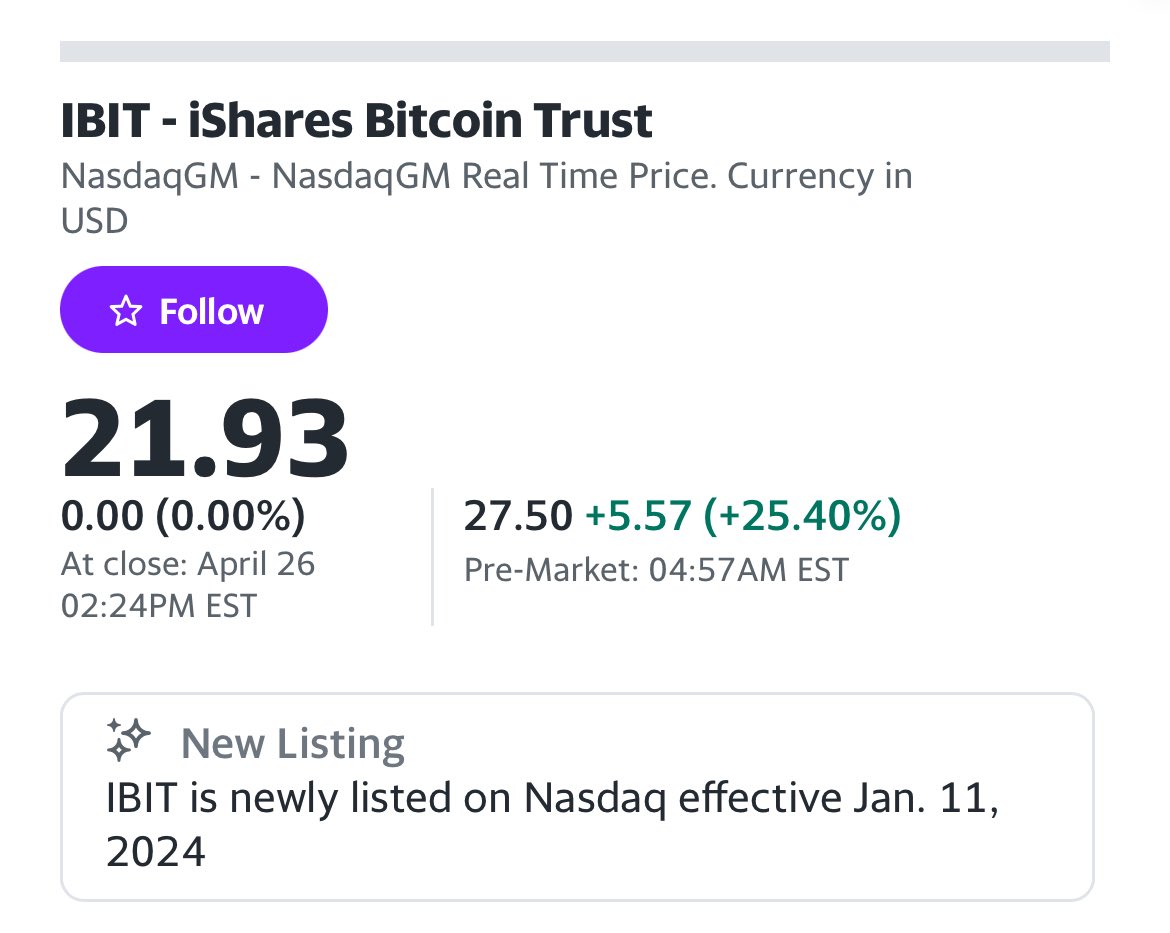

BlackRock Spot Bitcoin ETF Soars 25%

The iShares Bitcoin Trust (IBIT) exchange-traded fund by BlackRock is experiencing a surge in pre-market trading, with a price increase of over 25% on January 11. On the day of approval, the net asset value (NAV) of the BlackRock spot Bitcoin ETF was $26.12.

Anticipating Massive Inflow into Bitcoin ETFs

According to Bloomberg, experts predict that approximately $4 billion could flow into spot Bitcoin ETFs on the first day of trading. BlackRock is expected to receive nearly $2 billion in direct inflow.

BlackRock’s Accessibility and Reduced Fees

The BlackRock spot Bitcoin ETF is now available on their iShares website, Nasdaq, and Aladdin investor platforms. To make it more accessible, BlackRock has reduced the fee to 0.25% and waived a portion of the fee for the first year. This means that the fee will be 0.12% of the net asset value (NAV) for the first $5 billion of assets in the Trust.

“Through IBIT, investors can access bitcoin in a cost-effective and convenient way,” said Dominik Rohe, head of Americas iShares ETF and Index Investing business at BlackRock.

Removing Obstacles for Direct Bitcoin Investment

The introduction of the BlackRock spot Bitcoin ETF aims to eliminate barriers and operational burdens that hinder investors, including asset managers and financial advisors, from directly investing in Bitcoin.

Hot Take: BlackRock Spot Bitcoin ETF Soars on Debut

After receiving approval from the SEC, BlackRock’s iShares Bitcoin Trust ETF (IBIT) has made an impressive debut, with a significant surge in pre-market trading. With experts predicting massive inflows into Bitcoin ETFs, BlackRock is well-positioned to benefit from the growing interest in cryptocurrencies. The reduced fees and increased accessibility offered by the BlackRock spot Bitcoin ETF make it an attractive investment option for both individual and institutional investors. As more barriers to Bitcoin investment are removed, we can expect to see further adoption and mainstream acceptance of cryptocurrencies.

Gapster Innes emerges as a visionary adeptly blending the roles of crypto analyst, dedicated researcher, and editorial maestro into an intricate tapestry of insight. Amidst the dynamic world of digital currencies, Gapster’s insights resonate like finely tuned harmonies, captivating curious minds from various corners. His talent for unraveling intricate threads of crypto intricacies melds seamlessly with his editorial finesse, transforming complexity into an eloquent symphony of comprehension. Guiding both intrepid trailblazers and curious newcomers, Gapster’s insights serve as a compass for well-informed decision-making amidst the ever-evolving currents of cryptocurrencies. With the artistry of a linguistic craftsman, they craft narratives that enrich the evolving tapestry of the crypto landscape.