Bitcoin Price Correction Fills CME Gap

The crypto market experienced a liquidation of $250 million in the past 24 hours, with $60 million worth of Bitcoin longs being liquidated. The price of BTC dropped below the crucial $40,000 support level, leading to concerns about a weak trend due to macro and technical factors.

Since December, a correction in Bitcoin’s price has been expected following a rally fueled by retail and institutional investors. CoinGape previously reported on a CME Bitcoin gap near $39,700, which has now been filled as Bitcoin reached a 24-hour low of $38,923.

Peter Brandt Optimistic About Bitcoin

Popular trader Cheds predicted that side-liners would take long positions under $40,000, and Peter Brandt agrees that the decline is likely a washout of weak longs. In contrast to bearish sentiment and weak buying from bulls below $40K, Peter Brandt expressed his interest in seeing what would happen if the parabola is retested.

Although the major support has been broken and the CME Bitcoin gap has been filled, there is an expectation for buying from dip for longs. However, according to Peter Brandt’s parabola chart, a retest is most likely to occur in late February or early March.

March: A Crucial Month for BTC Traders

March holds significance for BTC traders due to macro and post-Bitcoin halving sentiment. The upcoming US Federal Reserve monetary policy decision in March will be closely watched, as the current macro environment is not favorable for Bitcoin’s bullish momentum.

The US 10-year treasury yield is hovering near 4.15%, while the US dollar remains strong. Bitcoin traders are also anticipating key economic data at the end of this month, including the US Treasury quarterly refunding announcement on January 31.

Whales Selling BTC and Technical Analysis

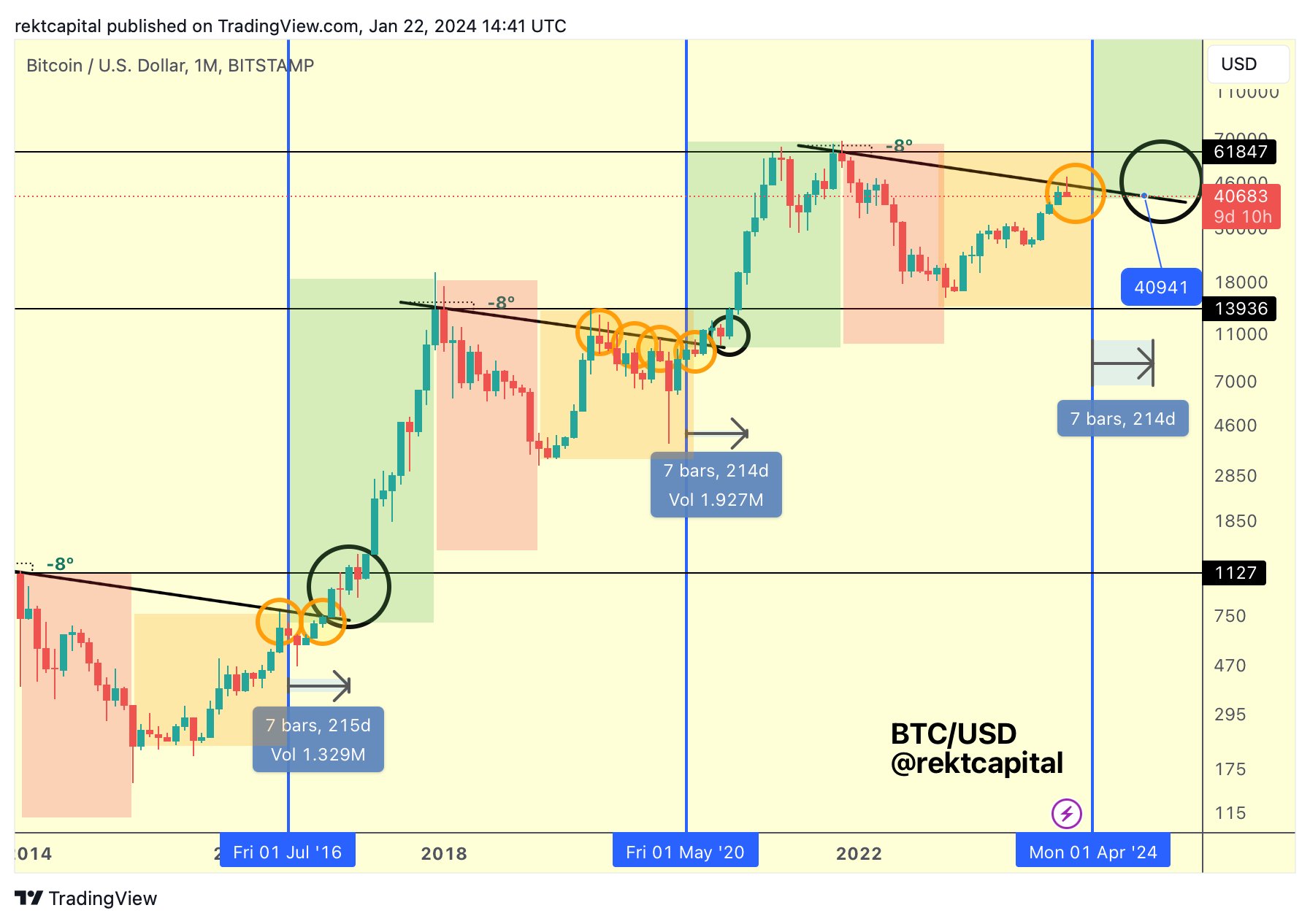

In the last two weeks, whales have sold around 70,000 BTC worth over $3 billion. Additionally, analyst Rekt Capital revealed that Bitcoin is exhibiting historical chart patterns during this correction phase before a halving.

Bitcoin Price and Trading Volume

Over the past 24 hours, BTC price has fallen by 5%, currently trading at $38,964. The 24-hour low and high were recorded at $38,839 and $41,242, respectively. Furthermore, trading volume has increased by 85% in the last day, indicating growing interest among traders.

Hot Take: Bitcoin Faces Uncertainty Amidst Correction

The recent correction in Bitcoin’s price has led to uncertainty in the market. While some traders anticipate a retest of the parabolic trend and potential buying opportunities from longs, macro factors such as the US Federal Reserve’s monetary policy decision and a strong US dollar pose challenges for Bitcoin’s bullish momentum. As whales continue to sell significant amounts of BTC, and technical indicators suggest a buy-the-dip opportunity, it remains to be seen how Bitcoin will navigate this period of correction and whether it can regain its upward trajectory.

By

By

By

By

By

By

By

By

By

By