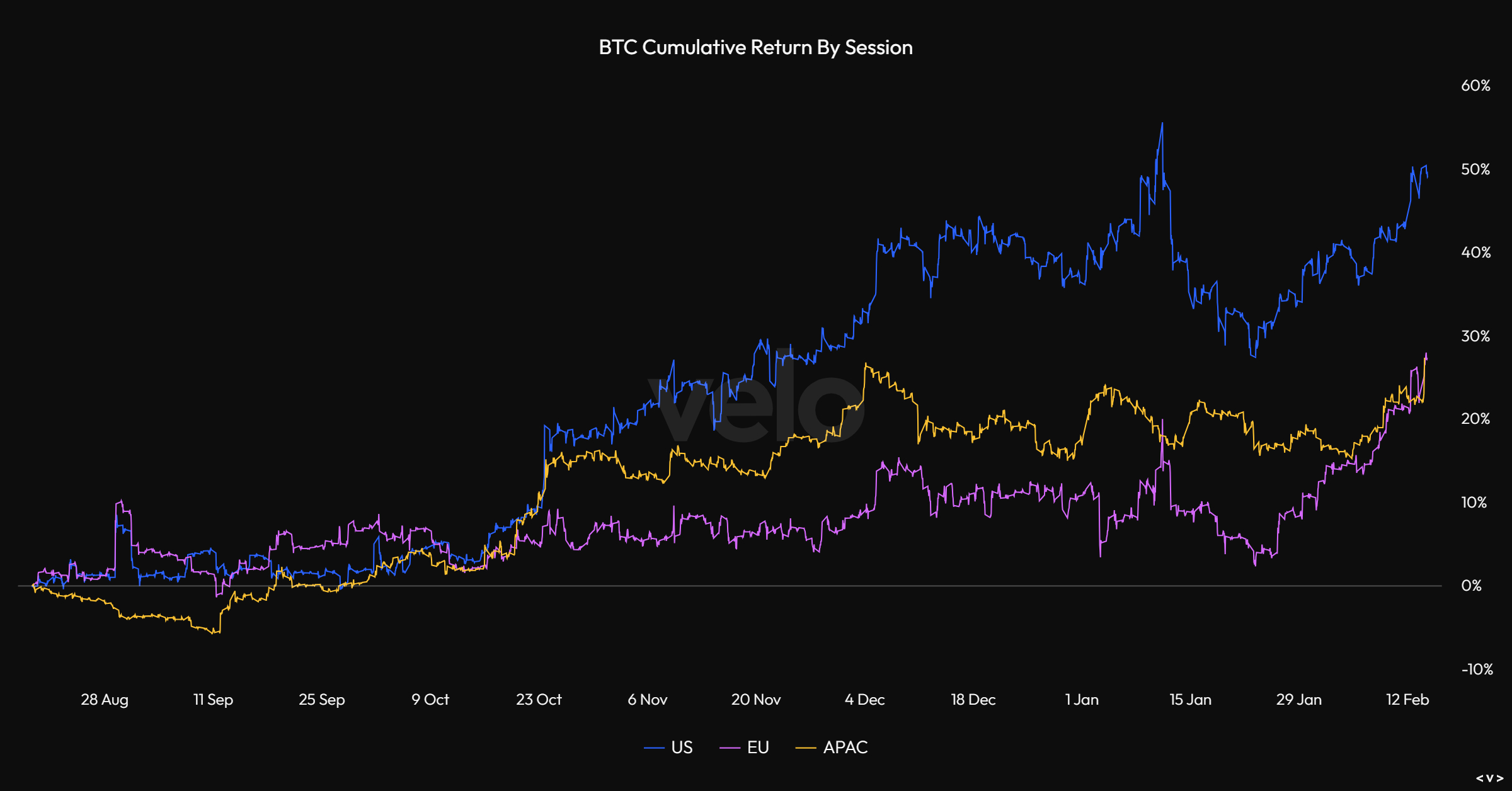

Data on cumulative returns by session shows that American investors have been the primary drivers behind Bitcoin’s price rally. The most positive returns have been observed during American trading hours, further confirming the significant buying pressure from US-based entities.

The Future of the Coinbase Premium Index

Given the correlation between institutional behavior on Coinbase and the BTC price, monitoring the Coinbase Premium Index in the coming days is crucial. If the index remains positive, it could indicate a continuation of the rally. Conversely, a shift to negative territory would suggest that these entities are selling.

Bitcoin Price Breaks $52,000

Following its ongoing rally, Bitcoin has now surpassed the $52,000 mark.

By

By

By

By

By

By

By

By

By

By

By

By