BlackRock Plans to Launch Ethereum Trust

BlackRock Investments (BlackRock) is seeking approval from the US Securities and Exchange Commission (SEC) to launch an Ethereum Trust. This comes after filing for a Bitcoin ETF in June. The move is expected to make cryptocurrency more accessible to a broader audience.

BlackRock Thinks Market is Ready

The investment manager aims to list its iShares Ethereum Trust on the Nasdaq, using the CME CF Ether-Dollar Reference Rate. However, it’s uncertain whether BlackRock will stake Ethereum on behalf of clients to earn rewards for securing the blockchain.

Read more: What Is Crypto Staking? A Guide to Earning Passive Income

Daniel Schweiger, a BlackRock director, is believed to be driving the application in Delaware. BlackRock’s filings are often seen as indicators for others in the market. ARK Invest and 21 Shares have already filed for an Ethereum ETF, while Grayscale Investments applied to convert its Ethereum Trust into a spot ETF.

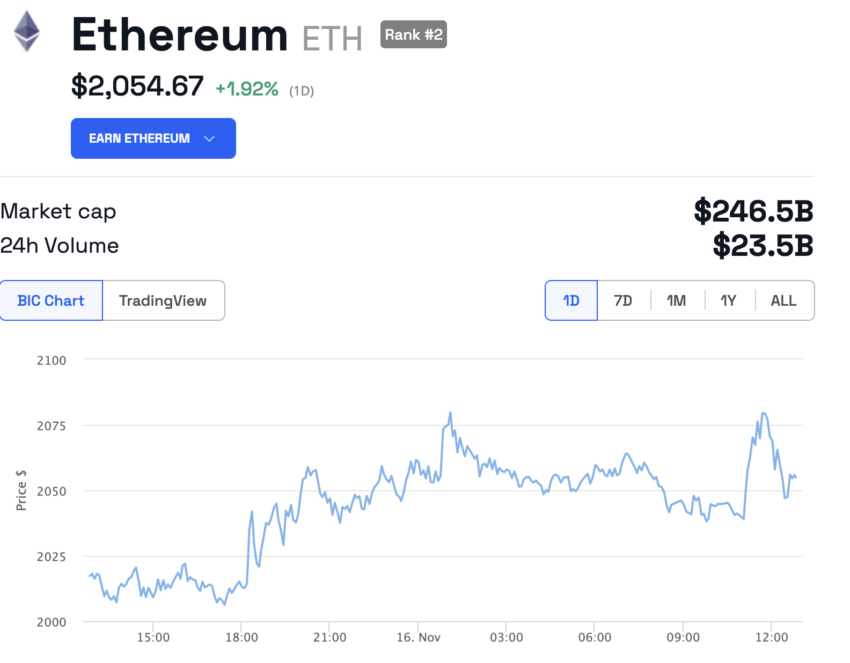

Following the announcement, Ethereum’s value peaked at $2,079.50 before dropping back down to $2,054.67 at press time. This reflects a 1.9% increase in the last 24 hours.

Read more: How To Buy Ethereum in 3 Simple Steps – A Beginner’s Guide

Will ETF Filings Widen Crypto Audience?

The SEC has until Nov. 17 to decide on Bitcoin ETF applications from nine financial companies, including BlackRock, WisdomTree, and Valkyrie. Experts have differing views on the potential impact of these rollouts on investors.

“All the other options right now have flaws to varying degrees.”

Bryan Armour of Morningstar suggested that a spot Bitcoin ETF could attract an ETF audience to crypto but other options like futures contracts have issues. Ben Smith, a certified financial planner, believes these ETFs could bring crypto to a wider audience but their uptake depends on an investor’s risk appetite.

Do you have something to say about whether BlackRock ETF applications can bring crypto to a wider audience, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Hot Take: The Potential Impact of Blackrock’s Crypto Initiatives

The move by Blackrock to file for an S-1 prospectus for an Ethereum Trust could signal a significant shift in the accessibility of cryptocurrencies as investments. With potential listings and approvals for both Bitcoin and Ethereum trusts looming, this could pave the way for wider adoption of cryptocurrencies within traditional investment strategies and portfolios.

By

By

By

By

By

By

By

By

By

By