Bithumb’s Strategic Move for an IPO

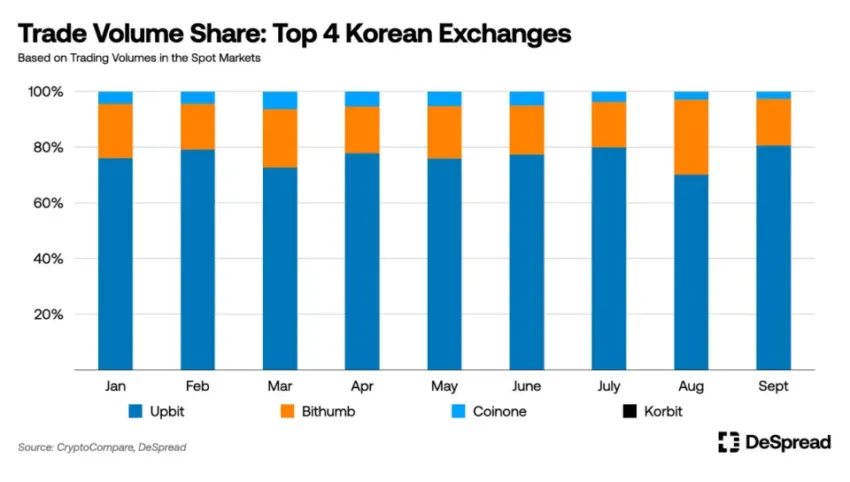

If you are a crypto enthusiast, you should take note of South Korea’s Bithumb as it gears up for an Initial Public Offering (IPO) to regain market dominance from Upbit. This shift emphasizes the company’s commitment to enhancing trust and reputation in the market.

Bithumb Moves Forward With Crypto Exchange IPO Plans

The operating entity of Bithumb, Bithumb Korea, has selected Samsung Securities as its underwriter, a significant step towards its IPO expected in the second half of 2025. The initial focus is on a KOSDAQ listing, but there is potential for transition to the KOSPI securities market. This move signifies Bithumb’s dedication to improving corporate governance and management transparency.

Reinstating former Chairman Lee Jeong-hoon and appointing Jaewon Lee as CEO are part of the leadership changes driving this transformation aimed at regaining market leadership.

Rebuilding Public Image

Bithumb is making these changes at a crucial time following the founder’s acquittal from a fraud trial involving BXA tokens. The ruling has helped stabilize the company’s public image and now, with its IPO plans, it aims to focus on financial growth and restoring trust in the market.

Hot Take: Bithumb’s IPO Strategy Sets Stage for Market Leadership

Bithumb’s move to go public marks a strategic shift in its efforts to regain market dominance from Upbit. With a focus on corporate governance and leadership changes, the company aims to rebuild trust and restore its public image while driving financial growth through its IPO plans.

By

By

By

By

By

By

By

By