Bitcoin Whales Increase in Number

In a significant development, Bitcoin’s whale addresses have experienced a notable surge, with 16 new addresses added within a 24-hour period. This surge coincides with Bitcoin’s ongoing attempt to break the crucial $27,000 resistance level.

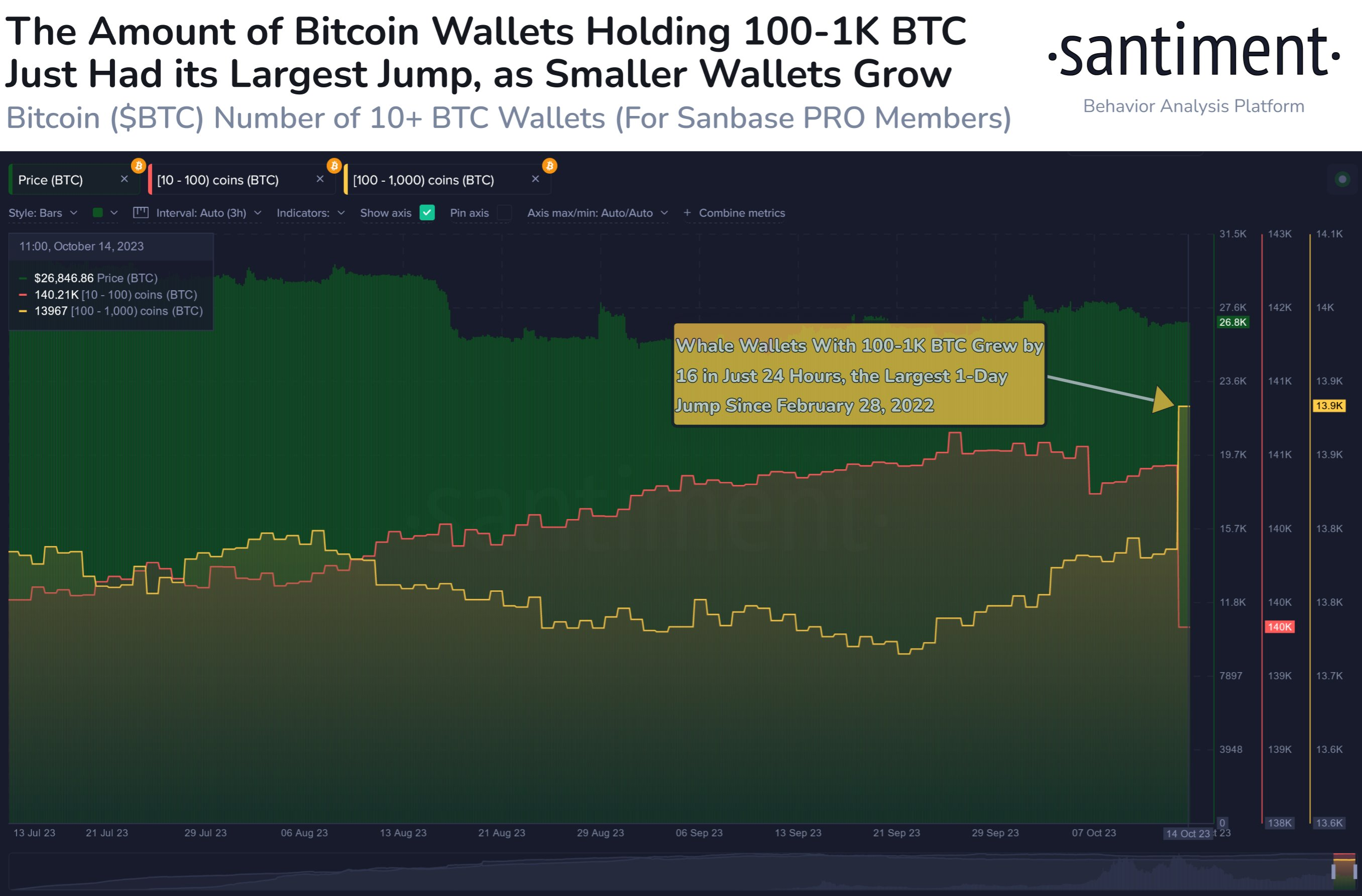

Santiment’s data highlights that this surge in whale addresses, specifically those holding between 100 to 1,000 BTC, represents the most substantial one-day increase since February 28, 2022. With these new additions, this cohort’s total count of addresses now stands at 13,967.

However, it’s worth noting that this growth is partially due to smaller wallets progressing into the next tier. Presently, 140,210 addresses hold between 10 and 100 BTC.

Earlier, Santiment disclosed that wallets containing at least 10 BTC had witnessed a historic rise since February 2022. Since March 2022, there have been 11,806 new addresses for holdings of 10+ BTC, indicating an 8.12% growth in these retail-oriented addresses.

Concurrently, the recent uptick in Bitcoin whale addresses coincides with the long-term holders’ continued acquisition of the top digital asset. Blockchain analytical firm IntoTheBlock revealed that investors holding BTC for over one year own 69% of the asset’s supply.

BTC Price Action

In October, Bitcoin’s price faced major challenges that pushed its value down to $26,900 from more than $28,000 recorded earlier in the month.

BeInCrypto warned that BTC risks falling to $25,000, citing the escalating tensions in the Middle East and conflicting derivatives market data. The warning was further augmented by IntoTheBlock, which reported that the market could see more selling pressure due to BTC miners’ action.

According to the firm, BTC miners sold over 20,000 BTC this week, the largest amount since April. It added:

“This suggests that miners are capitalizing on higher Bitcoin prices to offset their operational costs. While not uncommon, it can add significant sell pressure to the market.”

Despite these issues, market observers point out that BTC’s fortune would drastically improve if the U.S. Securities and Exchange Commission approved a spot exchange-traded fund (ETF). Additionally, they note that the upcoming Bitcoin halving is bullish for the industry, citing the asset’s historical performance.

Hot Take: Crypto Whales Alert: 16 New Bitcoin (BTC) Addresses in a Single Day

In a noteworthy development, the number of Bitcoin whale addresses has surged with 16 new addresses added in just one day. This surge aligns with Bitcoin’s attempt to break the important $27,000 resistance level. The increase in whale addresses, particularly those holding between 100 to 1,000 BTC, is the largest one-day increase since February 28, 2022. However, it’s important to note that this growth is partially due to smaller wallets progressing into the next tier. The recent uptick in whale addresses also coincides with long-term holders continuing to acquire Bitcoin. Despite recent challenges in Bitcoin’s price and selling pressure from miners, market observers believe that BTC’s fortune could improve with the approval of a spot ETF and the upcoming halving event.

Source: BeInCrypto

By

By

By

By

By

By

By

By