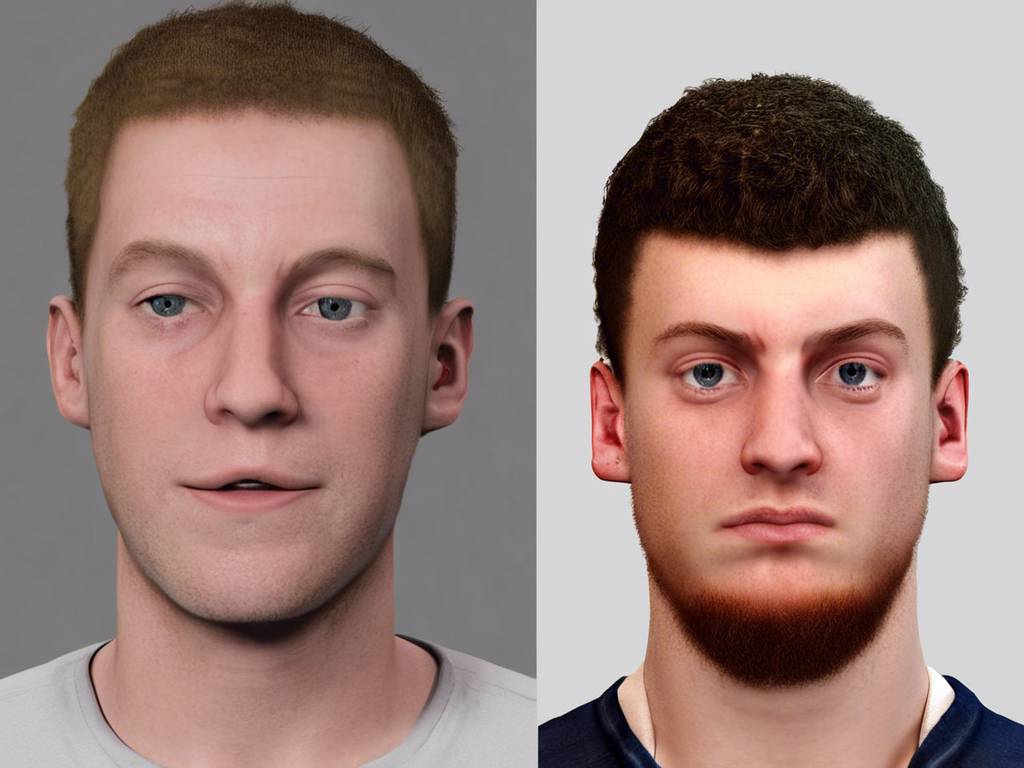

Sam Bankman-Fried Sentenced to 25 Years in Prison

Sam Bankman-Fried, the 32-year-old co-founder of FTX, has been sentenced to 25 years in prison after being convicted on seven fraud counts in 2023. The collapse of his cryptocurrency empire led to this outcome. While prosecutors sought a sentence of 40 to 50 years, Bankman-Fried’s attorneys argued for 6 to 12 years. Judge Lewis Kaplan’s decision marks a significant moment in the cryptocurrency industry, causing a ripple effect throughout the market.

Factors Leading to the Sentencing

The sentencing of Sam Bankman-Fried stemmed from various factors that contributed to the judge’s decision, including:

- Fraudulent activities: Bankman-Fried was convicted of seven counts of fraud, highlighting unethical practices within the industry.

- Financial impact: The collapse of his cryptocurrency empire resulted in significant financial losses for investors and stakeholders.

- Lack of remorse: Despite the court proceedings, Bankman-Fried showed little regret for his actions, influencing the severity of his sentence.

Appeal Process and Forfeiture Ruling

Despite the sentencing, Bankman-Fried’s legal team plans to appeal the conviction. In addition to the prison term, the judge also ruled that Bankman-Fried would need to forfeit more than $1 billion. This ruling further complicates his financial future and reputation within the industry, signifying a significant setback for his career.

Implications for the Crypto Industry

The sentencing of Sam Bankman-Fried has far-reaching implications for the cryptocurrency industry as a whole, including:

- Reputation damage: The scandal surrounding Bankman-Fried’s conviction tarnishes the reputation of the industry and erodes investor trust.

- Regulatory scrutiny: Authorities may increase their oversight of cryptocurrency activities to prevent similar fraudulent schemes from occurring in the future.

- Market volatility: The uncertainty surrounding Bankman-Fried’s case could lead to increased market volatility and price fluctuations in the cryptocurrency sector.

Hot Take: Lessons Learned from Bankman-Fried’s Sentencing

The case of Sam Bankman-Fried serves as a cautionary tale for individuals operating within the cryptocurrency industry. It highlights the importance of transparency, ethical conduct, and compliance with regulatory standards to maintain the integrity of the market. As a crypto investor, it is essential to conduct due diligence and assess the credibility of projects and individuals before making investment decisions. By learning from Bankman-Fried’s mistakes, you can navigate the cryptocurrency landscape more effectively and protect your assets.

By

By

By

By

By

By

By

By

By

By

By

By