Ethereum Surges to $2,023

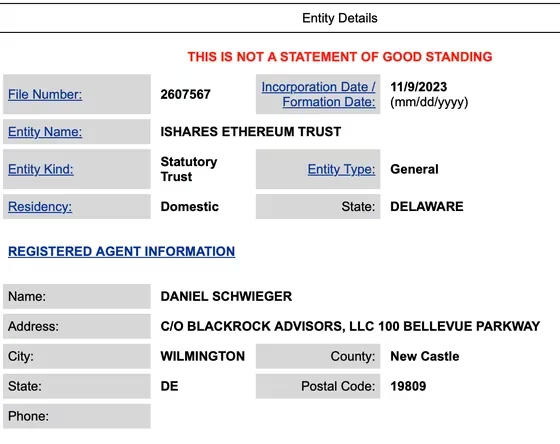

If you’ve been keeping an eye on the cryptocurrency market, you’ll have noticed that Ethereum (ETH) has experienced a significant surge of 7.4% in the last 24 hours, reaching $2,023 since April 2023. This spike in Ethereum’s value closely mirrors the recent upward movement of Bitcoin (BTC). Interestingly, this surge coincides with reports indicating that BlackRock, a renowned asset manager overseeing $9 trillion in assets, has registered an Ethereum Trust in Delaware.

Blackrock Ethereum ETF On The Horizon?

BlackRock made significant waves earlier this year when it submitted a filing for a spot Bitcoin exchange-traded fund (ETF) with the US Securities and Exchange Commission (SEC). Subsequently, BlackRock’s iShares Bitcoin Trust successfully obtained registration, solidifying the firm’s presence in the emerging cryptocurrency industry. However, the possibility of BlackRock filing for a spot Ether ETF has been a subject of discussion among industry experts for some time.

The registration of the Ether Trust by BlackRock reinforces the firm’s confidence in the long-term potential and impact of Ethereum, further strengthening its position within the digital asset industry and boosting the price of ETH.

ETH Prepares To Break Key Price Range

In recent weeks, ETH had been consolidating between $1,800 to $1,890. However, according to crypto expert Scott Melker, once Ethereum fully breaks and consolidates above the $2,000 to $2,100 range, a significant surge in price can be expected, indicating positive market sentiment. As BlackRock continues to explore digital asset services and the potential for an Ether ETF, market participants will closely monitor developments in the regulatory landscape.

Approving an Ether ETF in the United States would provide investors with a regulated and accessible investment vehicle and could expand the reach of Ethereum while validating its long-term growth potential.

Hot Take: Bullish Momentum for Ethereum

Ethereum’s recent surge to $2,023 reflects positive market sentiment and is bolstered by BlackRock’s registration of an Ethereum Trust. With discussions about a potential Ether ETF on the horizon and indications that ETH may break key price ranges soon, there is bullish momentum for Ethereum as it continues to solidify its position within the digital asset industry. This news is likely to attract more attention from investors and further boost Ethereum’s value as it prepares for potential future growth.

By

By

By

By

By

By

By

By

By

By