The Impact of the Fed’s Interest Rate Announcement

The recent announcement by the US Federal Reserve regarding interest rates caused a surge in volatility in the Bitcoin market. Within 24 hours, approximately $48 million worth of positions were liquidated.

Bitcoin’s Price Movement

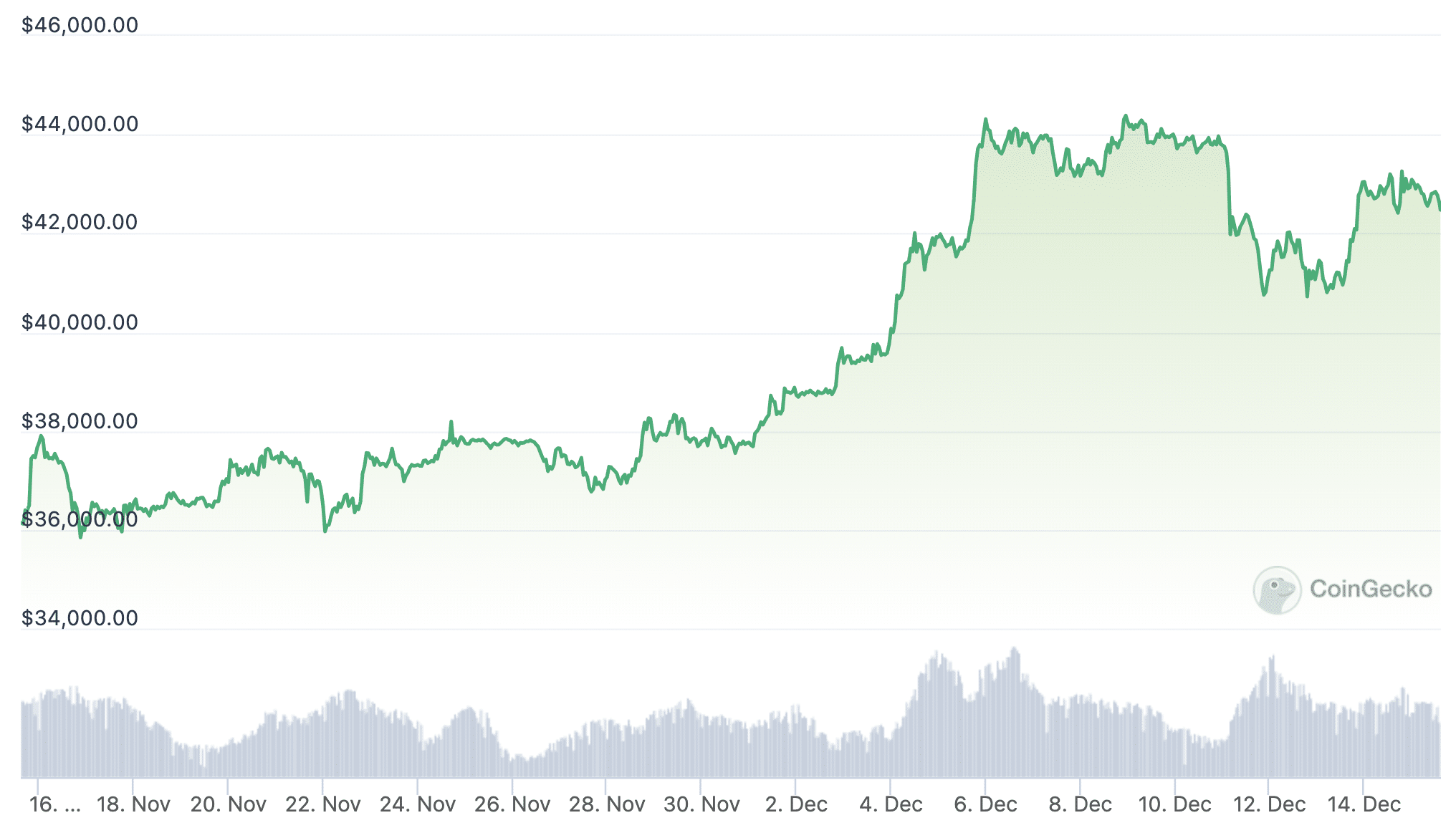

Currently, Bitcoin is trading just below the $43,000 mark after experiencing volatile trading sessions on Wednesday and Thursday. Although it reached a yearly high of $44,700 on December 8, it is still trading about 4.7% below that price.

Bitcoin’s Performance

Over the past seven days, Bitcoin has seen a 3% decrease in price. However, it remains up by over 17% in the last 30 days.

Liquidations of Leveraged Derivatives Positions

The initial market reaction to the Fed’s announcement led to significant liquidations of leveraged derivatives positions. Both long and short positions were affected.

According to Coinglass data, $35.4 million worth of Bitcoin shorts were liquidated on the day of the Fed’s announcement as the price initially increased due to a more dovish stance from the Fed. Additionally, $12.56 million worth of longs were liquidated after Bitcoin experienced a sudden drop.

In total, around $48 million in leveraged positions were liquidated on the day of the announcement.

These liquidations followed a previous event where $126.74 million in longs were liquidated within 24 hours due to a sudden crash in Bitcoin’s spot price.

Hot Take: Bitcoin’s Volatility and Market Reactions

The recent surge in volatility and subsequent liquidations in the Bitcoin market highlight the impact of major announcements, such as the US Federal Reserve’s interest rate decision. Traders should be prepared for increased market volatility and carefully manage their leveraged positions to avoid potential losses. While Bitcoin has shown resilience and continues to perform well on a monthly basis, short-term fluctuations can lead to significant financial consequences. It is crucial for traders to stay informed, adapt their strategies, and closely monitor market movements to make informed decisions.

Wyatt Newson emerges as a luminary seamlessly interweaving the roles of crypto analyst, dedicated researcher, and editorial virtuoso. Within the dynamic canvas of digital currencies, Wyatt’s insights resonate like vibrant brushstrokes, capturing the attention of curious minds across diverse landscapes. His ability to untangle intricate threads of crypto intricacies harmonizes effortlessly with his editorial mastery, transmuting complexity into a compelling narrative of comprehension. Guiding both seasoned navigators and curious newcomers, Wyatt’s insights serve as a compass for astute decision-making amidst the ever-shifting currents of cryptocurrencies. With the artistry of a linguistic craftsman, they skillfully craft narratives that enrich the evolving tableau of the crypto landscape.