The crypto market liquidated short and long positions worth over $100 million in the last 24 hours following a brief rise of Bitcoin to $31,000, marking its first such increase this year.

Short traders suffered greatly as the BTC price surge of the past week dashed their expectations of further cryptocurrency price declines amid regulatory pressures.

Over $140M Liquidated

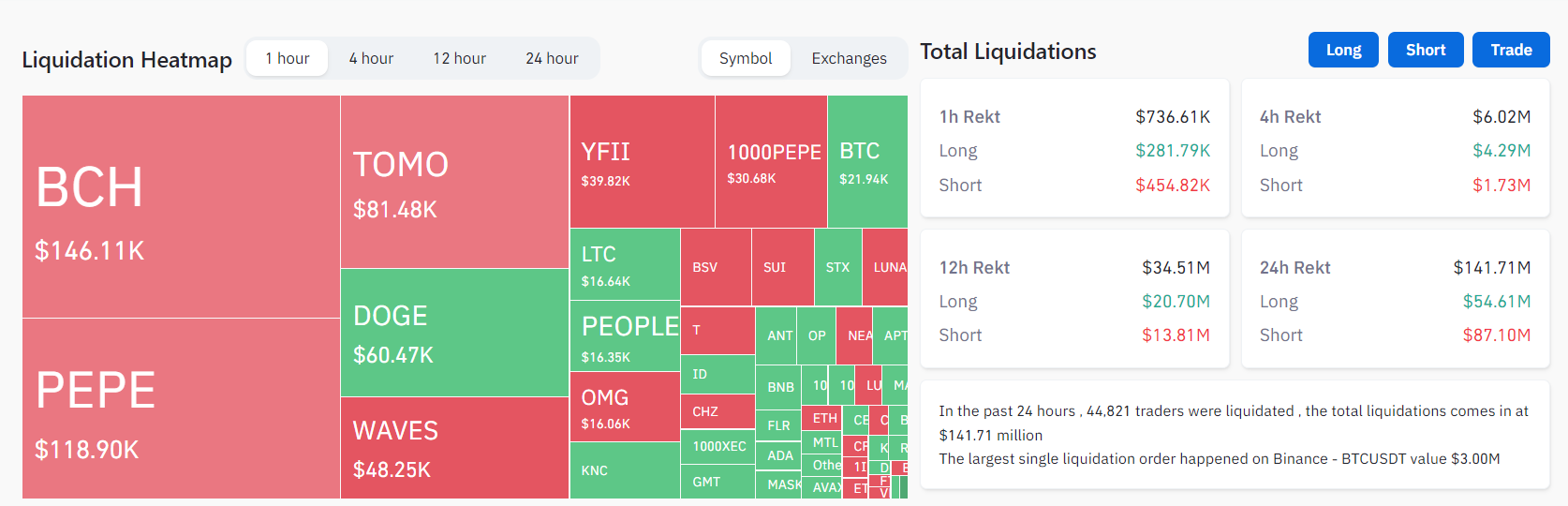

According to Coinglass data, out of the $141.71 million liquidated in the past 24 hours. The short positions account for $87.1 million. The largest liquidation occurred on Binance and was valued at $3 million.

Bitcoin alone accounted for $55.89 million of the total liquidations. Other cryptocurrencies such as Ethereum, Bitcoin Cash, Pepe, and Litecoin also recorded a sizeable amount of losses for investors trading them.

While shorts constituted most of the liquidated positions, long positions were also substantially liquidated. Crypto assets like SOL, XRP, CFX, and Doge witnessed a higher number of liquidated long positions. This suggests that some traders overshot their projections of a future rise in price for these assets.

Bitcoin ETF Applications

Over the past week, the crypto market has witnessed a new wave of institutional interest in Bitcoin. Several traditional financial institutions have filed applications for a spot BTC ETF.

BlackRock’s June 15 filing triggered an avalanche of applications by other rival firms. BlackRock is the world’s largest asset manager, with more than $10 trillion worth of assets under its management.

Since then, other asset management firms like Invesco and WisdomTree have submitted new BTC ETF filings to the U.S. Securities and Exchange Commission (SEC).

Additionally, a crypto exchange backed by several traditional institutions like Fidelity and Citadel Securities went live on June 20.

BTC Monthly Volume Above Yearly Average

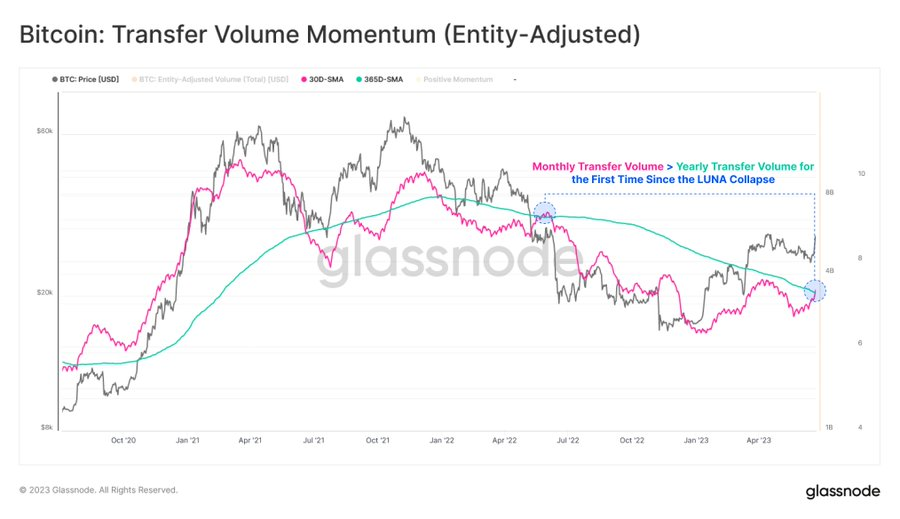

Meanwhile, the renewed bullishness surrounding the market has translated into Bitcoin monthly transfer volume overtaking the yearly averaged baseline for the first time since the LUNA implosion, according to Glassnode data.

The blockchain analytical firm added that this “suggests an expansion in on-chain activity, typical of improving network fundamentals and growing network utilization.”

By

By

By

By

By

By

By

By

By

By

By

By