Ethereum HODLers Now Control Over 70% Of The Asset’s Supply

New on-chain data reveals that over 70% of the Ethereum supply has remained untouched for more than a year, setting a new record for the network. According to market intelligence platform IntoTheBlock, this indicates that long-term holders (LTHs) now hold the majority of ETH.

LTHs are defined as addresses that have held their coins for at least one year. These holders are less likely to sell their coins, regardless of market conditions. Their reluctance to sell makes any instances of selling significant, indicating a potential shift in the market.

Tracking HODLer Movements

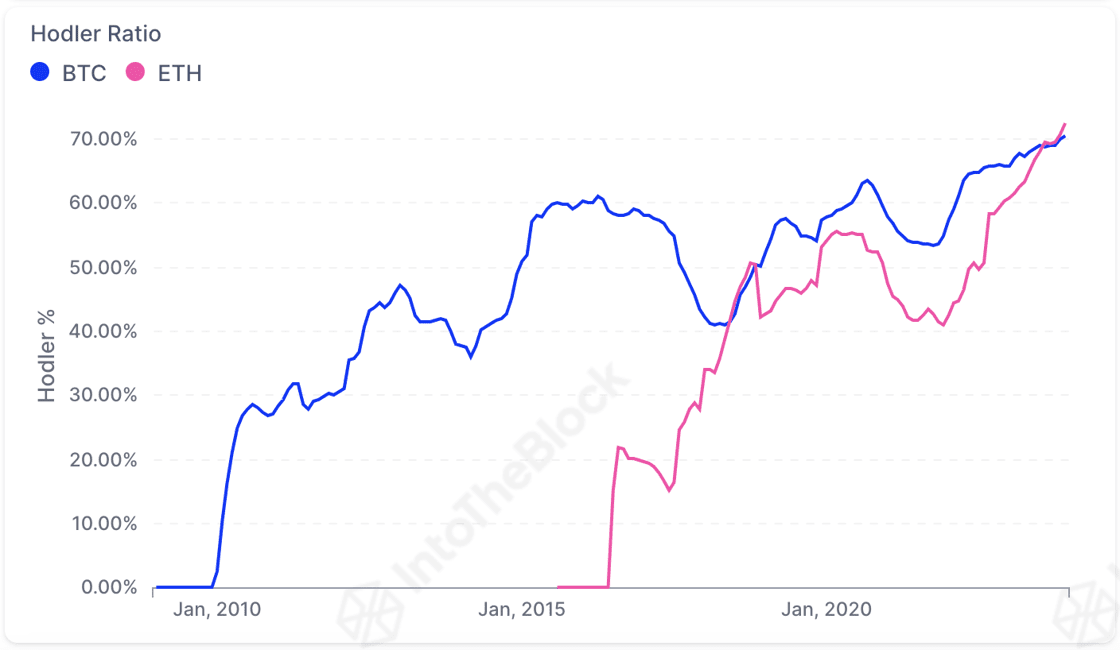

One way to track the activities of HODLers is by monitoring the combined amount of supply they have kept locked in their wallets for at least a year. The chart below illustrates the trend in LTH supply as a percentage of the total circulating supply for Ethereum and Bitcoin.

The graph shows an increasing trend in supply held by HODLers for both Bitcoin and Ethereum. However, it’s important to note that this increase does not necessarily mean current accumulation. Rather, it signifies buying activity from a year ago, with these coins remaining dormant long enough to become part of this cohort.

Despite substantial profits from this year’s rally, these holders show no interest in selling their assets. Both Ethereum and Bitcoin have experienced an upward trend in the HODLer ratio, with Ethereum surpassing Bitcoin’s growth rate.

ETH Price

Currently, Ethereum is priced at around $2,290, reflecting a 6% increase in the past week.

Hot Take: Ethereum HODLers Remain Steadfast Despite Market Conditions

The latest data shows that Ethereum’s long-term holders continue to hold a significant portion of the asset’s supply. With over 70% of the circulating supply being controlled by these HODLers, it indicates their unwavering commitment to the cryptocurrency. Despite the recent rally and potential profits, they have chosen not to sell their assets.

This demonstrates the confidence and conviction of Ethereum investors, as they remain steadfast even in the face of market volatility. It will be interesting to see if any future events or developments can sway these HODLers to part with their coins.

By

By

By

By

By

By